This article starts with what the Amazon-Netflix advertising partnership is and covers why the deal is significant for programmatic ad buying, which markets will be included and when rollout will begin, how advertisers will benefit from premium inventory integration, what challenges or caveats exist, how the partnership compares with existing programmatic streaming ad inventory deals, what the future may hold for streaming ads and premium inventory access, and finally ends with how advertisers should prepare to leverage the partnership effectively.

Amazon Ads and Netflix align premium streaming inventory with a commerce-first programmatic stack, linking CTV exposure to measurable outcomes through data collaboration, clean-room analytics, and AI-optimised buying. The integration concentrates high-quality reach, strengthens audience precision beyond demographics, and elevates performance transparency via incrementality and cross-media attribution. Constraints persist: premium CPMs, controlled ad load, and ecosystem dependence. The long-term trajectory points to closed, data-rich environments where advantage stems from the depth of behavioural and transactional signals rather than scale alone.

Amazon Netflix partnership to provide premium inventory

In September 2025, Netflix announced a global advertising partnership with Amazon Ads to expand programmatic access to its ad-supported plan inventory. The agreement enables advertisers to purchase Netflix’s premium ad slots through Amazon’s demand-side platform (DSP), marking the first time Netflix inventory is available via this route.

The rise of connected TV (CTV) is rewriting the rules of media buying. In the United States alone, more than 200 million users now watch via connected TV devices, and 88 % of U.S. households owned at least one CTV device in 2023.

