How a Comprehensive Strategy Allowed Clear Ads to Raise Monthly Sales by Over £100,000 & Reduce ACOS, All After a Post-lockdown Sales Drought

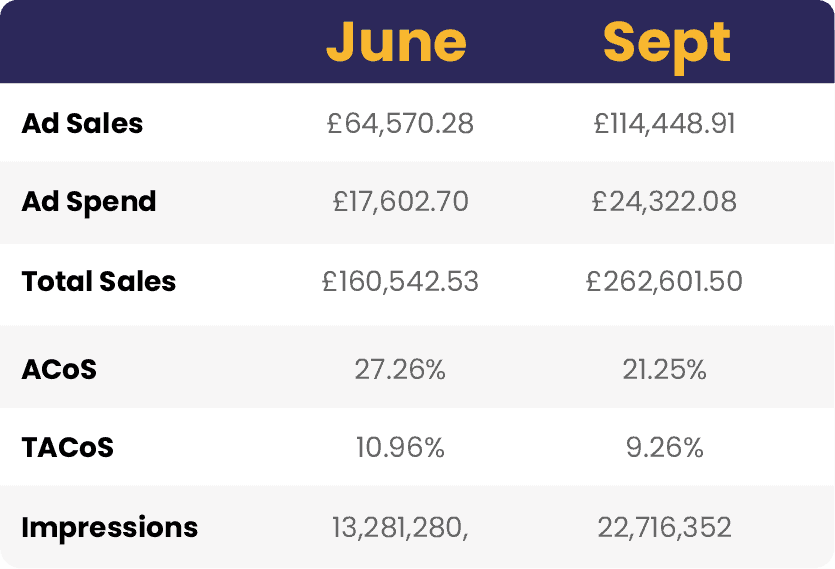

138%

Increase in Monthly Ad Sales

5%

Decrease in ACoS

Introduction

JMFA LTD sells on all Amazon EU marketplaces, specialising in shoe products. Whilst COVID-19 has been a period filled with uncertainty for many industries, JMFA can vouch for the unprecedented impact it has had on most Amazon sellers. When lockdowns eased and brick-and-mortar stores started to open, JMFA were negatively impacted and saw sales drop significantly.

Before onboarding we ran an in-depth PPC enhanced report and supporting video to ascertain viability with our service (Figure 6&7).After several calls to understand their objectives moving forward, on July 1st JMFA entrusted us with boosting sales and performance. Following the onboarding, a 3 month strategy report was produced, supported by weekly calls and performance reports which has resulted in surpassing client targets.

The Challenge

COVID played a big role in the issues faced by JMFA. Between the first lockdown in March 2020, to the easing of lockdowns by Feb 2021, monthly ad sales increased significantly from £49,370,37 to£191,416.90. However, by June 2021, ad sales had depleted back to lower levels than Feb 2020, a regression in sales by over a year. In June 2021, total ad sales were £64,570.28 and seemed to be on a spiralling downward trend.

As a consequence of depreciating sales and reducing ad spend, JMFA entered a difficult cycle of losing total sales, BSR as well as organic ranking.Meanwhile, their ACoS remained above their target at 30.3%. JMFA onboarded onto our services at the start of July with ambition to regain the deserved incline they had seen during lockdown. With the aims of reducing ACoS, increasing sales and reaching a TACoS of 8%.

The Approach

Clear Ads introduced a new account structure to their UK account and tailored an approach that worked for JMFA’s product range and situation in the market. Here was our step by step process:

Month 1:

- Clean up the existing campaigns on the account. With over 3000 campaigns, these needed to be optimised. Wasteful campaigns were identified through our audit tool, allowing us to pause and reduce bids of inefficient campaigns.

- Segmenting existing campaigns into a newly structured portfolio system (Figure 3). A new goal orientated structure was needed to allow for greater efficiencies and scaling.Campaigns and metrics were tracked easier based on their purpose to the overall strategy.

Month 2:

- Use our audit tool (Figure 5) to determine the best converting search terms from auto campaigns, tools like Helium 10’s Cerebro to perform keyword research.

- Migrate these targets into phrase and broad match manual keyword targeting campaigns.

- Create product targeting campaigns, focusing on the top competitors within JMFA’s product categories. In conjunction with defence campaigns, targeting our own products to prevent customers being taken away

- Create category campaigns to reach people in the awareness stage

- Using the audit tool to find the best converting keywords and ASINs from manual campaigns that can enter hero ASIN and keyword targeting campaigns. The keywords are only added in exact match type with higher bids than the suggested. (Figure 4)

- Create sponsored brands and sponsored display – Using different ad placements was a huge opportunity within the account. We used the data within the account to create multiple campaigns to increase brand awareness and create greater reach.

Month 3:

- Optimise account using bulk sheet optimisation (Figure 8) as cutting inefficiencies manually

- Continue to migrate search terms from the audit report into their designated hero, manual or product targeting campaign

- Expand ad placements being developed: Sponsored brands and sponsored display

The Result

The different campaign types allowed us to reach audiences at different points in their buying journey. (Figure 1 and 2).

Awareness:

Sponsored display, brand and category campaigns targeted those who hadn’t considered our product types. This generated long-term, new demand for JMFAs’ products.

- Evidenced by the % of orders new-to-brand rising from 86.3% to 91.3% and new-to-brand monthly orders increasing by 70 since the campaigns launched.

- Impressions increased from 9.3mil in July to 22.7mil in September

Consideration:

Product ASIN targeting, keyword targeting, heroes campaigns, sponsored brand and sponsored

display targeted those browsing the category or specific related products. This generated high volumes of short term interest, boosting sales significantly.

- Displayed via the fact that monthly clicks have doubled from 40,272 to 81,445 since launch.

Purchase intent:

Defensive campaigns enabled us to target people already browsing our brand, preventing our product detail pages from being attacked by competitors, and increasing the number of brand halo conversions.

By targeting audiences in a variety of stages on their buying journey, we were able to boost monthly sales by £102k from June to September while decreasing both the standard and total ACoS. The target TACoS of 8% was achieved in October and has been consistently decreasing since we took on the account. Sales are now reaching those similar to November 2020, when JMFA was experiencing significant growth. If growth continues at this rate we should be back toJanuary 2020 levels by the end of November, ensuring that growth isn’t reliant on circumstance but more on the brands recognition and ranking.

* Clear Ads signed up JMFA LTD on July 1st. This case study focuses on data and progress made from July 1st to September 30th