This article serves as a comprehensive guide for sellers looking to optimise their ad campaigns by interpreting Amazon Advertising Reports effectively. It begins by outlining the 10 critical steps to mastering these reports: selecting the right report, reviewing key metrics like Peer Impressions Top and 14-Day New-to-Brand Units, analysing performance trends, identifying high- and low-performing areas, optimising bids and budgets, refining targeting and keywords, monitoring competitor activity, experimenting with ad creatives, tracking performance goals, and iterating campaigns continuously.

The article also addresses foundational questions, starting with “What Is Amazon Advertising Report?”, providing a definition of these downloadable files and explaining their role in campaign optimisation. Next, it covers “How Are Amazon Ads Report Generated?”, detailing the process of accessing, customising, and downloading reports via the Amazon Ads Console.

The importance of these reports is highlighted in “How Is Amazon Advertising Report Important?”, where their value in making data-driven decisions and improving ad effectiveness is discussed. The section “What Does Amazon PPC Reports Contain?” elaborates on the key metrics included in these reports, such as campaign-level performance, keyword data, and invalid traffic metrics.

The article further explains “How to Monitor Amazon Ads?”, offering strategies for tracking performance using dashboards, KPIs, and real-time alerts. In “When Should Changes Be Made to Amazon Ads After Reviewing the Reports?”, actionable scenarios for refining campaigns, such as adjusting bids or reallocating budgets, are outlined.

Finally, it concludes with “Is PPC Better than Organic Performance?”, comparing the immediate impact of PPC campaigns with the long-term benefits of organic rankings, highlighting the synergy between the two approaches for maximising visibility and profitability. This article equips sellers with actionable insights to enhance their advertising strategies effectively.

This article offers a comprehensive guide for sellers to maximise the effectiveness of their Amazon ad campaigns using Advertising Reports. It provides step-by-step instructions on selecting the appropriate reports, analysing key metrics, and making data-driven decisions to optimise bids, refine targeting, and improve campaign performance. The guide explains the process of generating reports via the Amazon Ads Console and highlights their importance in enhancing visibility, engagement, and ROI.

Key strategies discussed include identifying high and low performing areas, monitoring competitors, testing ad creatives, and continuously iterating to adapt to market changes. Additionally, the article explores the relationship between PPC and organic performance, emphasising the value of combining both approaches for sustained success. By following the insights and steps outlined, advertisers can refine their campaigns, track progress, and achieve their advertising objectives effectively.

The article begins with a structured guide outlining critical steps to interpret and utilise Amazon Advertising Reports effectively. These steps include selecting the right report, reviewing essential metrics like Invalid Clicks and Impressions, and 14-Day Detail Page Views (DPV), analysing performance trends, refining targeting and keywords, and optimising bids and budgets. It also highlights monitoring competitor activity, experimenting with ad creatives, tracking performance goals, and continuously iterating campaigns to ensure sustained performance improvements.

In addition to the 10 steps, the article explains what Amazon Advertising Reports are, how they are generated using the Amazon Ads Console, and why they are essential for data-driven decision-making. It also explores the contents of these reports, such as campaign metrics, keyword performance, and invalid traffic data, which provide actionable insights. The article concludes by discussing how to monitor campaigns effectively, when to implement changes, and the relative benefits of PPC and organic strategies for maximising visibility and profitability.

Introduction

These reports offer insights into key metrics, enabling precise targeting, budget allocation, and ROI enhancement. This guide outlines 10 actionable steps to analyse and utilise these reports effectively.

Step 1. Select the Right Report

The Amazon Ads console offers comprehensive measurement and reporting tools, enabling the download of Amazon advertising reports to assess campaign performance. In the Create Report section, various report types are available for different ad formats, including Sponsored Products, Sponsored Brands, and Sponsored Display.

