This article starts with an overview of Amazon’s Native Commerce Advertising (NCA) program and its impact on digital publishing. It then explains how NCA differs from traditional affiliate marketing, operating on a traffic-based compensation model.

The article outlines key features, such as publisher partnerships and seamless content integration. It discusses the program’s implications for affiliate marketers, highlighting challenges and opportunities. The benefits for publishers, including revenue stability and content flexibility, are explored, followed by Amazon’s advantages, such as increased traffic and data acquisition. The article then examines potential challenges, including revenue variability and editorial integrity risks.

A comparison with traditional affiliate marketing differentiates NCA from Amazon Associates, followed by a detailed side-by-side analysis of both programs. The discussion extends to broader implications for digital advertising, including shifting monetization models. The future of e-commerce advertising is analyzed, covering hybrid models and AI automation. The article concludes by guiding publishers on how to leverage NCA for success, underlining its long-term significance in the digital commerce landscape.

Amazon’s Native Commerce Advertising (NCA) program introduces a traffic-based monetization model, allowing publishers to earn by driving visitors to Amazon, regardless of conversions. Unlike Amazon Associates, which pays commissions on sales, NCA compensates publishers per click. The program has been piloted with major media companies, positioning it as a potential disruptor in affiliate marketing. Publishers benefit from more stable revenue, while Amazon gains higher traffic and valuable user data for remarketing. However, challenges like earnings variability and regulatory considerations persist. The NCA model complements Amazon Associates, offering publishers dual monetization opportunities. As e-commerce advertising evolves, hybrid models integrating and AI automation are expected to shape the future.

Amazon’s Native Commerce Advertising (NCA) program is a new initiative designed to reshape how publishers monetize digital content. Unlike traditional affiliate marketing, where publishers earn commissions only when a purchase occurs, NCA compensates publishers for sending traffic to Amazon’s platform, regardless of whether a sale is completed. This shift introduces a traffic-based compensation model, making revenue streams more predictable for digital publishers.

Affiliate marketing continues to be a major force in digital commerce, with spending in the United States reaching $9.56 billion in 2023 and projected to grow to $10.72 billion in 2025. Amazon has played a dominant role in this space; as of 2021, its Associates Program was the largest affiliate marketing network globally, with over 900,000 affiliates.

Amazon launched NCA as a pilot program, initially partnering with major publishers such as CNN, Vox Media, and Future. These companies specialize in high-traffic editorial content, making them ideal candidates for testing this new monetization approach. The program allows media outlets to monetize their audience’s engagement without relying on conversions, potentially altering the digital advertising landscape.

NCA provides an additional revenue stream for publishers while expanding Amazon’s ability to acquire high-intent traffic through trusted media sources. If successful, this model could influence how e-commerce platforms compensate for content-driven traffic, setting a precedent for other digital advertising programs.

What is Amazon’s Native Commerce Advertising Program?

Amazon’s Native Commerce Advertising (NCA) program is a new initiative that shifts away from the traditional pay-per-sale (PPS) affiliate model, instead compensating publishers on a pay-per-click (PPC) basis. This means that media companies and content creators earn revenue simply by driving traffic to Amazon, regardless of whether a purchase is made. This marks a fundamental change from Amazon’s long-standing Associates Program, which requires a completed sale for commissions.

Unlike Amazon Associates, where publishers earn a percentage of sales, NCA provides fixed compensation per click. Additionally, NCA differs from traditional PPC ads, such as Google Ads, by integrating seamlessly within editorial content rather than appearing as separate advertisements. This allows publishers to generate reliable revenue while maintaining a native, non-intrusive user experience.

The NCA model functions as a bridge between content-driven engagement and Amazon’s e-commerce ecosystem. Instead of focusing on conversion rates, the program prioritizes audience engagement and referral traffic. The following points highlight how the NCA model connects content engagement with Amazon’s e-commerce ecosystem:

- Publishers embed native commerce ads within product-focused content, such as reviews, recommendation lists, and editorial articles.

- When users click on an Amazon-linked recommendation, publishers receive compensation, even if the visitor does not make a purchase.

- Amazon benefits by acquiring high-intent visitors, and increasing its opportunities for remarketing through targeted ads, personalized recommendations, and strategic follow-ups. These efforts increase the likelihood of a sale over time, maximizing Amazon’s long-term customer acquisition strategy.

By eliminating conversion dependencies, Amazon ensures a steady flow of traffic, making NCA particularly valuable for large media houses and high-traffic publishers. If the program expands beyond its initial pilot phase, it could provide an alternative monetization strategy for a wider range of content creators and independent publishers.

What are the Key Features of Amazon’s NCA Program?

