This article begins by explaining why Amazon sellers should focus on external traffic, noting which blogs and websites are becoming critical for visibility and rankings. It then introduces SmartScout’s Link Traffic tool, which shows which websites and blogs send buyers to Amazon listings, offering insights sellers can’t get from other tools. The piece compares Link Traffic with SmartScout’s suite and with Helium 10 and Jungle Scout, highlighting its unique ability to track off-Amazon referral sources. It also demonstrates how to access the tool, analyze competitor traffic domains, and apply insights to business strategies. Real-world examples show how sellers can discover new marketing channels and benchmark against competitors.

The blog introduces SmartScout’s new Link Traffic tool, which reveals the external websites, blogs, and affiliate publishers driving traffic to Amazon listings. It explains why external traffic is crucial for sellers, reducing reliance on PPC, boosting organic rankings, and building long-term visibility. The article compares Link Traffic with SmartScout’s other tools (Traffic Graph, Brands Tool, AdSpy, Rank Maker) and highlights how it fills a critical gap that Helium 10 and Jungle Scout do not address. A practical guide shows how to access, analyze, and apply the insights, helping sellers uncover referral domains, assess traffic volume, and prioritize partnerships. The piece outlines benefits such as competitor strategy insights, inspiration for campaigns, and improved ROI. Real-world use cases include identifying new marketing channels and benchmarking against competitors.

SmartScout link traffic tool: track Amazon competitors’ external traffic

SmartScout, a leading Amazon intelligence platform, has always helped sellers uncover insights about competitors, ad performance, and brand activity within Amazon. With the release of its new Link Traffic feature in June 2025, SmartScout extends its capabilities beyond Amazon itself. For the first time, sellers can see exactly which websites, blogs, and affiliate publishers are driving traffic to competitor listings.

For years, most strategies focused on on-Amazon optimization, keywords, and product placement. But the real game-changer lies outside the platform. Shoppers are discovering products through blogs, review sites, and search engines before they ever land on Amazon. Sellers who can track and leverage this external traffic gain a powerful edge.

This is a breakthrough for competitive intelligence. External traffic sources often generate high-intent, high-converting visitors, since many are tied to affiliate programs that only profit when conversions happen. By knowing which sites are already sending shoppers to similar products, sellers can identify new opportunities for partnerships, content placements, and influencer outreach.

Until now, sellers had no clear way to monitor this activity. The Link Traffic feature fills that gap, providing actionable data on where external clicks are coming from and how competitors are leveraging those channels. Combined with SmartScout’s established tools for internal traffic and sales insights, it gives sellers a 360-degree view of the forces driving product discovery and sales on Amazon.

What is SmartScout’s new Link Traffic feature?

SmartScout has introduced Link Traffic, a breakthrough feature designed to reveal the off-Amazon traffic sources driving shoppers to product listings. Unlike keyword research or PPC tools, this feature focuses on organic referral traffic generated by websites participating in the Amazon Associates ecosystem or monetizing through affiliate programs.

For example, a niche blog that writes “Best Kitchen Gadgets in 2025” may include affiliate links that send readers directly to specific Amazon listings. These blogs are incentivized to drive high-converting traffic since they earn commissions only when customers purchase. Link Traffic exposes these hidden sources of discovery, giving sellers an opportunity to pitch samples, request inclusion in reviews, or build partnerships with publishers already driving traffic in their category.

What makes this tool powerful is the actionability of the data. If a competitor’s listing is being promoted by a high-authority blog, sellers can identify that publisher and pitch their own products for inclusion. If niche sites are funneling buyers into Amazon, sellers can reach out to form partnerships. Essentially, the tool exposes the off-Amazon sales funnel that sellers previously had no visibility into.

Why should Amazon Sellers focus on external traffic?

Amazon has become a crowded and highly competitive marketplace, where organic discovery alone rarely guarantees growth. To stand out, sellers increasingly turn to external traffic sources, Google searches, and SEO-driven blog content. These channels not only bring shoppers directly to listings but also establish credibility and brand visibility beyond Amazon’s ecosystem. In effect, external marketing fuels both short-term sales and long-term brand recognition.

Another reason external traffic is so valuable is its role in reducing dependency on Amazon PPC. With ad costs steadily climbing, sellers who diversify into off-Amazon channels can capture high-intent customers at lower acquisition costs. Affiliates, bloggers, and niche publishers in particular have strong incentives to promote products; many monetize through the Amazon Associates program, so the traffic they send is typically targeted and purchase-ready.

Beyond direct sales, external traffic also has a powerful influence on Amazon’s ranking algorithm. The platform prioritizes listings that attract and convert outside visitors, rewarding them with better keyword rankings and organic placements. For sellers, this creates a compounding effect: every qualified visitor from a blog post not only drives immediate conversions but also helps push the listing higher in Amazon search results. This cycle of external traffic boosting organic rank is why top sellers treat off-Amazon marketing as a core part of their competitive strategy.

How does Link Traffic compare with SmartScout’s other tools?

While Link Traffic focuses on uncovering off-Amazon referral sources, it fits into the broader SmartScout ecosystem by complementing the tools designed to map activity happening within Amazon.

1. Traffic graph

The Traffic Graph is built to reveal Amazon-internal relationships, how shoppers navigate between ASINs, keywords, and variations. It helps sellers identify:

- Which ASINs are the best candidates for advertising placements.

- High-performing variations that attract the most clicks.

- Opportunities for bundles by seeing which products customers often view together.

This makes Traffic Graph ideal for internal targeting strategies. In contrast, Link Traffic shifts the focus outward, blogs, review sites, and affiliate publishers that are sending buyers directly to Amazon listings. Together, they give sellers a dual view: where traffic originates externally and how it flows once inside Amazon’s ecosystem.