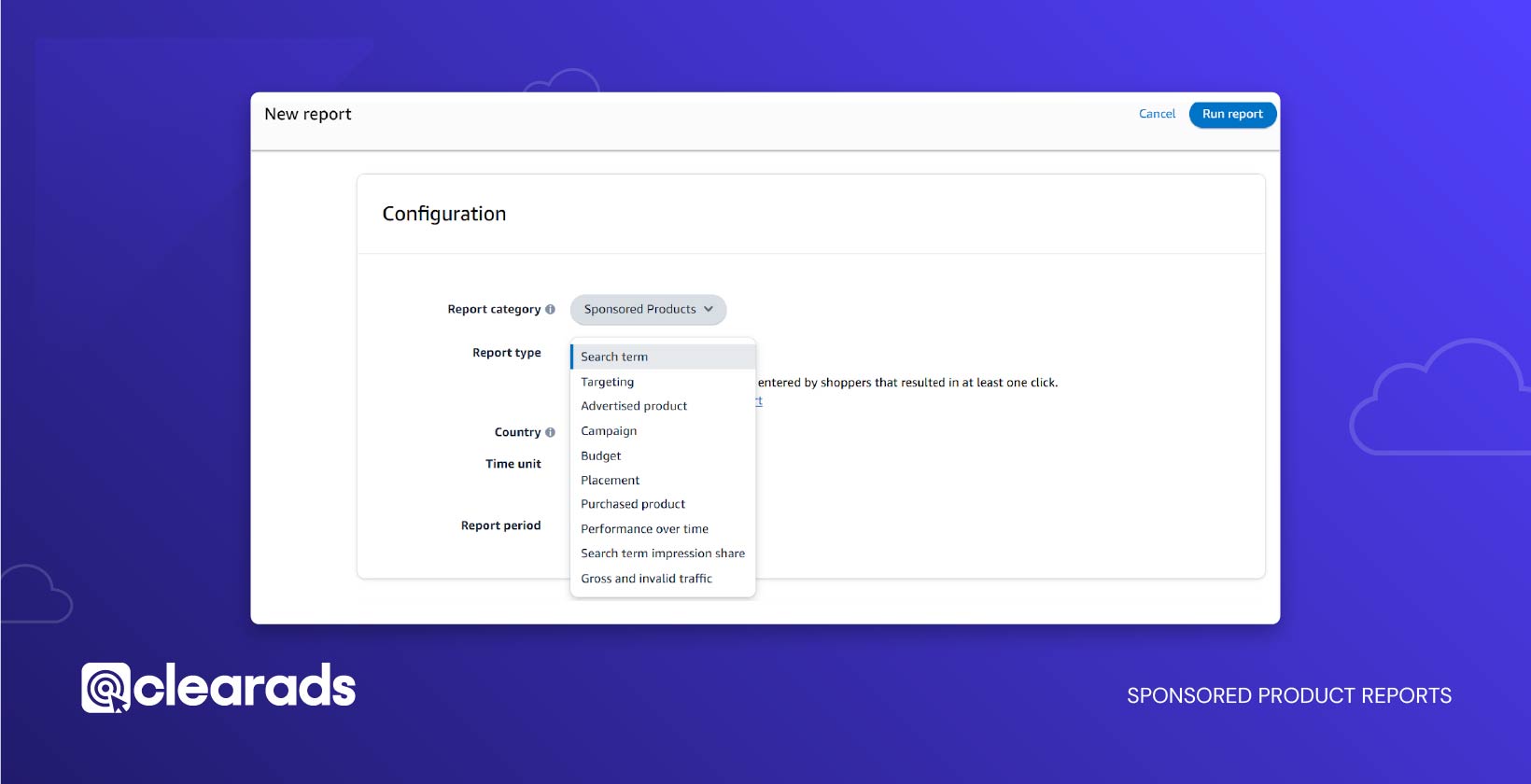

Let’s start with Sponsored Products, which offer the most comprehensive set of reporting options.

Sponsored Products Reports

Sponsored Products Ads is the primary ad type on Amazon. These ads allow sellers to promote individual product listings directly within Amazon’s search results or on product detail pages. Sponsored Products operate on a pay-per-click (PPC) model, where advertisers bid on keywords or target specific ASINs to gain visibility for their products. These ads are designed to boost discoverability, drive traffic, and ultimately increase sales for advertised items.

To evaluate and optimise these ad campaigns, Amazon provides a set of comprehensive reports. Here are the available reports for Sponsored Products campaigns:

- Search Term Report: Analyse specific search terms and competitor ASINs that led to clicks and conversions.

- Targeting Report: Evaluate the performance of targets like keywords, products, and categories.

- Advertised Product Report: Focuses on performance metrics for the advertised ASINs.

- Campaign Report: Summarises performance at the campaign level for long-term insights.

- Budget Report: Tracks budget allocation to identify underfunded or overspending campaigns.

- Placement Report: Provides insights into ad performance based on placement, such as Top of Search.

- Purchased Product Report: Shows which products were purchased after clicking your ad.

- Performance Over Time Report: Highlights trends in performance metrics over time.

- Search Term Impression Share Report: Compares impression share with competitors for specific search terms.

- Gross and Invalid Traffic Report: Identifies invalid clicks and impressions to ensure data accuracy.

