When Amazon Advertising’s demand side platform was introduced, it offered a way for vendors to purchase both display ads and video ads, and manage them all through a single, central hub

What is Amazon DSP?

Amazon DSP (Demand Side Platform) is a form of programmatic advertising developed by Amazon to broaden the horizons of opportunity for those advertising their products on Amazon.

It is extremely unique in its features; from Amazon’s own inventory of websites to hundreds of third-party publishers in the most relevant locations, Amazon DSP users can market, remarket and cross-sell to audiences via a plethora of mediums.

Not only is the targeting highly precise and versatile, but third-party publishers are also strictly monitored against Amazon policies and impressions and clicks are free of ad fraud, allowing sellers to be reassured of their brand’s security.

Further to this, over many decades Amazon has accumulated an abundance of user insights; recording shoppers’ behaviors, demographics and purchasing habits to provide advertisers with infinite targeting opportunities.

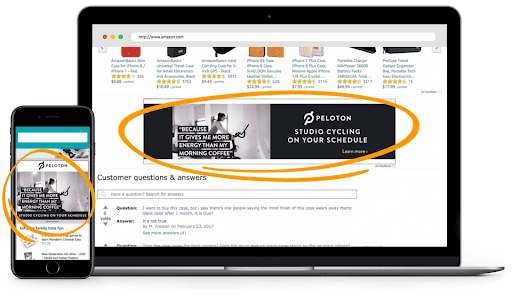

Amazon DSP ads come in many different formats including mobile banner ads, interstitial ads, desktop display ads, in-stream video ads, image and text ads, and more.

Ads are sold based on views (CPM – cost per thousand impressions), in contrast to the CPC (cost-per-click) model and are displayed as video or display ads.

This combination stems from the fact that Amazon DSP is primarily designed for expanding brand reach, instead of to drive user interaction.

Towards the end of 2020, the wealth of possibilities that come with Amazon’s DSP led to it being renamed advertisers’ number 1 preferred platform, a title that it has stolen back from Google, bolstered by the last few months’ e-commerce surge.

Unsurprisingly, 27% percent of respondents in the survey that led to this achievement told the market research firm that Amazon was their preferred DSP, followed by Google and The Trade Desk.

An astronomical 46% percent of respondents said they used Amazon DSP in the past 12 months.

On this platform, advertisers can capitalize on link-in and/or link-out campaigns and may market to the open exchange (OE) or Amazon’s owned and operated (O&O) supply sources.

This article will explore both of these subcategories, showing the many varieties of advertising Amazon DSP offers.

Note: sometimes Amazon DSP is confused with Amazon Delivery Service Partners due to them having the same acronym. They are very different however.

Open exchange vs Amazon O&O

Open Exchange

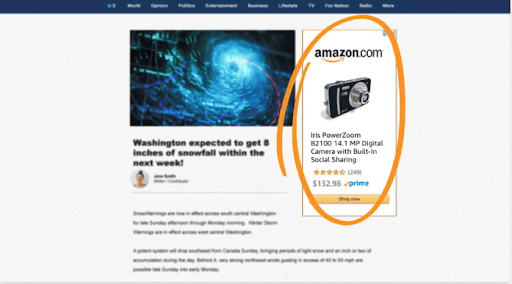

Open exchange is the medium by which advertisers using Amazon DSP can market to people on a variety of platforms away from Amazon’s own sites.

Open exchange includes Amazon Publisher Services (APS). Firstly, advertisers can access Amazon’s marketplace of 10,000+ directly integrated sites and apps to place their ads.

In addition, there is access to inventory on sites not owned or operated by Amazon, available through leading exchanges such as Google AdX and Rubicon.

These are known as third-party services and are a unique feature to Amazon DSP.

Open exchange is massively beneficial for many who want to expand their reach to people who are not on Amazon and can be used – with pixel tracking – to follow a customer on their internet journey.

Hence, open exchange is both efficient and provides an opportunity to scale.

Amazon O&O

Amazon O&O, on the other hand, provides exclusive advertising inventory from Amazon retail sites and O&O properties such as IMDb.

This spreads the reach of ads across different Amazon apps which can be utilized to leverage specific audience types to generate sales.

As the viewer of the ad is always on an Amazon site, it could be argued that they are more likely to convert as they may be less distracted by external factors and are more focused on shopping.

Both O&O and OE can be used in link-in and link-out campaigns, but below we will dive into the differences between the two…

Link-in vs Link-out

In principle, link-in and out variations have separate functions and will lead the viewer to different destinations.

Essentially, link-in campaigns display ads that, when clicked, will direct customers to a brand’s product detail page, storefront or campaign landing page.

In contrast, link-out campaigns take audiences away from Amazon sites, leading them to a non-Amazon destination, such as a brand’s website.

Link-in

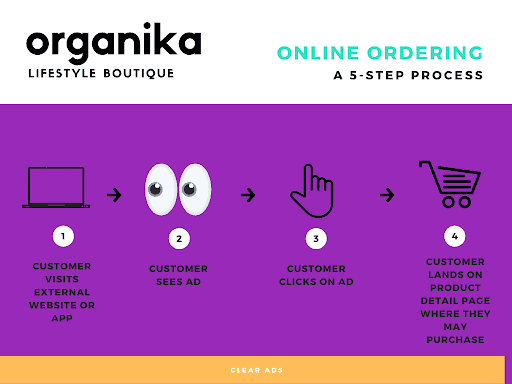

Link-in campaigns are the more commonly used type and are predominantly adopted to drive consideration and purchase. The customer journey through a link-in campaign is as follows:

This simple flow shows the ease of link-in campaigns which provide a way for sellers to bring in traffic from external mediums as well as directly on Amazon sites and bring them to their product.