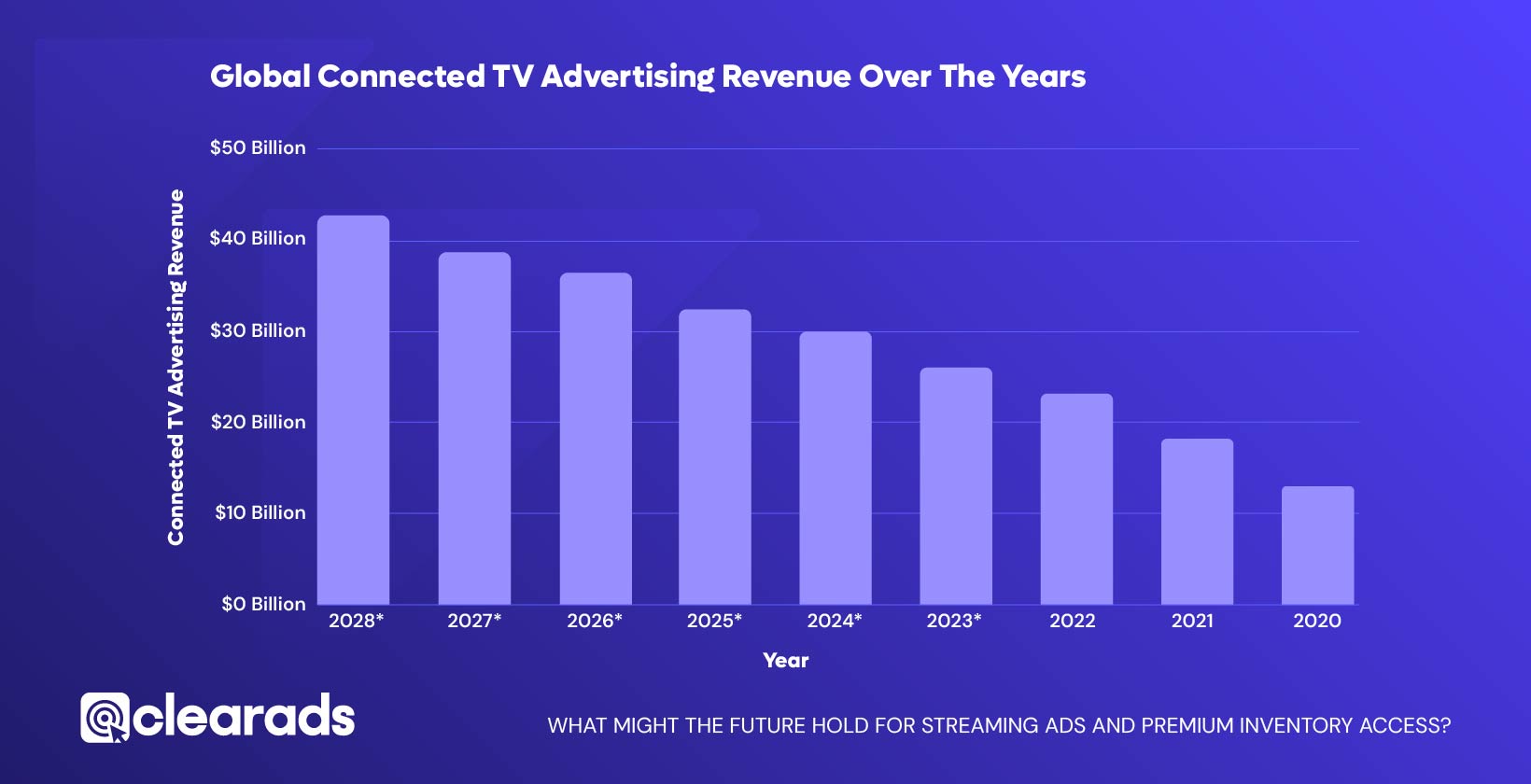

CTV advertising is rapidly scaling: global CTV ad revenues are projected to grow from US$ 25.9 billion in 2023 to US$ 46.89 billion by 2028, overtaking linear television for the first time.

Netflix’s ad-supported tier is expanding at a rapid pace. The company reported 40 million monthly active users on its ad-supported plan at the 2024 upfront (May 2024), showing strong early adoption. By May 2025, this had more than doubled to 94 million subscribers worldwide, confirming the format as central to Netflix’s long-term monetisation strategy.

In parallel, the global advertising market is undergoing a transformation. According to PwC’s outlook, digital formats already account for 72 % of ad revenue, and are expected to reach 80 % by 2029. CTV specifically is forecast to drive growth in ad spend, with digital and AI-powered ad formats playing an outsized role in media strategy.

Against this backdrop, the Amazon-Netflix partnership becomes more than a deal, it signals how premium streaming inventory will be monetised and distributed in the next era. As Paul Kotas, Senior Vice President at Amazon Ads, explained:

“We’re delighted to enter into this partnership with Netflix, enabling brands to reach their subscribers and extensive library of premium content with Amazon DSP. Our goal is to remove the guesswork for advertisers by making it simple to manage all of their TV planning and buying with Amazon Ads”.

What is the Amazon-Netflix advertising partnership?

Amazon confirmed that advertisers can access Netflix inventory programmatically across 11 initial markets, including the United States, United Kingdom, Canada, Brazil, Mexico, France, Germany, Italy, Spain, Japan, and Australia. Rollout is scheduled to begin in the fourth quarter of 2025.

The partnership aligns Netflix with a single major advertising technology provider after previously offering inventory only via direct sales and select third-party programmatic platforms. By choosing Amazon Ads, Netflix gains integration with Amazon’s data-rich advertising ecosystem, which offers advanced targeting and measurement capabilities alongside commerce insights.

Netflix positioned this partnership as part of its broader strategy to expand its in-house advertising suite, following significant growth of its ad-supported tier. At the 2025 Netflix Upfront, the company reported that the ad-supported plan had become central to its monetisation strategy.

This agreement also connects Netflix directly with Amazon Marketing Cloud and Amazon Publisher Cloud. Advertisers can therefore finally link storytelling to sales with precision targeting, privacy safe measurement and end to end attribution.

Why is this deal significant for programmatic ad buying?

The Amazon-Netflix partnership represents a structural change in connected TV (CTV) advertising because it combines one of the world’s largest streaming platforms with one of the most powerful programmatic ecosystems.