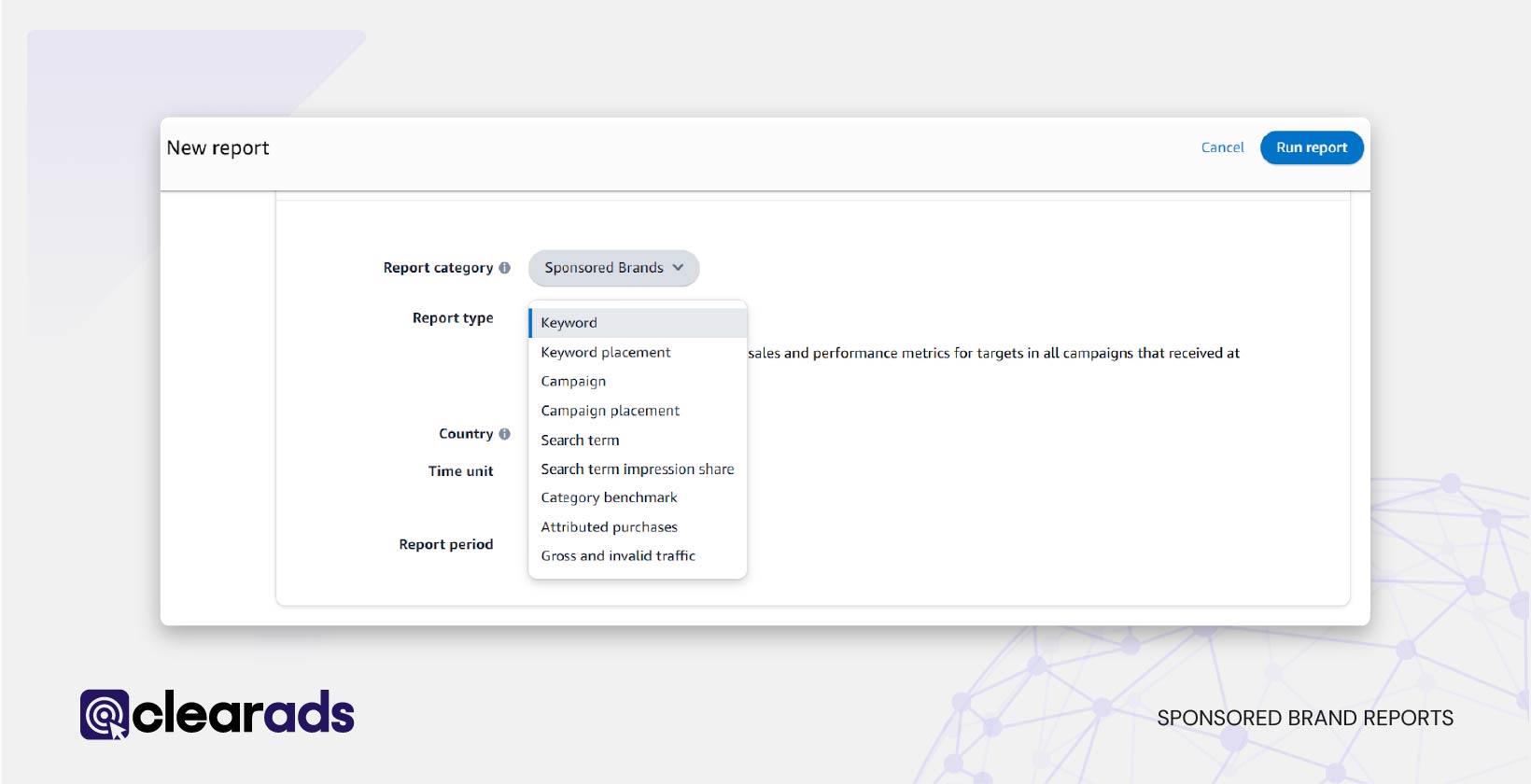

Sponsored Brands Reports

Sponsored Brands ads are designed to promote brand visibility and drive traffic to a group of products or a storefront. These ads appear prominently on Amazon, such as at the top of search results, and allow sellers to feature their brand logo, a customised headline, and multiple products. Sponsored Brands ads are ideal for increasing brand awareness and showcasing product collections.

Similar to Sponsored Products, Sponsored Brands ads use a pay-per-click (PPC) model, allowing advertisers to bid on keywords or target specific customer segments. These ads can lead shoppers to a brand storefront or a curated product list, offering a flexible way to showcase brand identity.

To optimise Sponsored Brands campaigns, Amazon offers the following nine comprehensive report types:

- Keyword Report: Offers performance data on targeted keywords in campaigns, identifying both high-performing and underperforming keywords.

- Keyword Placement Report: Shows how keywords perform in specific ad placements, such as Top of Search or Other Placements.

- Campaign Report: Offers a summary of performance at the campaign level, including spend, sales, and impressions.

- Campaign Placement Report: Displays campaign performance broken down by placement to optimise bid adjustments.

- Search Term Report: Examines search terms that triggered ads, providing insights into customer search behaviour and identifying potential negative keywords.

- Search Term Impression Share Report: Measures impression share for specific search terms in comparison to competitors.

- Category Benchmark Report: Offers category-level performance benchmarks to evaluate campaign performance against competitors.

- Attributed Purchases Report: Tracks purchases resulting from clicks on Sponsored Brands ads, providing insights into sales impact.

- Gross and Invalid Traffic Report: Identifies clicks or impressions flagged as invalid to ensure accurate reporting and budget efficiency.

These reports enable sellers to refine targeting, optimise ad placements, and improve campaign performance, making Sponsored Brands a powerful tool for enhancing brand presence on Amazon.

Sponsored Display Reports

Sponsored Display ads are a unique Amazon ad type designed to engage shoppers through audience targeting rather than keyword, ASIN, Category. These ads appear on Amazon’s product detail pages, shopping results, and even external sites within Amazon’s advertising network. Sponsored Display ads allow sellers to target audiences based on shopping behaviours, interests, or views of similar products, making them an effective tool for remarketing and driving conversions.

Sponsored Display operates on a cost-per-mille (CPM) and a pay-per-click (PPC) model, but it also includes audience-based targeting capabilities, enabling sellers to reach shoppers beyond keyword targeting.

To analyse and optimise Sponsored Display campaigns, Amazon provides the following seven reports:

- Campaign Report: Summarises campaign-level performance, including key metrics like spend, impressions, clicks, and conversions.

- Targeting Report: Provides performance data on audience and contextual targets, aiding in refining targeting strategies.

- Advertised Product Report: Provides metrics for products advertised in Sponsored Display campaigns.

- Purchased Product Report: Shows which products were purchased after shoppers clicked on Sponsored Display ads.