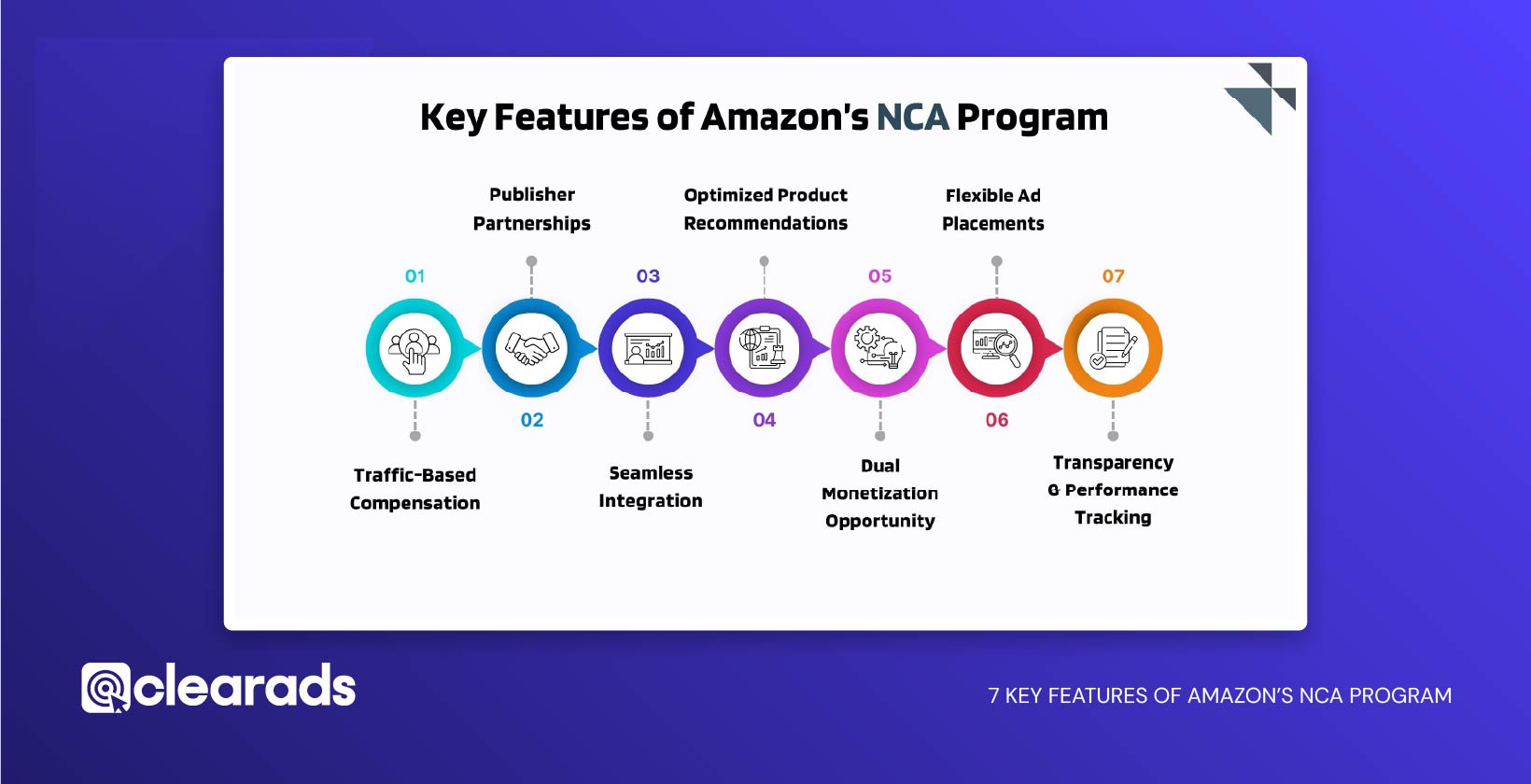

Amazon’s Native Commerce Advertising (NCA) program introduces a new monetization model for publishers, focusing on traffic-based compensation rather than direct sales commissions. The following key features highlight how NCA differs from traditional affiliate programs and enhances revenue opportunities for content-driven platforms:

1. Traffic-Based Compensation

Unlike the traditional Amazon Associates program, which requires a purchase for commission earnings, NCA pays publishers based on the traffic they send to Amazon. This model provides a more predictable revenue stream for content creators and publishers. Since monetization is not tied to conversions, it removes the dependency on users completing a transaction.

2. Publisher Partnerships

Currently, NCA is limited to select large publishers, including CNN, Vox Media, and Future, as part of its pilot phase. These publishers have been testing the effectiveness of traffic-based monetization in product recommendation content.

Amazon is expected to expand the program to additional publishers in the future, potentially opening participation to smaller content creators, niche media sites, and influencers. This could provide wider adoption opportunities for digital publishers.

3. Seamless Integration

NCA is designed to integrate naturally into content-driven websites, particularly those focused on product reviews, comparisons, and recommendations. The program’s native ad format ensures that product recommendations appear as part of the article, creating a non-intrusive user experience.

Amazon’s contextual algorithm optimizes these placements to match the relevance of the content, ensuring a higher engagement rate.

4. Optimized Product Recommendations

Amazon leverages its AI-driven recommendation engine to display the most relevant products based on user behaviour, past searches, and contextual content analysis. This enhances the effectiveness of the ads and increases the likelihood of user engagement.

5. Dual Monetization Opportunity

Publishers enrolled in both NCA and Amazon Associates can earn from both programs simultaneously. If a user clicks on an NCA ad and later completes a purchase, the publisher can earn revenue through both models, cost-per-click (CPC) from NCA and commission from the Amazon Associates program. This provides a hybrid revenue strategy for publishers.

6. Flexible Ad Placements

NCA ads can be positioned across various sections of a website, including:

- End of Content: Ideal for product reviews where engaged readers are more likely to take action.

- In-Content Ads: Placed within long-form articles to ensure visibility.

- Sidebar or Floating Ads: Ensuring continuous exposure throughout user navigation.

Amazon’s ad placement flexibility allows publishers to experiment and optimize for the best click-through rates (CTR).

7. Transparency & Performance Tracking

Publishers using NCA can access detailed analytics and tracking tools to monitor their traffic performance. Unique tracking IDs allow segmentation of performance by ad placement, page type, or content category, enabling better optimization strategies.

This feature provides insights into traffic quality, user engagement, and monetization trends, helping publishers refine their approach to maximize earnings.

What Does Amazon’s NCA Mean for Affiliate Marketers?