Shift from limited access to centralised buying

Before this partnership:

- Netflix inventory was only accessible via a small set of third-party demand-side platforms such as The Trade Desk, Google Display & Video 360, and Magnite.

- Additional inventory was managed through direct sales handled by Microsoft’s advertising division.

This fragmented model limited advertisers’ ability to consolidate campaigns across channels and reduced efficiency in planning and measurement.

The new integration with Amazon Ads establishes a single, centralised programmatic channel that simplifies campaign execution and enhances operational efficiency.

Access to premium inventory plus commerce data

Amazon’s unique advantage lies in its combination of premium media with commerce insights.

- Campaigns can be targeted using shopping behaviours, browsing activity, and purchase intent signals.

- This goes beyond traditional demographic segmentation, offering transaction-level targeting precision that directly links ad exposure to measurable outcomes.

Improved measurement and optimisation

By joining Amazon’s ecosystem, Netflix ads can now be analysed using advanced measurement and machine learning tools:

- Amazon Marketing Cloud (AMC): enables clean room analysis of incremental sales lift, audience overlap, and cross-media reach in a privacy-safe way.

- Amazon DSP reporting: allows advertisers to measure performance consistently across CTV, display, and audio, with unified reporting dashboards and attribution metrics.

- Machine learning optimisation: Amazon Ads notes that its DSP bidding uses machine learning to improve efficiency and campaign performance by optimising bids in real time.

Cross-channel campaign management

Netflix inventory becomes part of Amazon DSP’s unified platform. Advertisers can now:

- Plan and execute campaigns across streaming TV, display, and audio in a single environment.

- Manage frequency capping of channels to avoid oversaturation.

- Optimise budget allocation in real time across formats.

This cross-channel integration reduces inefficiencies from siloed buys and strengthens consistency of brand messaging.

Enhanced supply curation

Amazon Publisher Cloud adds another dimension to the partnership:

- It enables curated premium supply packages that combine Netflix inventory with other publishers.

- These packages integrate Amazon’s audience data with publisher-level insights, delivering campaigns with higher contextual relevance.

- Case studies from Publisher Cloud have shown measurable ROAS improvements when curated supply deals are applied.

By consolidating Netflix inventory within Amazon’s ecosystem, the partnership sets a new standard for programmatic access; the next critical detail lies in understanding the specific markets and rollout timeline where these advantages will first be realised.

Which markets will be included and when will rollout begin?

Netflix and Amazon Ads confirmed that programmatic access to Netflix ad inventory will begin in 11 markets starting in the fourth quarter of 2025. The rollout will cover the United States, United Kingdom, Canada, Brazil, Mexico, France, Germany, Italy, Spain, Japan, and Australia.

This geographic selection reflects Netflix’s largest advertising-supported territories, which together represent the majority of its global ad-subscriber base. According to Netflix, these markets combine high connected TV penetration with strong demand for premium inventory, making them strategically valuable for advertisers.

The staged rollout ensures that programmatic integrations align with regional compliance requirements, privacy regulations, and operational readiness. Advertisers in these 11 markets will be able to plan and execute programmatic campaigns directly through Amazon’s demand-side platform once deployment begins.

Market analysts highlight that this partnership places Netflix alongside other premium publishers in Amazon’s global ecosystem, where advertisers can extend campaigns seamlessly across multiple regions while maintaining consistent measurement and reporting.

Netflix highlighted that these launch territories represent regions where connected TV adoption is most advanced and advertiser demand for premium video inventory is strongest.

Amazon emphasised that consolidating Netflix inventory with other Amazon DSP supply gives advertisers the ability to plan global campaigns and still optimise at the country level. This ensures that brand strategies can remain consistent across borders while complying with local advertising regulations.

The geographic focus also aligns with where connected TV penetration is highest. Markets such as the United States and the United Kingdom already contribute a significant share of Netflix’s advertising-supported membership, while emerging regions like Brazil and Mexico provide high growth potential for incremental impressions.