- Matched Target Report: Lists audiences or products that matched ads, providing insights into targeting effectiveness.

- Gross and Invalid Traffic Report: Detects invalid clicks and impressions, ensuring accurate and reliable campaign data.

- Pricing Transparency Report: Offers insights into ad cost structure, aiding in budget evaluation and bid optimisation.

These reports empower sellers to monitor campaign performance, fine-tune targeting, and optimise ad spend, making Sponsored Display ads a versatile option for reaching customers on and off Amazon.

Step 2. Review Key Metrics

After selecting the appropriate report, analyse key metrics that offer insights into campaign performance. These metrics assess ad effectiveness in driving visibility, engagement, and sales, enabling data-driven optimisation of advertising strategies.

Each report highlights specific metrics to analyse different aspects of campaign performance. Examples of these metrics include:

- Peer Impressions Top (Sponsored Brands Category Benchmark Report)

- Represents the number of impressions achieved by top-performing advertisers in a category, serving as a benchmark to compare ad visibility.

- Peer Impressions Bottom (Sponsored Brands Category Benchmark Report)

- Indicates the number of impressions generated by lower-performing advertisers in a category, offering insights into baseline market performance.

- Peer ACoS Top 25% (Sponsored Brands Category Benchmark Report)

- Represents the Advertising Cost of Sale (ACoS) achieved by the top 25% of advertisers in a category, providing a benchmark for assessing ad cost efficiency against leading competitors.

- Targeting ASINs and Keywords (Sponsored Products Targeting Report)

- Displays the performance of targeted ASINs or keywords, including key metrics such as clicks, 7-day sales, and impressions. It highlights the effectiveness of each target in driving engagement and conversions.

- Top of Search Impression Share (Sponsored Products Targeting Report)

- Indicates the percentage of impressions an ad received in the top-of-search placement, with higher shares reflecting stronger competitiveness in prime ad positions.

- Advertised SKU and ASIN Metrics (Sponsored Products Advertised Product Report)

- Provides metrics for each advertised SKU and ASIN, including 7-day total sales, ACoS, and clicks. This helps assess the profitability of each product’s ad performance.

- Customer Search Terms (Sponsored Products Search Term Report)

- Shows the actual search terms customers used to find products, along with 7-day total sales and orders, helping identify high-performing keywords and optimise targeting.

- Invalid Clicks and Impressions (Sponsored Products Gross and Invalid Traffic Report)

- Monitors invalid clicks, impressions, and click rate to maintain campaign data integrity, identifying fraudulent or irrelevant traffic that may impact ad spend efficiency.

- Cost Type and Targeting Category (Sponsored Display Targeting Report)

- Offers insights into cost structure (CPC or CPM) and targeted categories in Sponsored Display campaigns, aiding in audience targeting refinement.

- 14-Day Detail Page Views (DPV) (Sponsored Display Targeting Report)

- Indicates the number of detail page views generated by Sponsored Display ads within 14 days of ad interaction, measuring ad-driven engagement.

- 14-Day New-to-Brand Units (Sponsored Display Targeting Report)

- Measures the number of units bought by first-time customers within 14 days of interacting with a Sponsored Display ad, assessing new customer acquisition.

- 14-Day Total Sales (Sponsored Display Targeting Report)

- Displays total revenue generated within 14 days of a Sponsored Display ad interaction, providing insights into overall sales impact.

Step 3. Analyze Performance Trends

Analysing trends helps identify factors influencing advertising performance, such as seasonality, shifts in customer behaviour, or changes in market competition. Follow these steps to effectively evaluate trends:

- Identify Seasonal Trends

- Analyse historical data from reports like the Campaign Report or Performance Over Time Report to identify seasonal sales patterns. Automating report generation with a monthly frequency ensures consistent data storage, sent to a chosen email. Since Amazon restricts how far back reports can be retrieved based on report type, storing them via email allows access to older records. Third-party tools can also be used as an alternative to email storage.

- Example: A spike in impressions and sales during December signals increased holiday season demand, enabling strategic budget increases and bid adjustments to maximise performance.

- Monitor CTR and Conversion Rate Trends

- Utilise metrics such as Click-Through Rate (CTR) and Conversion Rate (CVR) to evaluate the effectiveness of ad copy and targeting accuracy.

- Example: A declining CTR over time may suggest ad fatigue or ineffective targeting, necessitating adjustments to keywords, audience segments, or ad creatives.

- Evaluate Sales and ROAS Growth

- Evaluate trends in 7-Day Total Sales and Return on Advertising Spend (ROAS) to assess campaign effectiveness in generating revenue over time.

- Example: A consistent decline in ROAS may suggest overspending on low-performing targets, prompting optimisation.

- Track Budget Utilisation Over Time

- Leverage the Budget Report to track budget utilisation across campaigns, ensuring optimal allocation and spending efficiency.

- Example: If some campaigns consistently exhaust their daily budgets early, increasing the budget for high-performing campaigns can boost overall performance.

- Compare Performance Across Placements

- The Placement Report provides insights into ad performance trends across different placements, such as Top of Search versus Rest of Search, helping optimise placement strategies.

- Example: If Top of Search placements consistently generate higher conversions, increasing bids for those placements can enhance visibility and improve campaign performance.

- Measure Targeting Effectiveness

- Review the Targeting Report to assess long-term performance of ASINs, keywords, or categories.