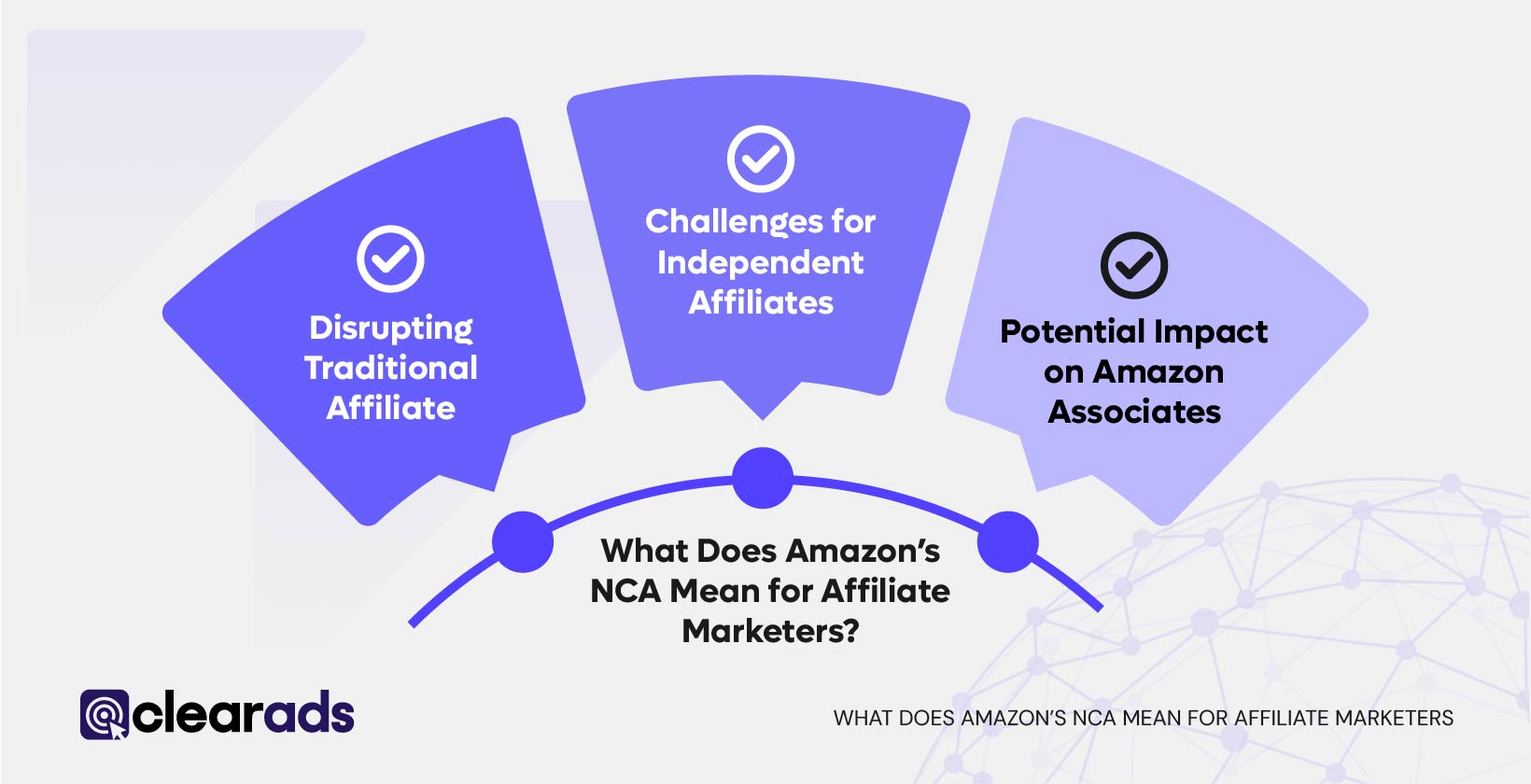

1. Disrupting Traditional Affiliate Marketing

Amazon’s Native Commerce Advertising (NCA) represents a significant shift in affiliate marketing dynamics by replacing the conversion-based commission model with a traffic-based monetization strategy. Instead of earning a percentage of completed sales, publishers in the NCA program get paid for driving users to Amazon, whether they make a purchase or not.

This shift primarily benefits large publishers that attract high traffic volumes, enabling them to monetize their audience without relying on conversions. However, it presents a major challenge for traditional affiliate marketers who optimize their strategies for sales-driven commissions.

Implications for the Affiliate Ecosystem:

- Less reliance on conversion optimization: Unlike Amazon Associates, where affiliates must ensure users complete a purchase, NCA rewards traffic regardless of user intent.

- Revenue diversification for publishers: Publishers can now generate income from two sources, NCA’s cost-per-click (CPC) model and Amazon Associates’ commission-based earnings.

- Increased focus on high-traffic platforms: Publishers with broad audiences, such as media companies and large review sites, stand to gain more than niche independent affiliates.

If Amazon scales NCA significantly, traditional affiliate marketing strategies that rely on purchase conversions may lose effectiveness over time.

2. Challenges for Independent Affiliates

While NCA presents a lucrative opportunity for large media publishers, it raises concerns for small and independent affiliate marketers who may struggle to compete. The program’s initial rollout has been limited to major publishers like CNN, Vox Media, and Future, reflecting Amazon’s preference for partners with substantial audience reach and authority.

Key Challenges:

- Reduced visibility in product recommendations: Large publishers with high domain authority may dominate search results, pushing independent affiliates lower in rankings.