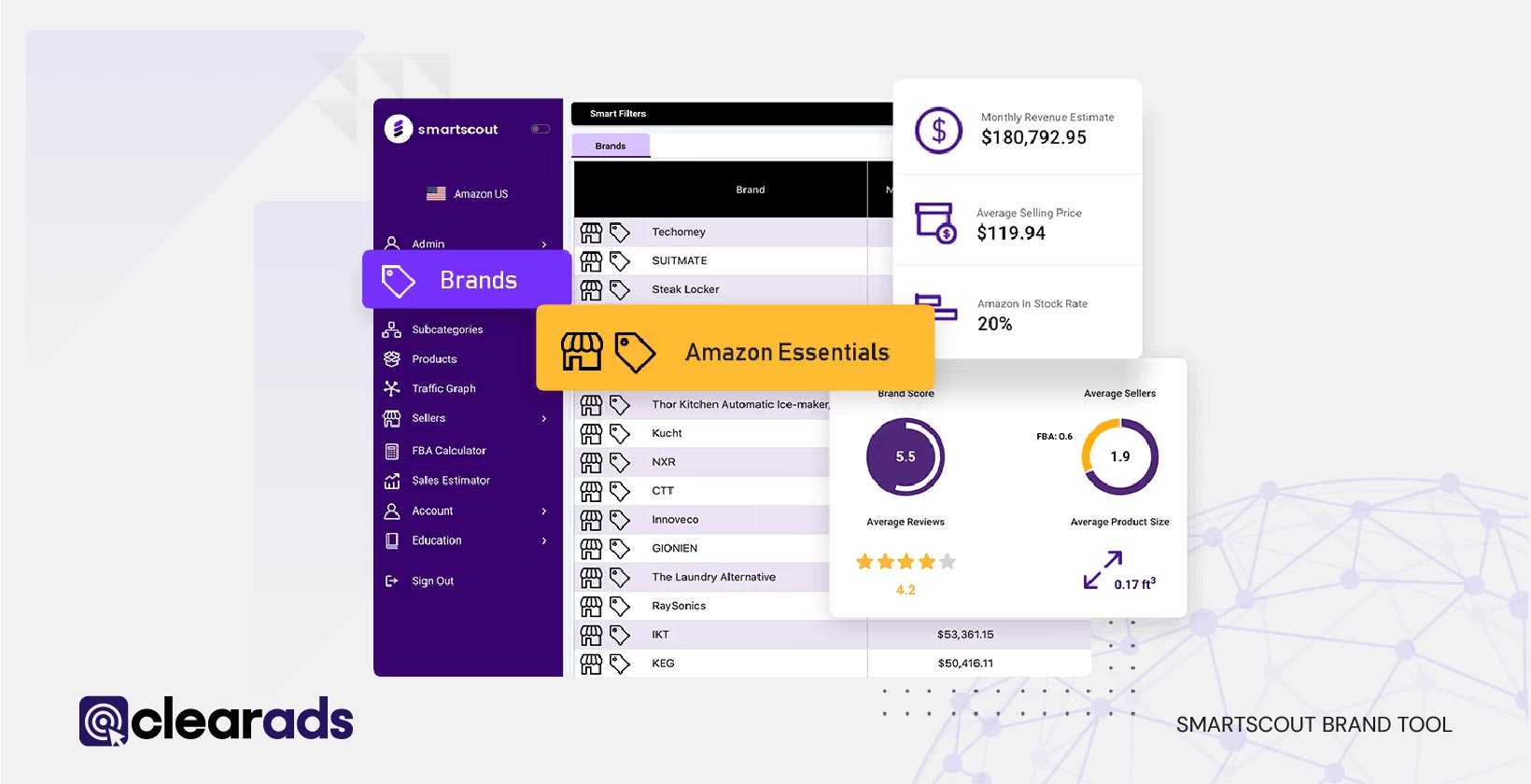

2. Brand tool

The Brand Tool provides a high-level view of competitor performance, including brand-level revenue, sales volume, and traffic sources. Sellers can benchmark against competitors by seeing which brands dominate a category and where their market share is growing.

While the Brand Tool highlights the scale and financial strength of a brand, it does not pinpoint who is driving the traffic. Link Traffic fills that gap by exposing the specific external sites and affiliates that are sending customers to ASINs, allowing sellers to go from big-picture brand analysis to actionable outreach targets. While other SmartScout tools focus on keyword targeting, ad strategies, or revenue data, Link Traffic uniquely reveals external referral domains driving discovery and conversions.

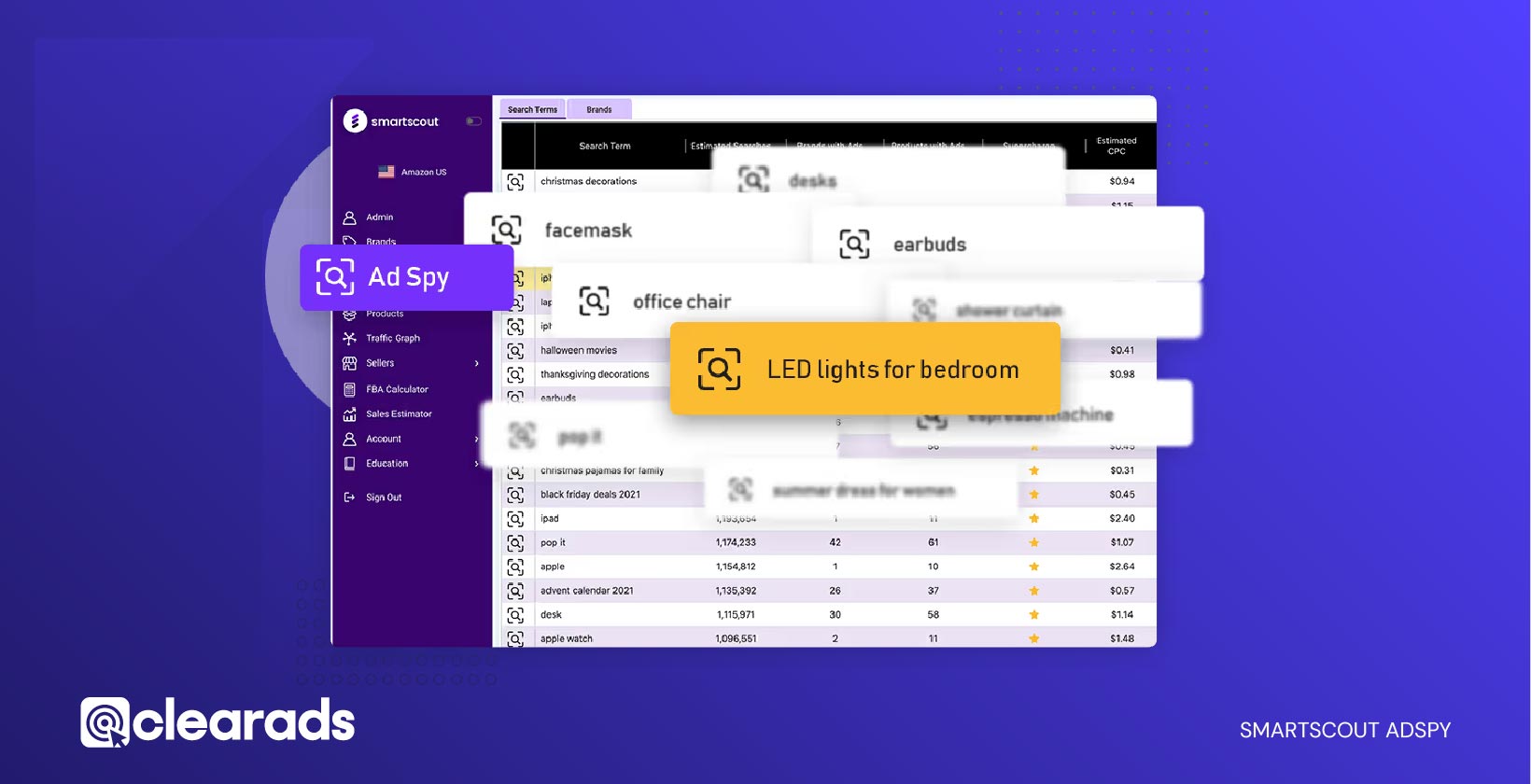

3. AdSpy

AdSpy focuses on Amazon advertising performance. It reveals:

- Competitors’ ad win rates (where their ads succeed or fail).