- Example: Identify which targets consistently perform well and allocate more budget toward them while eliminating low-performing ones.

Analysing these trends enables precise campaign adjustments, anticipates performance shifts, and supports a proactive advertising strategy for sustained results.

Step 4. Identify High-Performing and Low-Performing Areas

Identifying high-performing and low-performing areas allows for scaling successful strategies while optimising underperforming segments.

Follow these steps for an effective approach:

- Analyse High-Performing Keywords and Targets

- Use the Search Term Report and Targeting Report to identify keywords, ASINs, or categories that consistently generate high impressions, clicks, and conversions.

- Example: A keyword like “wireless headphones” with high CTR and ROAS should receive increased bids or be added as an exact match target to maximise its impact.

- Identify Low-Performing Keywords and Targets

- Pinpoint keywords or ASINs with high spend but low sales or high ACoS. Add them as negative keywords (for search terms) or reduce bids.

- Example: A keyword like “cheap earbuds” that attracts clicks but no conversions may require removal or bid reduction to save costs.

- Evaluate Product-Level Performance

- The Advertised Product Report provides insights into each advertised SKU or ASIN. Identify products that yield high 7-day sales and low ACoS for scaling, and flag low-converting products for further review.

- Example: A high-performing SKU with strong sales and a ROAS of 5x could be prioritised in ad campaigns, while a low-performing SKU might need pricing or content adjustments.

- Assess Placement Performance

- Use the Placement Report to compare performance across different placements, such as Top of Search versus Rest of Search.

- Example: If Top of Search consistently drives more conversions, increase placement-specific bid modifiers to optimise ad positioning.

- Monitor Budget Allocation

- The Budget Report highlights underfunded yet high-performing campaigns, enabling budget reallocation from low-performing campaigns to maximise overall effectiveness.

- Evaluate Invalid Traffic Impact

- Review the Gross and Invalid Traffic Report to identify invalid clicks and impressions, ensuring accurate campaign data and preventing wasted ad spend.

- Example: A campaign with a high invalid click rate may require tighter targeting or review of ad placements.

Identifying high-performing and low-performing areas enables precise budget allocation, bid adjustments, and targeting refinements, ensuring each campaign element drives overall success.

Step 5. Optimize Bids and Budgets

Strategically adjusting bids and reallocating budgets allows prioritisation of high-performing campaigns while minimising wasted spend on underperforming targets.

Here’s how to optimise bids and budgets effectively:

- Increase Bids for High-Performing Keywords and Targets

- Use the Targeting Report and Search Term Report to identify high-performing keywords, ASINs, or categories with strong conversions and low ACoS.

- Example: If a keyword like “ergonomic chair” has a high ROAS and low CPC, increasing its bid can help secure more impressions and clicks.

- Reduce Bids for Low-Performing Targets

- Lower bids for targets with high ACoS or low conversion rates to minimise unnecessary ad spend.

- Example: If a keyword like “cheap office furniture” generates clicks but few conversions, reducing the bid can improve cost efficiency.

- Adjust Placement-Specific Bids

- Use the Placement Report to optimise bids for specific placements such as Top of Search.

- Example: If Top of Search placements have a higher CTR and conversion rate than Rest of Search, increase the bid modifier for Top of Search to gain better visibility.

- Monitor Daily Budgets

- Review the Budget Report to ensure campaigns are adequately funded. Increase budgets for campaigns that consistently exhaust their daily limit early, especially high-converting ones.

- Example: If a Sponsored Products campaign with a $20 daily budget frequently maxes out by noon, consider raising the budget to capture additional sales opportunities.

- Pause or Reallocate Budgets from Low-Performing Campaigns

- Identify campaigns with high spend and low returns. Pause these campaigns or reallocate their budgets to better-performing ones.

- Example: A campaign promoting a low-demand product with a high ACoS might have its budget redirected to a campaign with higher demand and better results.

- Set Competitive Bids for New Campaigns

- For new campaigns, set competitive initial bids to generate data quickly. Once sufficient performance data is available, adjust bids based on ACoS and conversion rates.

- Example: Start a new keyword campaign with a mid-range bid (e.g., $0.50 per click) and refine it after reviewing the first two weeks of performance.

- Monitor Budget Efficiency Across Campaign Types

- Analyse spend, sales, and ROAS across Sponsored Products, Sponsored Brands, and Sponsored Display to optimise budget allocation and maximise campaign efficiency.

- Example: If Sponsored Display ads have a significantly lower ROAS compared to Sponsored Products, consider shifting a portion of the budget to Sponsored Products.

Regularly reviewing and optimising bids and budgets enhances advertising ROI, ensuring every pound spent aligns with business objectives.

Step 6. Refine Targeting and Keywords

Utilising performance data from an Amazon marketing report enables the elimination of wasted spend and focuses on targets that generate results. Here is how to refine targeting and keywords effectively:

- Analyse High-Performing Keywords

- Leverage the Search Term Report to find search terms that consistently drive clicks and conversions. Incorporate these as exact match keywords to attract highly relevant traffic.

- Example: If “wireless gaming headset” generates high sales, adding it as an exact match keyword ensures ads appear for shoppers actively searching for that product, improving targeting precision.