- Shift in Amazon’s revenue-sharing strategy: If Amazon allocates more resources to NCA, it might lower commission rates for Amazon Associates affiliates.

- Difficulty in securing direct NCA partnerships: Smaller affiliates may not meet the traffic thresholds required to qualify for NCA participation.

- Less control over earnings: Since CPC rates vary based on Amazon’s bidding system, publishers may experience fluctuating revenues compared to stable commission rates in Amazon Associates.

Unless Amazon widens access to NCA or maintains strong incentives for traditional affiliates, smaller publishers could see a decline in earnings. To remain competitive, independent affiliates may need to focus on highly specialized content and explore alternative affiliate networks beyond Amazon.

3. Potential Impact on Amazon Associates

Amazon has positioned NCA alongside Amazon Associates rather than replacing it, allowing publishers to monetize their traffic in multiple ways.

- Earnings from NCA: Publishers receive CPC payments for directing users to Amazon.

- Earnings from Amazon Associates: If users later complete a purchase, publishers still receive a commission through Amazon Associates.

This hybrid approach provides more revenue streams for large publishers while maintaining familiar commission structures for smaller affiliates. However, as Amazon analyzes NCA’s profitability, it might adjust commission rates or traffic incentives in the future.

Amazon’s Strategic Benefits from NCA:

- More user data collection: NCA allows Amazon to track user intent and behaviour before a purchase, enabling better remarketing efforts.

- Higher conversion rates: Even if users don’t buy immediately, Amazon can later retarget them with personalized recommendations to maximize sales.

- Expanded ad inventory: NCA helps Amazon increase advertising revenue without cluttering search results with more sponsored ads.

If NCA proves to be more cost-effective than the traditional commission model, Amazon may gradually shift priorities, affecting how future affiliate programs are structured.

What are the Benefits of Amazon’s NCA Program for Publishers?

Amazon’s Native Commerce Advertising (NCA) program provides publishers with new revenue opportunities by shifting from a commission-based model to traffic-driven earnings. This approach enhances financial predictability, expands monetization potential, and allows greater content flexibility. The key benefits for publishers include:

1. Revenue Stability

Amazon’s Native Commerce Advertising (NCA) offers publishers a more predictable revenue stream compared to traditional affiliate marketing, which depends on user purchases to generate commissions.

Why NCA Provides More Stable Earnings:

- Traffic-Based Compensation: Publishers earn based on the number of users they drive to Amazon, rather than waiting for a purchase to be completed.

- No Dependence on Conversion Rates: Unlike Amazon Associates, where earnings fluctuate based on seasonal trends, pricing changes, or user buying behaviour, NCA provides consistent earnings based on traffic performance.

- Less Impact from Cart Abandonment: Publishers are not affected by users who click on an affiliate link but fail to complete a purchase, a common issue in commission-based models.

By removing the uncertainty of conversion rates, publishers can forecast earnings more accurately and scale their content strategies with confidence.

2. Expanded Monetization Opportunities

For publishers producing product-focused content, NCA provides an additional monetization avenue without requiring users to make immediate purchases. This is particularly beneficial for websites specializing in:

- Product reviews (e.g., tech blogs, lifestyle sites)

- Gift guides (e.g., holiday shopping recommendations)

- Comparison articles (e.g., “Best Laptops Under $1,000”)

Key Advantages of NCA for Monetization:

- Higher Revenue Potential for Large Publishers: High-traffic media companies can monetize a larger portion of their audience, even if users don’t convert right away.

- Additional Earnings Beyond Amazon Associates: Publishers who are part of both programs can generate two revenue streams: CPC payments from NCA and commissions from Amazon Associates if a sale occurs later.

- Scalable Content Strategy: Websites with significant organic or social traffic can increase revenue simply by generating more clicks to Amazon.

This model makes NCA an attractive option for content-driven platforms that focus on product discovery and recommendations rather than direct sales conversions.

3. Content Strategy Flexibility

One of the most significant benefits of NCA is that it frees publishers from the constraints of direct sales-driven content, allowing for greater creativity in content marketing strategies.

How NCA Enhances Content Flexibility:

- Encourages Broader Product Discussions: Instead of focusing only on high-converting products, publishers can explore a wider range of product categories.

- Reduces Pressure to Optimize for Conversions: Traditional affiliate marketing requires publishers to prioritize calls to action (CTAs) and persuasive techniques; NCA allows for a more organic content flow.

- Supports Educational and Informational Content: Publishers can create how-to guides, trend reports, or industry insights while still earning from traffic, even if the content is not explicitly sales-driven.

For example, a tech blog can now write about emerging smartphone trends without being forced to push specific affiliate links, as they would still earn through NCA’s traffic-based model. This change could lead to more diverse and reader-friendly content strategies.

How Amazon Benefits from the NCA Program?

Amazon’s Native Commerce Advertising (NCA) program strengthens its e-commerce ecosystem by driving traffic, collecting consumer insights, and expanding its ad inventory. The core benefits for Amazon include:

1. Increased Traffic to Amazon’s Marketplace

Amazon’s Native Commerce Advertising (NCA) program allows the company to leverage publisher networks to drive highly engaged shoppers to its platform.

Why NCA Increases Amazon’s Traffic:

- Broader Audience Reach: By collaborating with large media publishers (e.g., CNN, Vox Media, Future), Amazon taps into millions of daily readers who might not have directly searched for products on its site.

- High-Intent Shoppers: Since NCA is often integrated into product recommendation articles, the users clicking these ads already show purchase intent, increasing their likelihood of buying.