- Key ad performance metrics like clicks, conversions, and placements.

This makes AdSpy invaluable for shaping PPC and on-Amazon advertising strategies. Link Traffic, on the other hand, goes beyond paid ads by tracking organic and affiliate referrals, traffic that isn’t tied directly to PPC but can be equally impactful. When combined, sellers can see both how competitors advertise on Amazon and how they drive discovery off Amazon.

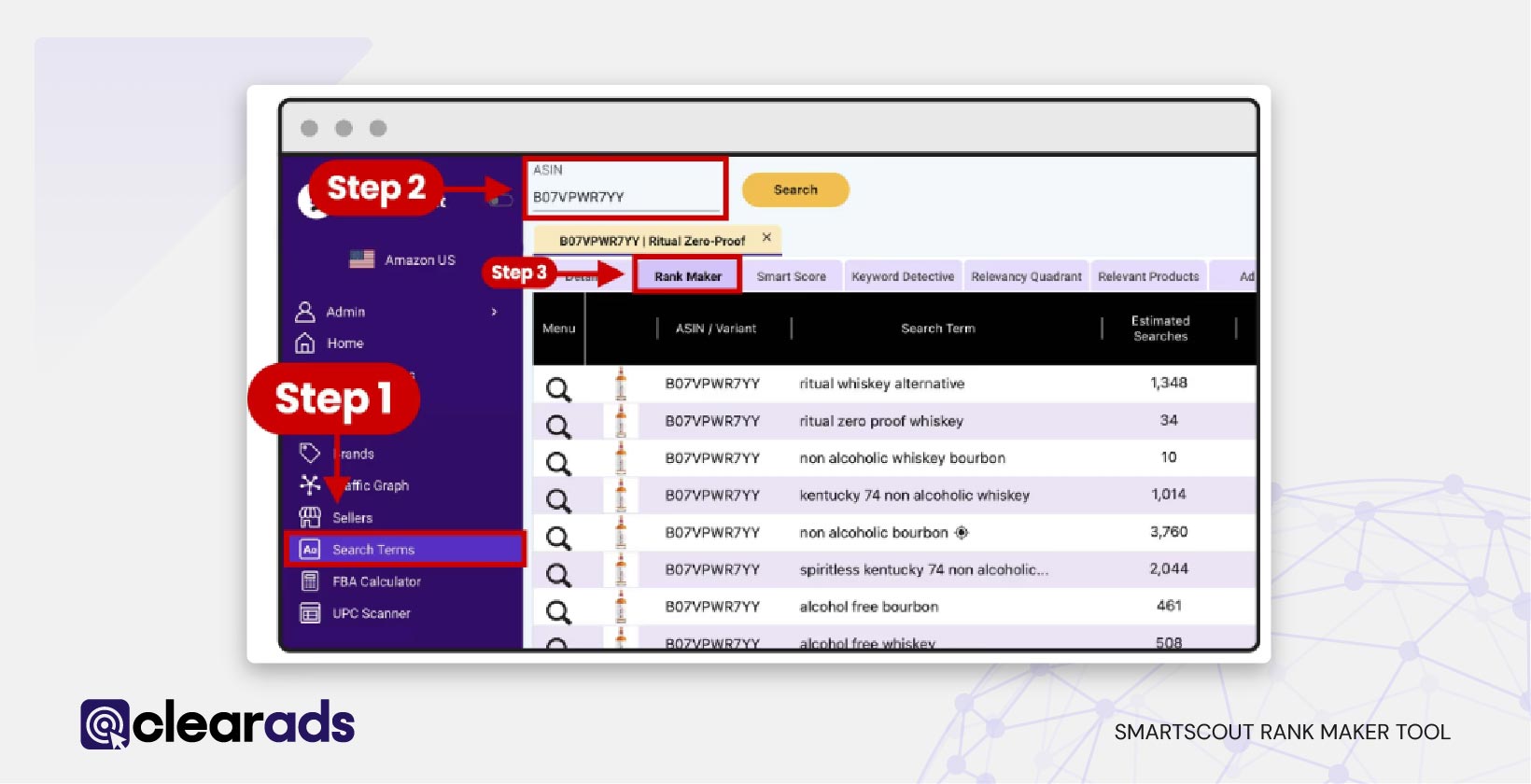

4. Rank maker

The Rank Maker Tool adds a keyword ranking dimension. With features like historic keyword trend tracking and reverse ASIN lookup, it helps sellers:

- Analyze how competitors rank over time on important keywords

- Discover new keyword opportunities missed in current campaigns

- Benchmark historic ranking trends to anticipate shifts in search visibility

SmartScout tools comparison table

| SmartScout Tool | Primary Function | Unique Value for Sellers |

| Link Traffic | Identifies external referral domains (blogs, affiliates, review sites) sending traffic to Amazon listings | Lets sellers uncover competitor traffic sources and pitch partnerships with high-converting publishers |

| Brands Tool | Provides revenue insights and traffic sources for specific Amazon brands | Helps sellers gauge competitor market share and discover which channels fuel their sales |

| AdSpy Tool | Tracks competitor ad placements, win rates, and performance | Reveals where competitors are winning with Amazon ads, helping sellers refine PPC strategy |

| Rank Maker | Explores historic keyword rankings via reverse ASIN lookup | Shows long-term keyword performance and opportunities to optimize rankings |

How does Link Traffic differ from Helium 10 and Jungle Scout?

Most Amazon seller tools, including Helium 10 and Jungle Scout, are excellent at covering the fundamentals: keyword tracking, product research, and PPC campaign insights. They help sellers optimize their listings, monitor keyword performance, and refine advertising strategies. However, they stop short when it comes to showing off-Amazon referral traffic.

Neither Helium 10 nor Jungle Scout reveals which external websites and blogs are sending traffic to specific competitor ASINs. That gap makes it difficult for sellers to uncover the hidden partnerships and affiliate-driven content that often fuel a competitor’s visibility and sales.