How will advertisers benefit from this premium inventory integration?

The Amazon-Netflix partnership offers advertisers multiple advantages by combining premium streaming inventory with programmatic efficiency. Netflix provides high-quality, brand-safe environments, while Amazon’s demand-side platform (DSP) delivers automation, advanced targeting, and measurable outcomes.

Streamlined campaign management

One of the most immediate benefits is operational efficiency.

- Advertisers can plan, buy, and measure Netflix campaigns directly in Amazon DSP, alongside other media channels such as display, audio, and connected TV.

- This eliminates the complexity of managing separate platforms or relying on fragmented third-party integrations.

- A single workflow helps reduce overhead, improve campaign speed, and centralise reporting across formats.

Integration of commerce-driven targeting

Amazon’s retail and browsing signals bring an unmatched level of targeting precision to Netflix campaigns.

Amazon highlights this unique value in its announcement:

‘The partnership leverages unique first-party insights paired with sophisticated clean room technology to increase efficiency and improve performance’.

- Campaigns can be segmented using shopping behaviours, browsing activity, and purchase intent signals.

- This approach moves beyond demographic targeting, enabling advertisers to focus on users most likely to convert.

For example, a consumer electronics brand can align Netflix ad exposure with high-intent shoppers already browsing similar products on Amazon, creating a direct path from impression to transaction.

Expanded measurement capabilities

Measurement is a critical advantage of this integration.

- Amazon Marketing Cloud (AMC) provides a clean room environment where advertisers can analyse sales lift, audience overlap, and cross-media reach without compromising user privacy.

- These advanced analyses allow brands to distinguish between attributed sales and incremental impact, improving confidence in campaign effectiveness.

- AMC queries can also reveal how Netflix impressions contribute to outcomes across other channels, such as Amazon retail or streaming audio.

Curated supply through Amazon Publisher Cloud

Beyond measurement, advertisers gain access to curated premium supply packages.

- Amazon Publisher Cloud (APC) enables buyers to combine Netflix inventory with other publishers while layering Amazon’s commerce insights.

- These curated packages allow advertisers to secure contextually relevant inventory at scale, while improving efficiency in targeting.

- Case studies show that curated supply deals within APC have delivered higher ROAS for brands compared to standard open-market buying.

Premium content environment

Netflix inventory carries intrinsic advantages tied to its content.

- Ads appear within long-form, cinematic programming where user attention levels are higher than in user-generated or short-form video environments.

- This positioning improves brand recall, increases message impact, and provides a safe environment for advertisers focused on brand protection.

- Exposure within popular series or films also creates opportunities for association with high-value entertainment content, a feature that is often absent from open-web placements.

Unified retail media integration

Another benefit lies in how Netflix campaigns can be managed alongside Amazon’s retail media formats.

- Advertisers can run cross-channel campaigns spanning streaming TV, display, audio, and sponsored retail placements within the same DSP.

- This unified structure reduces fragmentation and ensures consistent messaging across touchpoints.

- By linking connected TV exposure with retail transactions, advertisers can directly measure how video impressions drive sales behaviour.

These combined advantages establish Netflix as a premium, data-enhanced environment for advertisers; the next consideration is how these benefits will vary across different global markets as the rollout progresses.

What are the challenges or caveats for advertisers?

Despite the strategic advantages, the Amazon-Netflix partnership introduces several challenges for advertisers.

These challenges highlight the balance between accessing premium inventory and managing cost, supply, and transparency constraints within the programmatic environment.

Pricing

Netflix maintains a premium cost structure for its inventory, with higher CPM rates than most connected TV platforms. This restricts access for smaller advertisers and places emphasis on large-scale brands with significant budgets.

Limited ad supply:

Netflix enforces a low ad load, averaging 4 to 5 minutes of ads per hour, compared to traditional broadcast television which often exceeds 15 minutes. While this improves viewer experience, it constrains total available impressions and increases competition among advertisers.