- More Entry Points to Amazon’s Ecosystem: Even if users do not make an immediate purchase, they become part of Amazon’s marketing funnel through remarketing campaigns and personalized recommendations.

By distributing shopping ads across trusted publisher sites, Amazon ensures that its platform remains a primary destination for online shoppers, regardless of where they start their search.

2. Enhanced Data Acquisition & User Insights

Every click on an NCA ad provides Amazon with valuable consumer data, strengthening its ability to target users with personalized marketing strategies.

How Amazon Uses NCA Data:

- Understanding Shopping Interests: By tracking which articles generate the most clicks, Amazon gains insights into trending products, emerging consumer preferences, and seasonal demand patterns.

- Improving Remarketing Strategies: Users who click an NCA ad but do not purchase can be retargeted through Amazon’s on-site recommendations, email marketing, and external ads.

- Refining Product Listings & Search Algorithms: Data from NCA clicks helps Amazon optimize its search results and ad placements, ensuring more relevant product recommendations for future shoppers.

This data-driven approach allows Amazon to continuously refine its advertising strategies, ensuring that users see more relevant products and that advertisers achieve better conversion rates.

3. Expansion of Amazon’s Ad Inventory & Revenue Streams

Amazon’s advertising revenue started on sponsored listings within its search results and then included programmatic advertising through their own demand side platform and supply side platform. NCA offers a new revenue stream for publishers that expands the number of users on Amazon.

Why NCA is a Strategic Move for Amazon’s Ad Business:

- Diversification of Traffic Sources: Amazon benefits from more high-intent shoppers directed from third-party publisher websites, increasing overall visibility for its marketplace.

- Enhancing Customer Acquisition Without Increasing On-Site Ads: Amazon’s search results have become increasingly competitive with sponsored product placements. By leveraging external publisher traffic, NCA helps attract potential buyers without altering the ad structure within Amazon’s search pages.

- Competitive Positioning Against Google & Meta: By integrating commerce-driven content on publisher sites, Amazon strengthens its presence in performance marketing, directly challenging platforms like Google Ads and Meta Audience Network in driving purchase-intent traffic.

Through NCA, Amazon maximizes revenue not just from affiliate commissions but also by monetizing consumer intent at an earlier stage of the buying journey.

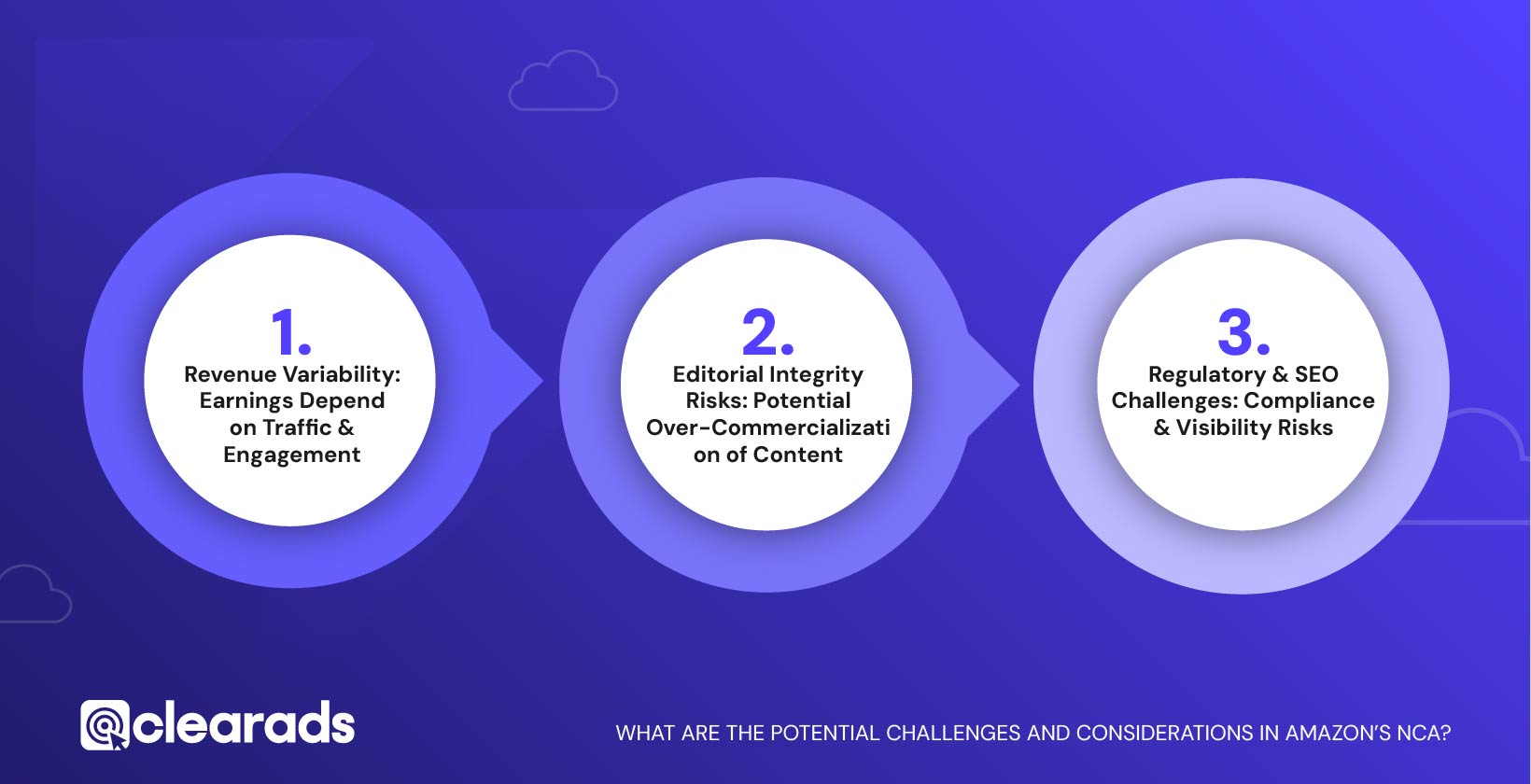

What are the Potential Challenges and Considerations in Amazon’s NCA?