This is where SmartScout’s Link Traffic tool stands apart. It doesn’t just track what’s happening inside Amazon; it shows the external ecosystem behind a product’s success. By surfacing referral domains and affiliate blogs, SmartScout gives sellers direct opportunities to replicate, partner, or outmaneuver their competitors’ traffic strategies.

In short, while Helium 10 and Jungle Scout help optimize within Amazon, SmartScout adds visibility into the off-Amazon discovery funnel that most sellers completely overlook.

Tool Comparison Table

| Tool | Strengths | Limitations | What SmartScout Adds |

| Helium 10 | Keyword tracking, listing optimization, product research, PPC management | No visibility into external referral traffic | Complements internal insights with competitor external traffic data |

| Jungle Scout | Product research, sales estimates, keyword tools, supplier database | Cannot identify blogs, websites driving traffic | Misses external discovery channels that strongly impact competitor sales |

| SmartScout – Link Traffic | Shows referral sources (blogs, niche websites) | Newer feature (Business Plan only) | Unique in surfacing who is actually sending external traffic to competitor listings |

How to use Smartscouts’ Link Traffic feature?

The Link Traffic feature is designed to give sellers a direct line of sight into where their competitors’ Amazon listings are gaining visibility outside the marketplace. Instead of guessing which blogs, websites, or SEO-driven articles are driving conversions, sellers can now identify these referral sources in just a few clicks. This makes it far easier to build relationships with affiliates, pitch samples to publishers, or even mirror competitors’ external strategies.

By leveraging this tool, sellers can:

- Discover which websites are actively linking to and promoting competitor ASINs.

- Spot high-converting traffic opportunities that go beyond traditional Amazon PPC.

- Build long-term brand awareness by partnering with established publishers already incentivized to drive sales.

Ultimately, Link Traffic helps sellers transform external traffic from a “blind spot” into an actionable growth channel.