As both of these types can be used to leverage ad impressions, both open exchange and Amazon O&O campaigns can be built.

The audience link-in campaigns reach is entirely subject to the advertiser and can be decided on a multitude of factors.

Audience insights can provide a foundation for who you may like to bring to your detail page.

For example, if you own a skincare brand and audience insights show your best converting demographic are women between the ages of 18-26, you can show your ad for a face cream to this cohort.

Alternatively, you could remarket your product to those who have purchased your product in the last 3 months who have not made a purchase.

The power to manipulate audience insights to generate audience types regarding purchasing behavior is the driving force behind the influence DSP has in advertising.

To learn more about building Amazon DSP audiences from scratch you can read this blog.

Link-out

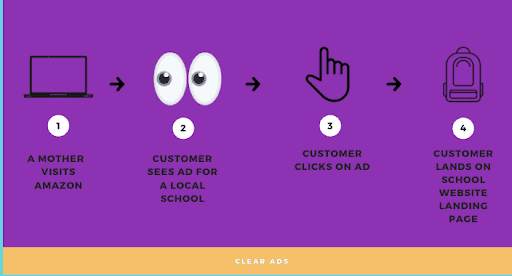

Link-out campaigns are an untapped goldmine for a lot of advertisers who are promoting external sites.

They take the enormous amount of customers from Amazon sites away from Amazon to the advertisers’ desired location.

For example, a new school attempting to recruit new students could target Amazon shopper mums and dads who have searched for back to school items and take them onto their school website landing page.

Only certain campaigns can be approved for link-out, these include:

- advertising a service that Amazon does not offer

- advertising products under a category that Amazon does not offer

Link-out campaigns are purposed in moving people from Amazon to external websites.

Hence, typically the only type of supply source used is Amazon O&O sites. Below is an example of a link-out campaign, advertising a product and brand that can’t be found on Amazon.

How to Prepare for Amazon DSP Growth

It’s no secret that the number of advertising platforms and retailer media networks is growing at an unprecedented rate.

It’s also no secret that the two major players in digital advertising — Google and Facebook — have recently been challenged by a third contender: Amazon.

As Amazon Advertising has grown, so has the popularity of its demand-side platform, not only for Amazon vendors but external service providers, too.

According to its own financial records, Amazon’s ad revenue grew 39% in Q2 of 2019 – generating an astounding $3 billion in the quarter for the second time ever, following on from the same achievement in Q4 last year.

Clearly, more and more advertisers are taking their budgets to Amazon and, as we approach the critical holiday shopping season, we expect that this will accelerate even further in the next few weeks.

While Amazon DSP is fast becoming a preferred option, particularly for Amazon vendors who can take advantage of a lower rate for being an existing platform seller.

It’s vital to remember that there is no single player in the current ad-tech industry that is able to optimize ads, plan campaigns, and create marketing strategies across all channels, across all platforms, and across all mediums.

This, of course, results in a need for an omnichannel approach that now spans not just two platforms, but three.

So just how should businesses start to prepare for the huge predicted growth of the Amazon DSP?

Understand Value

At this time, the most pressing issue is for businesses to fully understand the unique value of each system.

One of the primary reasons why Amazon has been so successful to date is due to the comprehensive data sets that it holds over its users.

Amazon has access to both purchase history and browsing history, providing valuable insight into who buys what, and when; key data for targeting the right people, at the right time.

However, there’s value in other systems, too, which is working to keep them up there near the top of the leader board even as Amazon begins to dominate.

Facebook, for example, may know much more about interests, social connections, and potential future purchases which are equally as valuable to vendors.

Google, on the other hand, understands why people perform the online actions that they do. It looks at context.

To prepare for the ‘tripoly’, customer behavior and preferences must be taken into account.

Who is the target audience? Where are these potential customers sharing their information, and with whom? What platforms are they engaging with? Where are they when they are in the buying mindset?

Customer behavior is key to navigating a future where three separate and distinct platforms share the most prestigious position.

Budgeting

Perhaps one of the biggest factors that Amazon will disrupt is budgeting. With budgets allocated between Google and Facebook, the introduction of a third platform disrupts the balance.

The rise of Amazon DSP will undoubtedly impact how marketers make budgeting decisions.

Investing in Amazon Advertising should be considered alongside other promotional investments, with a long-term view to the future best for allocation.

Conclusion

Advertisers have already begun to shift spend to Amazon DSP in order to leverage impressions in the most relevant places, with millions of viewers at their disposal.

Although there is a greater barrier of entry compared to Amazon sponsored display ads it can be highly profitable.

The link-out feature makes advertising on Amazon a simple way to expand your reach and means that the Amazon DSP can be adjusted to be useful for every brand and organization!

After all, if your audience tends to shop on Amazon – as 197 million people do in the US each month (more than the population of Russia) – then DSP can hit your target audience.

With all things Amazon DSP considered, now is the time to move onto the platform, with confidence in the safety and potential of your ads.

For more information on how our Amazon DSP agency could help you to scale your business using the platform you can visit our DSP website pages and enquire today.