Amazon’s Native Commerce Advertising (NCA) model comes with challenges that could affect earnings stability, content authenticity, regulatory compliance, and SEO performance. Below is a detailed analysis of the potential hurdles publishers may face when adopting Amazon’s NCA program.

1. Revenue Variability: Earnings Depend on Traffic & Engagement

Unlike Amazon Associates, where earnings are directly tied to completed purchases, NCA compensates publishers for driving traffic to Amazon, regardless of whether a visitor makes a purchase. While this model can provide more predictable earnings for large publishers, smaller affiliates or those with fluctuating traffic may struggle with revenue instability.

1.1 Traffic Volume & Audience Engagement

NCA earnings heavily depend on how much traffic a publisher can generate, making site visits, audience engagement, and click-through rates (CTR) crucial for revenue. If a publisher’s website traffic declines due to search algorithm updates, seasonality, or changing consumer interests, earnings may drop significantly.

For example, if a publisher experiences a sudden loss in search rankings, they may see a dramatic decrease in clicks to Amazon, directly reducing their earnings.

1.2 Cost-Per-Click (CPC) Variability

Unlike Amazon Associates, which provides fixed commission rates per product category, NCA does not offer a consistent CPC across all publishers. Instead, the compensation fluctuates based on advertiser demand, product category, and Amazon’s internal pricing strategies.

- A publisher promoting high-demand electronics might earn higher CPC rates than one promoting books or office supplies.

- CPC rates can range widely, with some publishers reporting earnings per click between $0.20 to $0.60, while others see much lower rates.

Because CPC is influenced by market conditions and Amazon’s internal ad pricing models, publishers may find it difficult to predict future earnings or scale their content strategy effectively.

1.3 Amazon’s Performance Benchmarks & Eligibility Criteria

Since NCA is still a pilot program, Amazon may set internal quality benchmarks, where only publishers that meet certain engagement metrics (such as a minimum number of clicks or high user retention) remain eligible for higher CPC payouts. If a publisher’s performance does not meet Amazon’s criteria, their CPC rates may be reduced or they may lose access to the program altogether.

2. Editorial Integrity Risks: Potential Over-Commercialization of Content

Because NCA compensates publishers based on traffic volume rather than sales, there is a potential risk that content becomes overly optimized for clicks rather than genuine product recommendations. This shift could negatively impact reader trust and long-term engagement.

2.1 Pressure to Maximize Clicks Instead of Value

Since publishers earn money from clicks regardless of whether visitors make a purchase, some may prioritize content strategies that generate as many clicks as possible, even at the expense of quality recommendations.

- Some publishers might resort to clickbait headlines, exaggerated product claims, or misleading comparisons to encourage clicks, potentially harming their long-term credibility.

- Others may prioritize high-CPC products even if they are not the best choices for consumers, leading to biased recommendations that do not genuinely benefit readers.

2.2 Overuse of Native Advertising

Unlike traditional display ads, native advertising blends promotional content with editorial content, making it harder for consumers to distinguish between organic recommendations and sponsored links.

- If publishers overuse NCA-driven content, readers may lose trust in the platform’s product reviews, leading to lower engagement and repeat visits.

- Large publishers may still safeguard their editorial integrity, but smaller affiliates might struggle to balance revenue generation with audience trust.

2.3 Long-Term Publisher Reputation Risks

Reputable publishers maintain clear boundaries between editorial content and sponsored promotions, ensuring that monetization does not compromise content quality. However, as NCA prioritizes traffic over genuine conversions, some publishers may face scrutiny for over-commercialized content.

To mitigate these risks, publishers should:

- Maintain transparency by clearly labelling NCA links as sponsored content.

- Ensure recommendations are unbiased and not solely driven by CPC rates.

- Use native commerce ads sparingly to avoid excessive monetization tactics.

3. Regulatory & SEO Challenges: Compliance & Visibility Risks

As native advertising grows, publishers must navigate legal compliance rules and search engine policies to avoid penalties.

3.1 FTC Disclosure Compliance for Native Ads

The Federal Trade Commission (FTC) requires that native advertisements be clearly labelled to ensure that consumers understand the difference between editorial content and paid promotions.

- Publishers using Amazon’s NCA must include clear disclaimers such as:

“This article contains affiliate links, and we may earn a commission from clicks.”

“Sponsored content: This content contains Amazon NCA links.” - Failure to comply with FTC regulations can result in legal consequences, such as fines or reputational damage.

3.2 Google’s SEO Crackdown on Affiliate-Heavy Content

Google has cracked down on websites that rely too heavily on third-party affiliate links, particularly those that lack original research, analysis, or user value.

- Google’s Search Quality Evaluator Guidelines state that pages with “thin content” or excessive affiliate links may be penalized in rankings.

- If a site publishes too many Amazon NCA-driven articles without original insights, its SEO performance could decline, reducing organic traffic and overall revenue.

- Publishers that focus on quality, informative, and research-backed product recommendations will be less affected by Google’s updates.

How Publishers Can Avoid SEO Penalties:

Create high-value content that provides real value beyond promotional links.