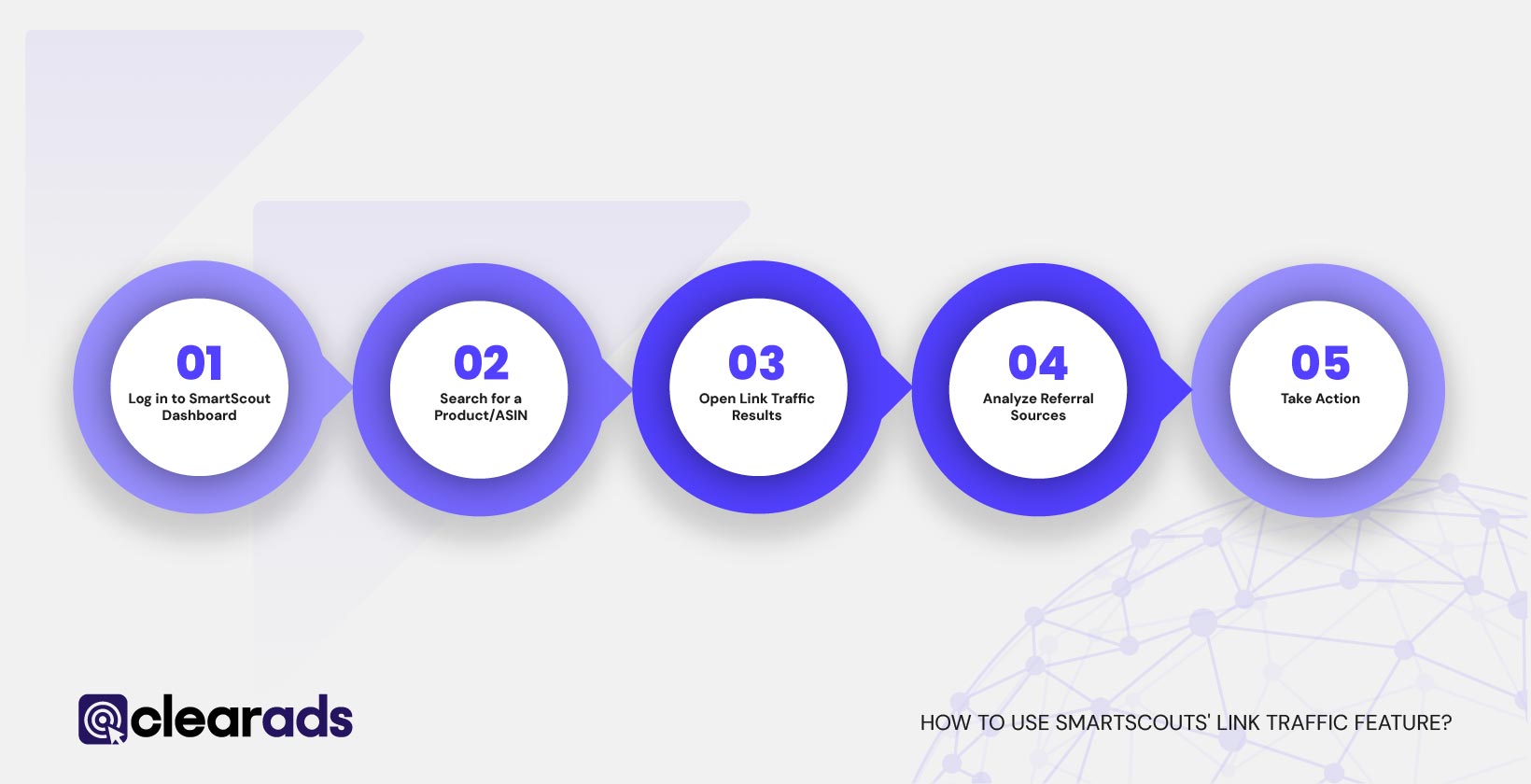

Step-by-step guide to accessing the Link Traffic feature in SmartScout

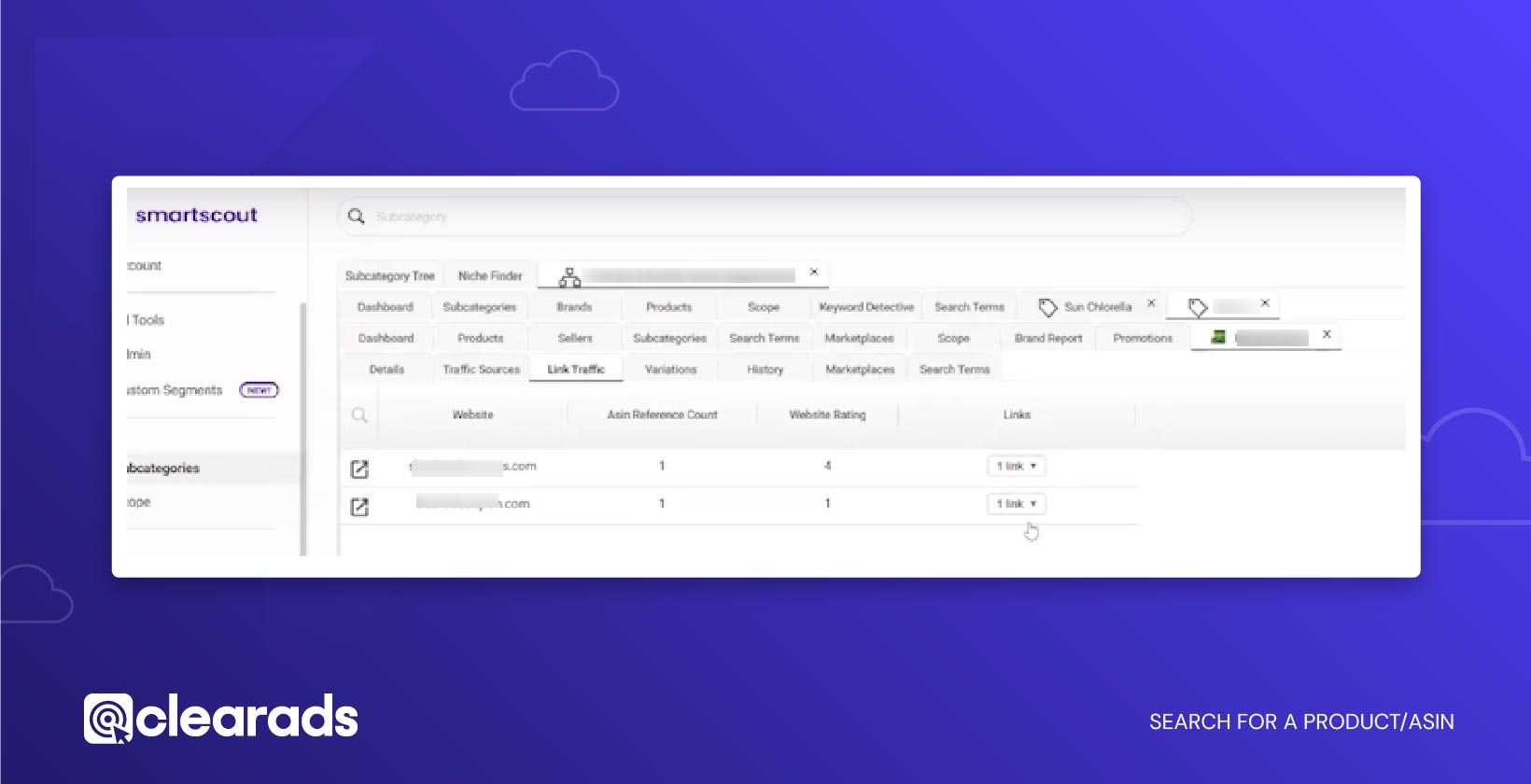

Using Link Traffic inside SmartScout is simple and intuitive. Here’s how sellers can get started:

- Log in to SmartScout Dashboard – The feature is available under the Business Plan.

- Search for a Product/ASIN – Enter either your own ASIN or a competitor’s ASIN.

- Open Link Traffic Results – SmartScout displays a list of external websites, blogs, and referral domains linking directly to the listing.

- Analyze Referral Sources – Review which sites send traffic most frequently and evaluate their authority or relevance.

- Take Action – Reach out to publishers, negotiate affiliate deals, or develop your own blog/SEO presence to mirror the strongest referral sources.