Transparency and measurement:

Although Amazon offers advanced reporting through its DSP, advertisers may face restrictions in accessing granular Netflix-specific data due to privacy requirements and clean room policies. This can limit the level of independent verification available compared to open-web programmatic campaigns.

Competitive tension:

By selecting Amazon as its primary DSP partner, Netflix reduces flexibility for advertisers who prefer using other platforms such as The Trade Desk or Google DV360. This consolidation may create dependency on Amazon’s ecosystem, reducing cross-platform neutrality.

Scaling:

While Netflix’s ad-supported base has grown to 94 million subscribers as of May 2025, distribution across 11 launch markets means inventory availability will vary regionally. Advertisers planning multi-country campaigns may find imbalances in reach depending on adoption rates in each territory.

How does this partnership compare with existing programmatic streaming ad inventory deals?

The Amazon-Netflix partnership differs from traditional programmatic streaming deals because it consolidates premium inventory with a single dominant DSP. Historically, Netflix relied on Microsoft as its exclusive sales partner and offered programmatic access through platforms such as The Trade Desk, Google Display & Video 360, and Magnite. These channels provided reach but fragmented buying across multiple partners.

In contrast, Amazon’s DSP integration unifies programmatic access, reducing operational fragmentation. Advertisers benefit from consolidated campaign planning and measurement within one platform, which distinguishes this agreement from competitor streaming partnerships where inventory remains scattered across several DSPs.

Netflix’s move toward Amazon Ads builds on its 2024 decision to invest in building proprietary ad technology, including its in-house ad server and forecasting tools. These capabilities were announced during Netflix’s 2024 upfronts, where the company also reported surpassing 40 million monthly active users on its ad-supported tier. This foundation enabled Netflix to shift from reliance on Microsoft for sales to a broader programmatic strategy anchored in Amazon’s DSP.

Amazon’s track record with premium publishers also sets this deal apart. For example, Amazon Publisher Cloud has already been used to package curated supply from FOX’s portfolio, demonstrating how Amazon integrates entertainment inventory with its commerce-driven data ecosystem The inclusion of Netflix represents a scale increase beyond these earlier partnerships, consolidating some of the most in-demand content in streaming within Amazon’s ecosystem.

Compared to rivals such as Hulu or Disney+, whose inventory remains accessible through multiple DSPs, the Netflix-Amazon agreement stands out for exclusivity and integration depth. This shift points to a growing divide between open-market programmatic access and closed, first-party-data-driven supply channels.

Industry analysts describe the deal as a structural shift, aligning premium streaming inventory with a closed, data-rich ecosystem rather than maintaining open programmatic access. This creates new competitive dynamics in the connected TV advertising sector.

What might the future hold for streaming ads and premium inventory access?

The Amazon-Netflix partnership signals a broader shift in how premium streaming inventory is distributed and monetised. Industry forecasts estimate that global connected TV advertising expenditure will grow from 25.9 billion USD in 2023 to 46.89 billion USD by 2028, overtaking linear TV advertising for the first time.

One expected development is increased exclusivity. By centralising programmatic access through Amazon, Netflix may establish a model where premium publishers prefer single DSP alignments. This could encourage other streaming services to pursue similar closed partnerships, consolidating power within select advertising ecosystems.

Another potential outcome is intensified competition among demand-side platforms. The Trade Desk, Google, and Magnite previously held positions as gateways to Netflix inventory. With Amazon gaining priority, rival platforms may strengthen relationships with other publishers such as Disney+, Warner Bros. Discovery, or Peacock to maintain market relevance.

The partnership also points to growing integration between commerce data and streaming ads. As advertisers increasingly value performance metrics like sales attribution and ROAS, platforms with first-party transaction data, such as Amazon, are likely to dominate premium inventory distribution.

On the macro level, the advertising market as a whole is projected to exceed 1 trillion USD in annual revenue for the first time in 2025, underscoring the shift of budgets into digital and programmatic channels. Within this environment, closed partnerships like Amazon-Netflix are positioned to capture a growing share of premium budgets.