Avoid publishing low-value, keyword-stuffed content solely for affiliate earnings.

Incorporate diverse content formats, such as comparison tables, expert opinions, and detailed product analysis.

Comparison of NCA with Traditional Affiliate Marketing

Amazon’s Native Commerce Advertising (NCA) introduces a pay-per-click (PPC) earnings model, significantly different from traditional affiliate marketing, including Amazon’s own Amazon Associates program (pay-per-sale, PPS).

As Amazon expands its NCA program, many publishers are evaluating how it compares to Amazon Associates and whether both models can be used together. Below is a detailed side-by-side analysis of their differences, revenue potential, and coexistence.

1. NCA vs. Amazon Associates: Key Differences

| Feature | Amazon NCA | Amazon Associates |

|---|---|---|

| Revenue Model | Pay-Per-Click (PPC) | Pay-Per-Sale (PPS) |

| Payment Trigger | Publisher gets paid per visitor redirected to Amazon, even if they don’t buy anything | Publishers earn a commission only if the visitor makes a purchase within Amazon’s tracking window (usually 24 hours) |

| Earnings Stability | Higher (predictable per-click revenue) | Lower (dependent on conversion rates) |

| Who Can Join? | Invite-only (large publishers) | Available to all affiliate marketers |

| Content Integration | Editorial recommendations, product reviews | Product links, display ads |

| Control Over Links | Publishers fully control recommendations | Amazon dynamically selects product ads |

| Best For | Large publishers, high-traffic websites | Independent affiliates, niche sites |

- More Predictable Earnings with NCA: Since NCA doesn’t require a sale, publishers monetize traffic more consistently, reducing fluctuations based on user purchase behaviour.

- Higher Revenue Potential with Traditional Affiliate Marketing: Amazon Associates often offers higher commissions per successful purchase, making it more profitable for affiliates with high-intent audiences.

- NCA is ideal for publishers generating broad, high-volume traffic (e.g., news websites, and product discovery blogs).

- Amazon Associates suits affiliates focusing on high-converting niche content (e.g., in-depth reviews, comparison guides).

2. Can Publishers Use Both NCA and Amazon Associates?

Yes, Amazon allows publishers to use both programs simultaneously, meaning they can:- Monetize traffic via NCA (guaranteed PPC earnings) while still earning commissions via Amazon Associates (PPS model).

- Diversify revenue streams, ensuring consistent income per click while still benefiting from conversion-based commissions.

- Use strategic link placement, sending low-intent traffic to NCA and high-intent traffic to Amazon Associates.

- Large media publishers (e.g., CNN, Vox Media) can use NCA for broad traffic monetization and Amazon Associates for specific high-converting articles.

- Independent bloggers and product review sites may optimize Amazon Associates for high-intent traffic while using NCA selectively for additional earnings

3. NCA vs. Amazon Native Shopping Ads

Amazon also provides Native Shopping Ads, a separate monetization option within Amazon Associates. However, it operates differently from NCA.| Feature | Amazon NCA | Amazon Native Shopping Ads |

|---|---|---|

| Monetization Model | PPC (Pay-Per-Click) | Pay-Per-Sale (PPS) |

| Who Can Use It? | Select large publishers only | All Amazon Associates members |

| Revenue Trigger | Clicks (traffic sent) | Sales (completed purchases) |

| Ad Type | Editorial links, integrated natively | Display ads, dynamically selected by Amazon |

| Publisher Control | Full control over content | Amazon controls product selection |

Key Takeaways:

- NCA offers higher revenue predictability since it’s based on traffic volume, not conversions.

- Native Shopping Ads depend on purchases, making them better suited for high-intent traffic.

- NCA is only available to select publishers, whereas Native Shopping Ads are open to all Amazon Associates members.

Implications for the Digital Advertising Landscape

Amazon’s NCA program represents a major shift in digital advertising monetization by moving away from conversion-based earnings toward a traffic-driven model. This has significant consequences for publishers, affiliate marketers, and competitors in the eCommerce space.

1. Shifting Monetization Strategies in Digital Publishing

Traditionally, publishers relied on commission-based affiliate models where earnings were tied to completed purchases. However, NCA introduces a pay-per-click (PPC) structure, providing more predictable revenue for content-driven sites.

Key Trends:

- Publishers shift focus from direct sales to traffic generation. This allows them to monetize broader audiences instead of optimizing only for conversions.

- Hybrid PPC + PPS models emerge. With Amazon leading the way, other affiliate networks may introduce blended earnings models, offering both per-click and per-sale payments.

- Diversified revenue streams for content creators. Instead of relying solely on Amazon Associates (pay-per-sale), publishers can combine multiple monetization strategies to stabilize earnings.

2. Impact on Consumer Experience & Content Strategies

As publishers shift toward NCA, consumer-facing content strategies evolve:-

Key Changes in Content Approach:

- Less “hard-selling” and more editorial-driven commerce. Instead of aggressive “buy now” CTA-driven content, publishers create softer, research-driven product recommendations.

- More engaging, native content integration. Articles, listicles, and product guides will blend seamlessly with editorial narratives, making advertising less intrusive.

- Greater emphasis on high-traffic topics. Since earnings depend on visitor numbers, publishers may focus on mass-appeal products rather than high-ticket niche items.

3. Competitive Response: How Other E-Commerce Giants May React

Amazon’s shift toward traffic-based monetization may prompt competitors to adapt similar models.

Potential Reactions from Other E-Commerce Platforms:

- Walmart, eBay, and Shopify could launch PPC-based affiliate programs. These platforms may experiment with traffic-based rewards to attract more publishers and drive marketplace traffic.