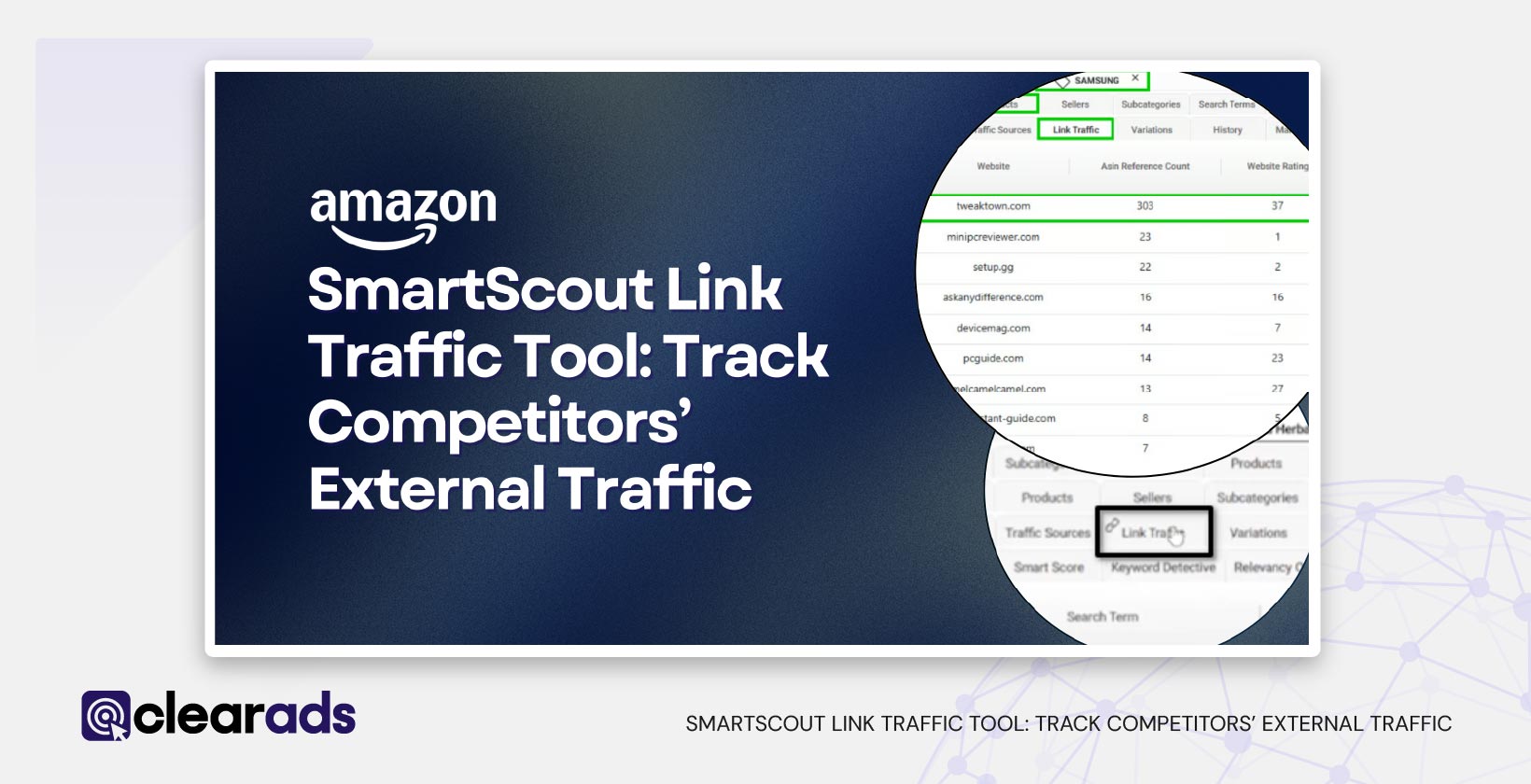

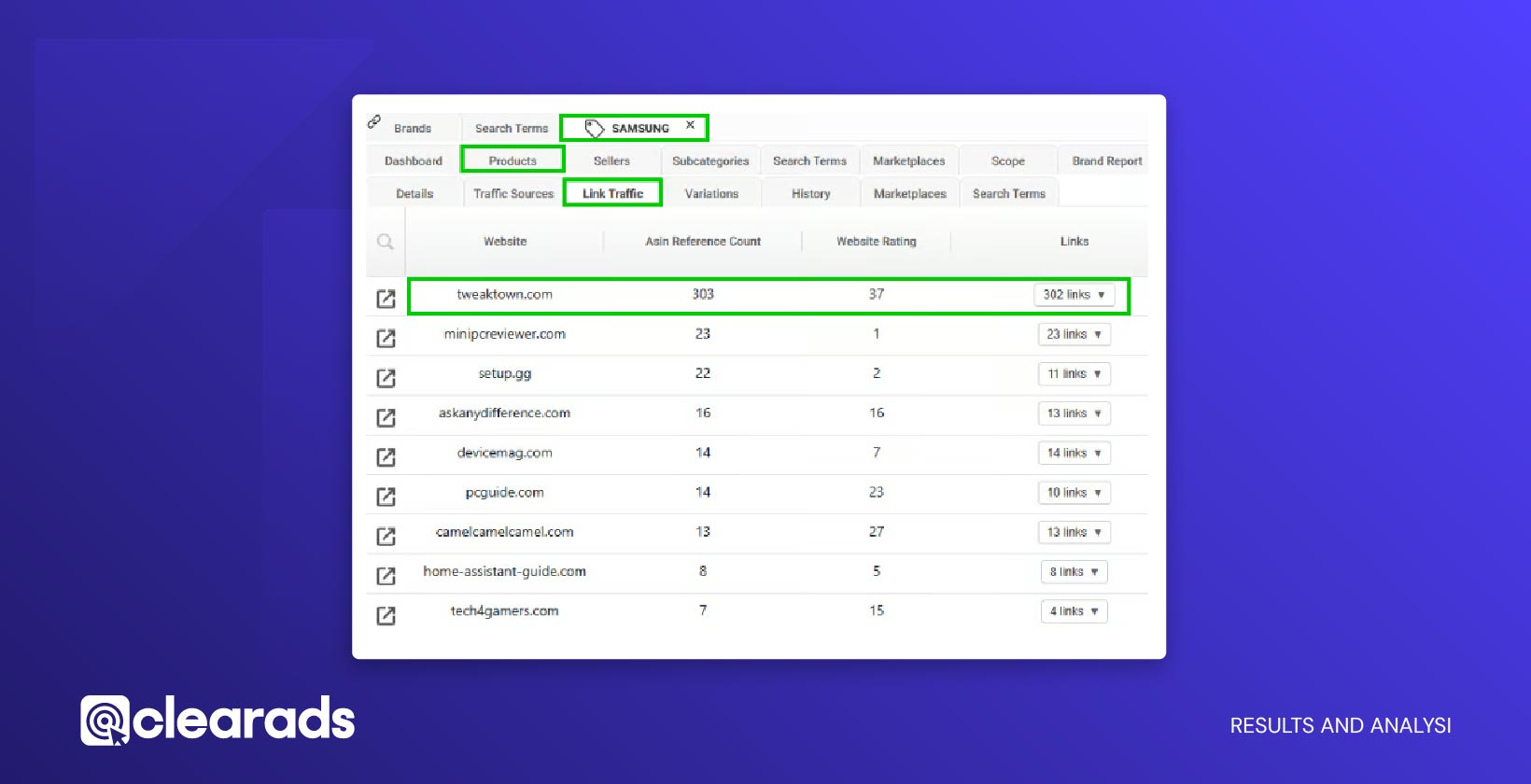

For example, in a demo using a Samsung SSD product, SmartScout revealed multiple tech blogs actively linking to the listing. Sellers could then evaluate those same publishers as potential partners to feature their competing product. This demonstrates how Link Traffic goes beyond internal data and opens a window into off-Amazon demand.

How to Analyze Link Traffic Data Effectively?

Once you open the Link Traffic feature, the real value lies in interpreting what the data reveals. Sellers can see which domains are actively linking to a product, whether competitor ASINs or their own. Most of these sites are affiliate-driven publishers that participate in Amazon Associates. This means they’re motivated to send high-converting, purchase-ready traffic.

For instance, if you analyze a gaming product like the Samsung 990 PRO SSD, you might see multiple tech review sites and niche blogs funneling traffic directly to that ASIN. From this data, sellers can:

- Identify referral domains that consistently drive sales in your niche.

- Spot affiliate signals, such as websites monetizing through Amazon Associates links.

- Gauge channel strength, understanding which types of publishers (blogs, forums) generate the most traction.

- Track trends over time, noticing if competitors double down on specific channels like SEO blogs.

Instead of chasing generic traffic strategies, sellers now have a precise map of where their audience is being influenced and can prioritize accordingly.

How to apply Link Traffic insights to business?

The most powerful step comes after analysis, turning competitor data into actionable growth strategies. By understanding where competitors’ traffic originates, sellers can directly approach those same sources and build partnerships.

Here’s how sellers can apply Link Traffic insights:

- Partner with top-performing affiliates & publishers: If a blog or review site is already driving traffic to similar products, they’re prime candidates to feature your product too. A simple outreach with a free sample or affiliate commission can secure placement.

- Expand into off-Amazon channels: Instead of limiting your marketing to Amazon PPC, use the identified channels, blogs, or niche content platforms to drive fresh, converting traffic back to your listings.

- Build long-term SEO & brand presence: When your product is mentioned across multiple high-authority sites, it doesn’t just send traffic. It also strengthens brand recognition and boosts visibility in Google and AI-driven search engines (like ChatGPT responses).

- Prioritize ROI-driven channels: Since Link Traffic reveals which sources already convert well for competitors, sellers can avoid wasting ad spend on unproven campaigns.

This flips the usual seller playbook from guesswork to data-backed partnerships and smarter marketing allocation.