Regulatory scrutiny is also expected to increase, particularly in Europe, where programmatic adoption and retail media growth are prompting closer examination of fairness and transparency standards in ad buying.

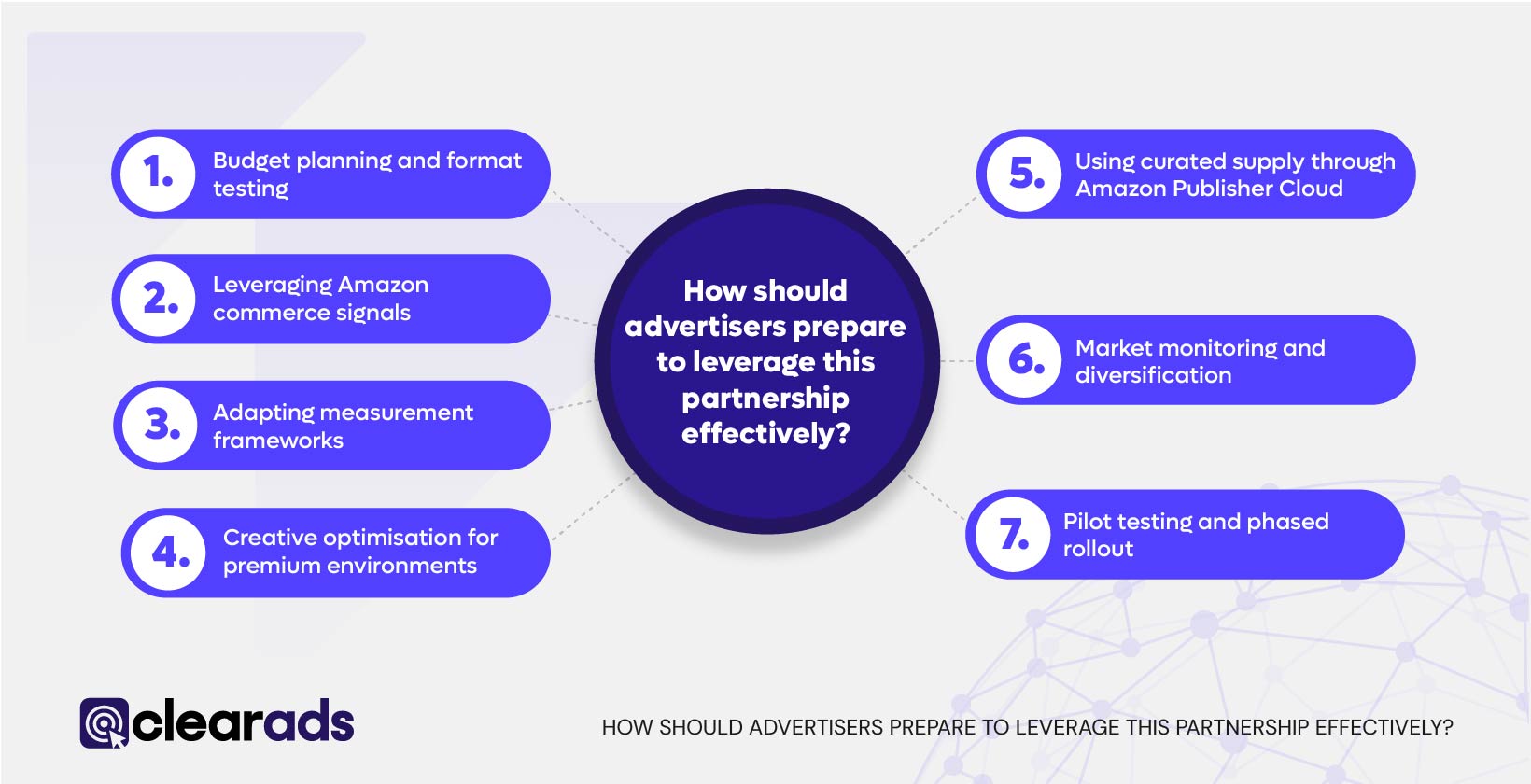

How should advertisers prepare to leverage this partnership effectively?