- Google and Meta may enhance their eCommerce ad offerings. Google Shopping and Facebook Marketplace could introduce new native advertising options, allowing brands to tap into traffic-driven compensation models.

PPC vs. PPS Affiliate Models Across Platforms

Affiliate marketing typically operates on two primary compensation models:

- PPC (Pay-Per-Click): Publishers earn based on traffic sent to an advertiser, regardless of conversions.

- PPS (Pay-Per-Sale): Earnings depend on actual purchases made by referred users.

1. Core Differences Between PPC & PPS Models

| Feature | Pay-Per-Click (PPC) | Pay-Per-Sale (PPS) |

|---|---|---|

| Payment Trigger | Clicks (traffic sent) | Completed sales |

| Revenue Stability | More predictable | Highly variable |

| Conversion Dependency | Not required | Required |

| Earnings Per Action | Lower per click | Higher per sale |

| Best for | High-traffic publishers | Conversion-optimized marketers |

| Example Programs | Amazon NCA, Google AdSense | Amazon Associates, CJ Affiliate |

2. How Different Platforms Use PPC & PPS Models

| Platform | Affiliate Model | Compensation Structure |

|---|---|---|

| Amazon Associates | PPS | Commissions based on purchases (3% - 10% by category) |

| Amazon NCA | PPC | Publishers earn per click, even without a sale |

| Google AdSense | PPC | Advertisers pay per click; rates vary based on niche |

| eBay Partner Network | PPS | Earnings based on the percentage of completed sales |

| Walmart Affiliate Program | PPS | Commission-based model (1% - 4%) |

| Rakuten Marketing | PPS | Performance-based earnings per sale |

| ShareASale | PPS and PPL | Partner merchants offer commission-based payouts based on either Sales or Leads |

3. Advantages & Disadvantages of Each Model

Advantages of the PPC (Pay-Per-Click) Model

- Guaranteed earnings: Publishers are compensated for traffic regardless of conversions.

- Easier to scale: High-traffic websites benefit from consistent revenue streams.

- Lower risk: Earnings don’t depend on user purchasing decisions.

Disadvantages of PPC

- Lower payouts per action: Earnings per click are typically much lower than commission-based sales.

- Risk of low engagement: Advertisers may pay for clicks that don’t convert into sales.

Advantages of the PPS (Pay-Per-Sale) Model

- Higher earnings potential: Commissions per sale are often significantly higher than PPC rates.

- Stronger advertiser relationships: Brands prefer PPS as it directly ties payouts to performance.

- Incentivizes quality traffic: Publishers focus on high-converting audiences.

Disadvantages of PPS

- Unpredictable revenue: Earnings fluctuate based on conversion rates.

- Requires conversion optimization: Affiliates must strategically target high-intent buyers.

4. Which Model is Better for Publishers?

PPC (e.g., Amazon NCA) is best for:

- High-traffic publishers who want consistent earnings.

- Content sites focused on product discovery.

- Publishers who don’t want to rely on conversions for revenue.

PPS (e.g., Amazon Associates) is best for:

- Niche websites with strong buyer intent.

- Affiliates with expertise in conversion rate optimization.

- Publishers who prefer higher commissions per action.

What is the Future of E-Commerce Advertising?

E-commerce advertising is shifting towards hybrid monetization models and AI-driven automation. Amazon’s Native Commerce Advertising (NCA) program reflects these changes, blending traffic-based payouts with traditional affiliate marketing. The below-mentioned points highlight the key trends shaping the future of e-commerce advertising.

1. Hybrid Monetization Models in E-commerce Advertising

Affiliate marketing is evolving from a pure commission-based structure (PPS) to a hybrid approach that includes pay-per-click (PPC) models.

- Amazon NCA compensates publishers for traffic sent to Amazon, regardless of conversions.

- Traditional Amazon Associates still operate on a commission-based model, rewarding actual sales.

- Future models could integrate both PPC and PPS: allowing publishers to earn for clicks and completed sales.

Why this matters: A hybrid model allows more predictable earnings for publishers while still incentivizing high-intent traffic.

2. AI & Automation in E-Commerce Advertising

Artificial intelligence (AI) is transforming digital advertising by optimizing ad placements, bidding strategies, and user targeting.

Key AI-driven changes in e-commerce advertising:

- Dynamic pricing & ad bidding: AI helps set real-time bids for ad placements, ensuring optimal cost per click (CPC) and return on ad spend (ROAS).

- Automated content recommendations: AI suggests high-converting products for affiliates and advertisers.

- Personalized remarketing: Machine learning helps track user click behaviour and retarget potential buyers.

How to Succeed with Amazon’s NCA Program

Success with NCA requires strategic content integration, performance tracking, and optimization.

The following strategies help publishers maximize earnings and engagement through Amazon’s NCA program.

1. Eligibility & Enrollment in Amazon NCA

- NCA is currently available to select major publishers, including CNN, Vox Media, and Future.

- The program is expected to expand to mid-sized publishers as Amazon refines the model.

- Interested publishers should contact Amazon’s advertising team or check for invitations via Amazon’s affiliate program dashboard.

2. Best Practices for Publishers to Succeed

- Site-Wide Integration for Better Reach

- Apply NCA across multiple sections of your website to maximize impressions.

- Prioritize high-traffic pages like product reviews, buying guides, and comparison articles.

- Optimize Ad Placement for Higher Engagement

- Ensure NCA ad placements are contextually relevant to the article content.

- Place ads in visible locations such as above the fold, within content, or near call-to-action buttons.