- Eliminate Irrelevant Keywords

- Find search terms with high spend but no conversions and add them as negative keywords to prevent ads from appearing in irrelevant searches, reducing wasted spend.

- Example: If the term “budget headphones” generates clicks without sales, adding it as a negative keyword ensures more budget for high-converting terms.

- Optimise Product Targeting

- Review the Targeting Report to evaluate ASIN or category-level performance. Focus on targets that deliver high ROAS and conversion rates, while excluding or lowering bids for underperforming ones.

- Example: If targeting the category “ergonomic chairs” yields high conversions but “office furniture” does not, shift the focus to “ergonomic chairs.”

- Leverage Top of Search Opportunities

- Use metrics like Top of Search Impression Share from the Targeting Report to identify opportunities for premium placements. Increase bids for keywords with strong conversion rates to secure these placements.

- Example: If a keyword like “standing desk” performs well in Top of Search placements, increase the bid to dominate this high-visibility position.

- Segment Campaigns for Precision Targeting

- Set up separate campaigns for broad, phrase, and exact match keywords to enhance budget control and enable more precise optimisation for each match type.

- Example: Broad match campaigns can identify new opportunities, while exact match campaigns focus budget on high-performing keywords.

- Test and Expand Keyword Lists

- Continuously experiment with new keywords identified from customer behaviour trends or the Search Term Report. Add them to test campaigns and monitor their performance.

- Example: Add variations like “noise-cancelling headphones” or “Bluetooth earbuds” to expand reach while tracking conversions.

- Focus on Retargeting Opportunities

- For Sponsored Display ads, retarget shoppers who previously viewed advertised products or similar ASINs. Analyse the Targeting Report to evaluate the effectiveness of this strategy.

- Example: Retargeting shoppers who viewed the advertised “smart TV” but did not purchase helps keep the product visible, increasing the likelihood of conversion.

Optimising targeting and keywords is a continuous process requiring regular analysis and adjustments. Prioritising high-performing targets and removing inefficiencies enhances campaign performance and maximise ROI.

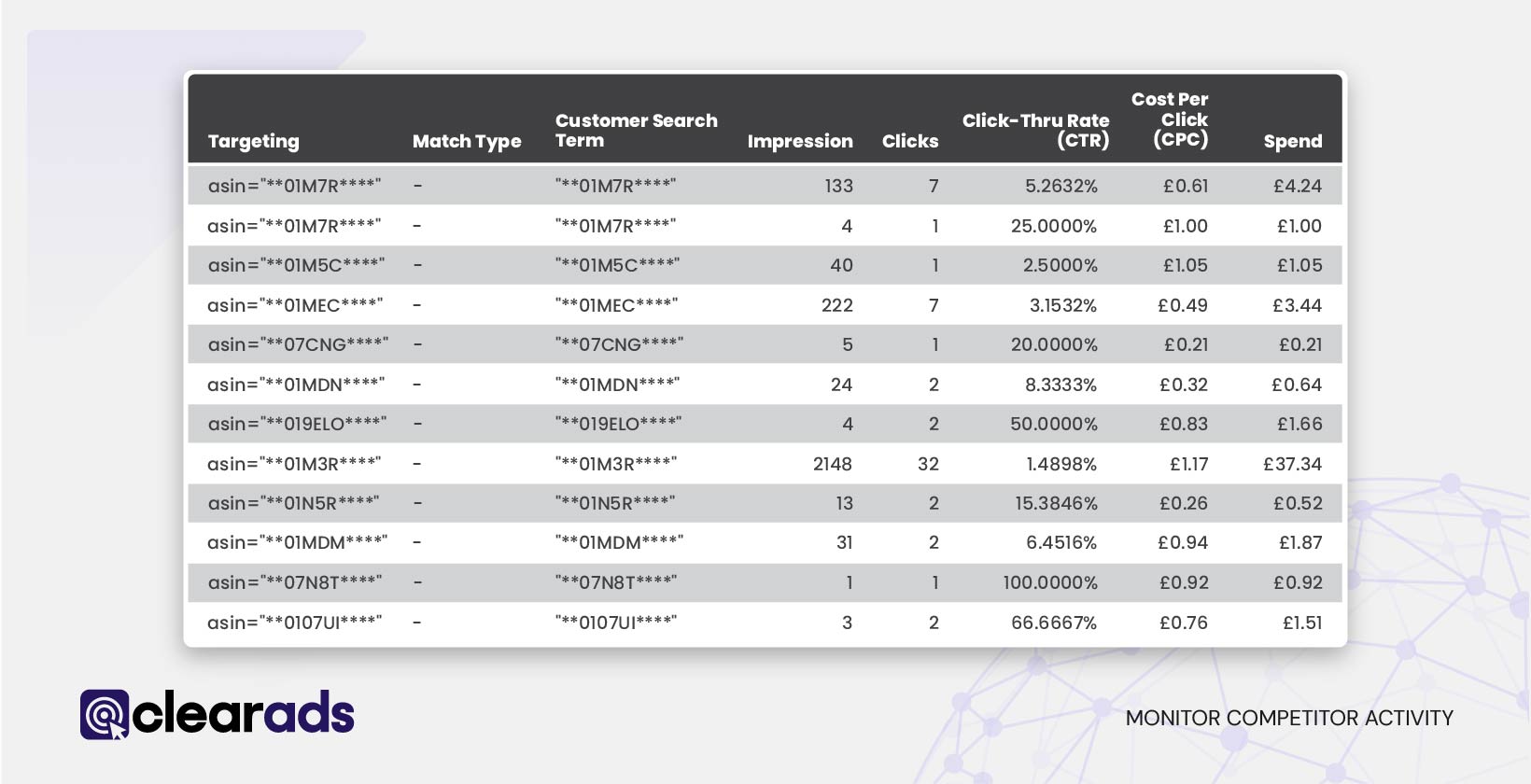

Step 7. Monitor Competitor Activity

Examining competitor advertising and performance within a category reveals opportunities to enhance strategy and maintain a competitive edge in the marketplace.