Advertisers can maximise the value of the Amazon-Netflix partnership by aligning campaign strategies with the unique features of both platforms. Preparation requires adjustments across budget planning, targeting, measurement, creative execution, and market monitoring.

Budget planning and format testing

Netflix maintains premium CPM rates compared to most connected TV platforms. To balance reach with frequency, advertisers should allocate larger budgets specifically for Netflix inventory.

- Running campaigns across multiple formats, such as 15 second and 30 second video ads, helps identify which units deliver the strongest cost efficiency.

- Early tests can reveal whether shorter formats drive incremental reach or whether longer storytelling units perform better in premium environments.

- Advertisers in high-competition sectors such as consumer goods or automotive can benefit from format benchmarking to ensure that investment aligns with outcomes.

Leveraging Amazon commerce signals

One of the main advantages of this partnership is the ability to integrate Amazon’s first-party commerce data into targeting strategies.

- Advertisers can use browsing data, purchase intent, and retail transaction insights to refine audience segments.

- For instance, brands in consumer packaged goods or consumer electronics can connect Netflix ad exposure directly with measurable retail outcomes on Amazon.

- This data-driven targeting increases campaign relevance compared to broad demographic models, supporting improved conversion rates and stronger return on ad spend (ROAS).

Adapting measurement frameworks

Traditional media metrics are insufficient for programmatic streaming environments. Advertisers must adapt by focusing on incremental and outcome-based measurement.

- Core metrics include incremental sales lift, brand recall, and ROAS, which connect ad exposure with business results.

- Amazon Marketing Cloud (AMC) provides customised clean room analysis. Advertisers can run queries to compare exposed and non-exposed groups, calculate overlap with retail purchases, and identify true incremental impact.

- AMC’s privacy-safe environment ensures compliance while still allowing deep performance evaluation across campaigns.

Creative optimisation for premium environments

Netflix inventory is delivered within long-form, high-engagement content. This means ad creative must align with cinematic standards.

- Storytelling-focused formats, designed with higher production quality than social-first video, consistently perform better in these environments.

- Case studies from Amazon Streaming TV campaigns show that polished creative assets improve brand impact and recall.

- Repurposed short-form social assets often underperform, so advertisers should allocate resources to bespoke creative for Netflix placements.

Using curated supply through Amazon Publisher Cloud

Advertisers can enhance campaign precision by leveraging Amazon Publisher Cloud (APC).

- APC allows curated premium supply deals that combine Netflix with other top publishers.

- These curated packages link Amazon’s commerce insights with publisher data, enabling cross-network strategies while retaining commerce-linked targeting precision.

- This is particularly effective for advertisers pursuing regional campaigns where Netflix adoption may vary in scale.

Market monitoring and diversification

As exclusivity increases within streaming ecosystems, advertisers should not rely solely on one platform.

- Maintaining a diversified connected TV strategy ensures reach across multiple publishers.

- Monitoring regulatory changes, especially in Europe where scrutiny of exclusive ad partnerships is rising, will help advertisers adjust buying strategies early.

- This flexibility provides insurance against shifts in inventory access or cost structures.

Pilot testing and phased rollout

Advertisers should adopt a phased approach to global rollout.

- Running pilot campaigns in select launch markets will allow brands to refine targeting, creative, and measurement strategies.

- Lessons learned from these tests can then be scaled across additional markets as availability expands.

- This structured rollout ensures efficiency in budget allocation and improves knowledge transfer within media teams.

Preparing strategies in this way allows advertisers to capture the unique advantages of the Amazon-Netflix integration; the next challenge lies in adapting these approaches across different regions as the partnership rolls out globally.