How does SmartScout track competitor traffic?

The strength of the Link Traffic feature isn’t just in showing that competitors receive external traffic, but in revealing where it originates. To provide this visibility, SmartScout relies on a mix of referral tracking, affiliate network signals, and publicly available data sources. This ensures sellers can see which external publishers are actively sending visitors to Amazon listings, and more importantly, which of those are worth pursuing for their own marketing.

What are the data sources and methodology behind Link Traffic?

SmartScout’s Link Traffic pulls insights from multiple public and affiliate-based signals rather than guessing. Much of the data comes from websites and publishers monetizing through the Amazon Associates program, which means the traffic is already high-intent and conversion-focused.

In practice, this means sellers can uncover:

- Blogs and review sites linking directly to Amazon listings.

- affiliate-driven traffic across niches.

- SEO-driven content that drives discovery for both branded and generic keywords.

By combining these referral sources with public visibility signals, Link Traffic builds a map of which external channels matter most in your category. This allows sellers to move beyond speculation and into actionable partnerships with the publishers already driving competitor sales.

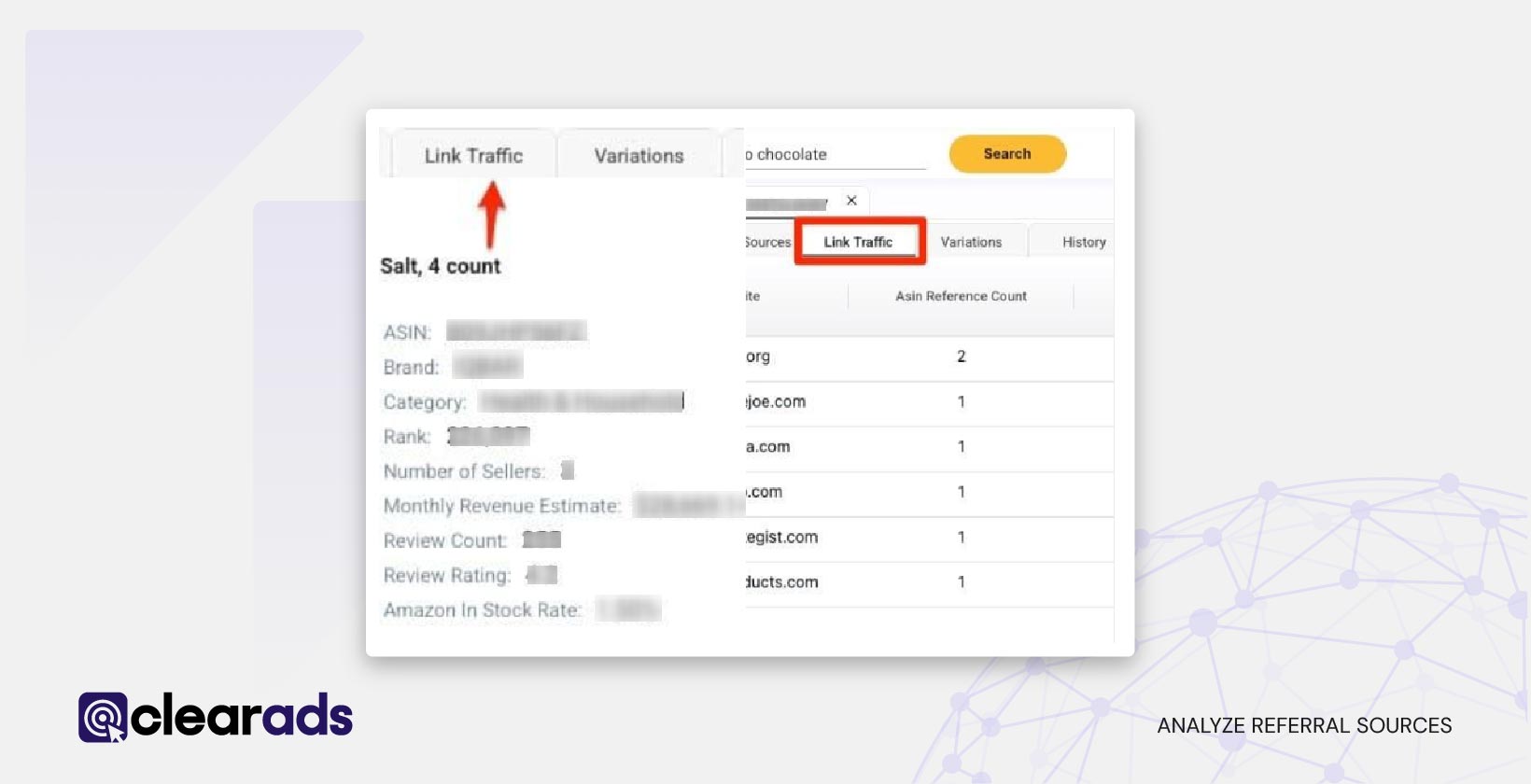

What metrics can sellers see with the Link Traffic tool?

Inside SmartScout’s Link Traffic tool, sellers get a structured view of the external websites driving clicks toward Amazon listings. The key metrics available include:

- Referral domains: A list of the websites or blogs sending external traffic.

- ASIN reference count: How many times a product/ASIN appears on that site.

- Website rating: A quality score to evaluate the authority of each referral site.

- Link count: The number of active links pointing from that site to the ASIN.

This data equips sellers to identify high-value referral sources and spot which external publishers consistently drive discovery for their competitors.

How does monitoring competitors’ external traffic help sellers?

Understanding competitors’ external traffic isn’t just about curiosity; it’s about gaining a tactical advantage. By seeing which blogs, publishers, and referral sites are sending buyers to competing listings, sellers can uncover proven pathways for discovery and growth. This reduces wasted effort and highlights partnership opportunities that directly impact sales and rankings.

What competitor strategy insights can sellers gain?

By analyzing external referral data, sellers gain visibility into where competitors are focusing their marketing. Link Traffic reveals:

- Which affiliate blogs and publishers consistently send traffic to competitor listings?

- How often competitor ASINs are mentioned across external sites.

- The relative authority of each referral source makes it easier to prioritize outreach.

Example: If a competitor’s ASIN is receiving steady referral traffic from a well-known affiliate blog, that site has already proven its ability to convert in your category. Instead of guessing which partnerships might work, sellers can pitch the same publishers with collaboration offers or product samples.

How can competitor tracking inspire your own campaigns?

Monitoring competitor traffic also fuels creative inspiration. If their referral partnerships and content placements are working, sellers can adapt similar strategies for their brand.

Practical ways to apply insights:

- Pitch to blogs and publishers already linking to competitor products (they’re open to affiliate content, making them easier to work with).