Here’s how to monitor competitor activity effectively:

- Analyse Competitor ASIN Impact

- Use the Search Term Report to identify competitor ASINs that appear in your campaigns. The ASINs in the Customer Search Term column of the Search Term Report indicate that your product appeared as a Sponsored Ad on another product’s detail page due to Amazon’s algorithm associating them. This product may belong to you or a competitor.

- Example: If the products are strongly related, overlapping keywords make this placement logical and can drive relevant traffic. Otherwise, conversions will likely be low despite impressions and clicks. In such cases, adding the ASIN as a negative match can help prevent unqualified traffic.

- Measure Impression Share Against Competitors

- The Search Term Impression Share (SIS) Report provides a comparison of Sponsored Products and Sponsored Brands ads against competing ads; it ranks keywords based on their share of total impressions. This report assists in evaluating ad visibility and competitive positioning within search results.

- Example: If there’s a Sponsored Products ad for the keyword “ink pen”, and the SIS report shows a 20% impression share on 1st August, it means the ad received 20% of all Sponsored Products impressions for that keyword across competitors on that day.

- Analyse Category Benchmarks

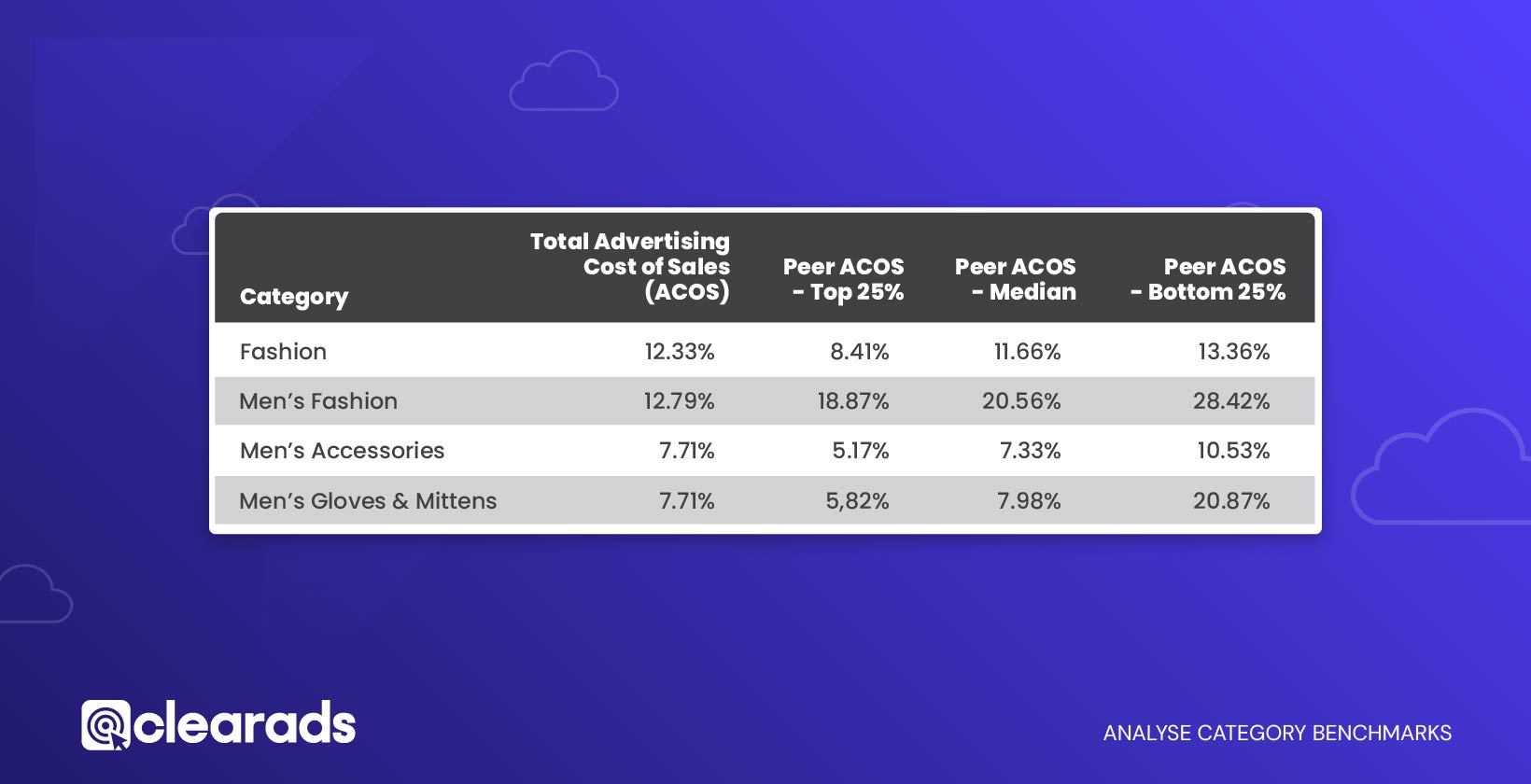

- The Category Benchmark Report for Sponsored Brands provides insights into Peer Impressions and Peer ACoS. Amazon presents data for the 25th, 50th, and 75th percentiles of peer advertisers within the category. These metrics help assess visibility and cost-efficiency in comparison to leading competitors.