- Develop educational content (blogs, tutorials, comparisons) that answers customer questions while linking naturally to your products.

- Expand into SEO-focused guides and niche forums where your audience is already researching.

Content marketing is especially powerful here. Brands that invest in trust-building and education outside Amazon generate sustainable external traffic streams that improve rankings without relying solely on PPC. For instance, a blog post comparing options (e.g., “best eco-friendly cookware”) can drive high-intent buyers before they even enter Amazon’s search bar.

How does this improve ROI and marketing efficiency?

Tracking competitor traffic sharpens how sellers allocate their marketing spend. Instead of spreading budget across unproven platforms, insights from Link Traffic help sellers:

- Focus the budget on channels already proven to convert for competitors.

- Reduce PPC dependency by supplementing with affiliate and referral partnerships.

- Identify profitable ASINs, bundles, or variations worth targeting in campaigns.

Example: SmartScout’s Traffic Graph highlights which ASINs or product clusters receive the highest inbound traffic. By layering this with Link Traffic insights, sellers can prioritize advertising and bundling strategies, aligning spend with real customer demand instead of trial-and-error.

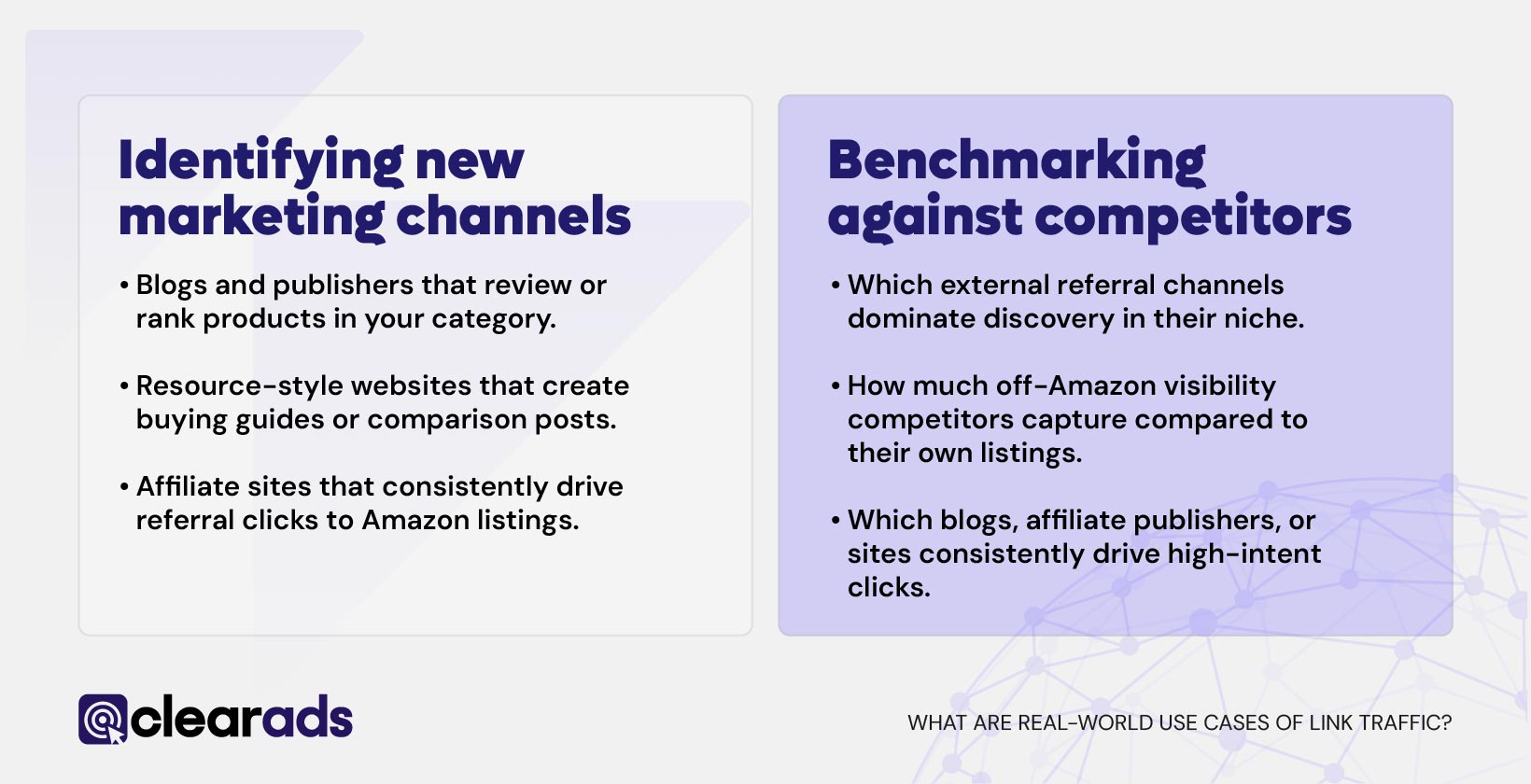

What are real-world use cases of Link Traffic?

SmartScout’s Link Traffic feature isn’t just theoretical; it delivers practical applications that Amazon sellers can use to grow visibility, optimize marketing, and outperform competitors. Below are two of the most common use cases.

1. Identifying new marketing channels

Many sellers rely heavily on PPC and Amazon’s internal ranking system, but this creates dependence and limits long-term growth. By tracking competitors’ external traffic, sellers can discover new and untapped channels such as:

- Blogs and publishers that review or rank products in your category.

- Resource-style websites that create buying guides or comparison posts.

- Affiliate sites that consistently drive referral clicks to Amazon listings.

Example: If competitors are consistently featured in “Top 10” product roundups or shopping guide blogs, those sites represent ready-made audiences with purchase intent. Instead of testing channels blindly, sellers can step directly into proven traffic pathways.

This aligns with content marketing principles: brands that appear in external resources, educational blog posts, how-to guides, or product comparisons capture buyers earlier in their journey, long before they search on Amazon. This improves both organic visibility and conversion rates while reducing reliance on paid ads.

2. Benchmarking against competitors

Another powerful use case is benchmarking your traffic mix against competitors. Sellers can see:

- Which external referral channels dominate discovery in their niche.

- How much off-Amazon visibility competitors capture compared to their own listings.

- Which blogs, affiliate publishers, or sites consistently drive high-intent clicks.

This type of analysis shows who owns the conversation outside Amazon. For instance:

- If competitors dominate niche blogs, you’ll know to prioritize affiliate content partnerships.

- If competitor listings are repeatedly referenced across resource sites, you’ll understand which channels to pursue first.

This insight allows sellers to identify gaps in their own strategy and redirect budget where it matters most. Instead of spreading marketing dollars across untested campaigns, sellers can double down on channels already proven to convert for others in your market.