- Example: In the sample screenshot below, the Men’s Fashion category appears to be the most profitable advertising opportunity for this brand, as its performance exceeds the bottom 25% of peers, surpasses the median, and is significantly stronger than the top 25%. In contrast, performance in the Fashion category is near the lower percentile, indicating limited visibility. Meanwhile, rankings in Men’s Accessories and Men’s Gloves & Mittens are closer to the median, suggesting room for improvement in these categories.

Actively monitoring and analysing competitor activity allows for strategy adaptation to surpass rivals and increase market share.

Step 8. Experiment with Ad Creative and Messaging

Optimising ad creative and messaging is key to enhancing customer engagement and maximising campaign impact. Testing different formats, headlines, and visuals helps determine what resonates best with the audience.

Here’s how to experiment effectively with ad creative and messaging:

- Test Multiple Headlines

- For Sponsored Brands ads, experiment with different headlines that highlight product benefits, features, or promotions. Use performance metrics like Click-Through Rate (CTR) to determine which headline drives the most engagement.

- Example: Test variations like “Discover Premium Noise-Cancelling Headphones” versus “Best Wireless Headphones for Every Budget.”

- Optimise Ad Visuals

- Use high-quality images or videos for Sponsored Brands and Sponsored Display ads. Experiment with lifestyle images, product-only visuals, or feature-specific imagery to determine which format performs best.

- Example: Test a product image against a lifestyle image showing the product in use, and compare the impact on CTR and conversions.

- Highlight Unique Selling Points (USPs)

- Craft ad messaging that emphasises a product’s key benefits, such as affordability, premium quality, or unique features. Monitor conversion rates to see which USPs resonate most with the audience.

- Example: Use messaging like “Eco-Friendly and Durable” or “Trusted by 10,000+ Customers” to differentiate a product.

- Incorporate Promotions and Offers

- Highlight time-sensitive deals or discounts in the ad copy to create urgency. Experiment with different formats to see which generates the best response.

- Example: Add phrases like “Limited Time 20% Off” or “Buy 1 Get 1 Free” and track the impact on sales and CTR.

- Tailor Messaging for Audience Segments

- For Sponsored Display ads, use audience targeting to customise ad messaging for specific customer segments, such as repeat buyers or first-time shoppers.

- Example: Target new customers with “Discover Our Bestsellers” and returning customers with “You Loved It, Get It Again!”

- Monitor A/B Test Results

- Set up A/B tests to compare two versions of an ad with different creatives or messaging. Use metrics like CTR, conversion rate, and sales to identify the winning variation.

- Example: Test a short headline like “Shop Now” against a more descriptive headline like “Upgrade Your Home Office Setup.”

- Iterate Based on Performance Metrics

- Continuously optimise ad creative and messaging using insights from testing. Leverage reports like the Placement Report and Campaign Report to pinpoint areas for improvement.

- Example: If a specific visual drives better engagement on Top of Search placements, prioritise that format for high-visibility campaigns.

Experimentation is essential for identifying what resonates with the audience and enhancing ad campaign effectiveness. Regular testing and optimisation keep messaging relevant and impactful.

Step 9. Track Performance Goals

Monitoring performance goals is crucial for evaluating campaign success and aligning advertising strategies with business objectives. Establishing clear benchmarks and consistently tracking progress helps identify areas for improvement and maintain focus on key outcomes.

Follow these steps to track performance goals effectively:

- Define Measurable Objectives

- Start by setting specific, measurable goals such as improving ROAS, reducing ACoS, increasing total sales, or boosting impressions.

- Example: A goal might be to achieve a 20% increase in 7-day total sales for a specific ASIN within the next month.

- Use the Right Reports to Measure Progress

- Each goal requires monitoring specific metrics through relevant reports:

- Search Term Report: Evaluate high-converting search terms to track keyword performance.

- Campaign Report: Analyse overall spend, sales, and ROAS to ensure campaign efficiency.

- Advertised Product Report: Monitor sales, ACoS, and clicks for specific products.

- Each goal requires monitoring specific metrics through relevant reports:

- Track Milestones for Ongoing Monitoring

- Break larger goals into smaller milestones to measure incremental progress.

- Example: If the objective is a 20% increase in monthly sales, monitor weekly sales growth to track progress and make necessary adjustments.

- Compare Actual Performance Against Benchmarks

- Leverage metrics such as Peer ACoS and Peer Impressions from the Category Benchmark Report to evaluate performance relative to competitors within the category.

- Example: If Total Advertising Cost of Sales (ACoS) is lower than Peer ACoS – Top 25% (representing the top 25% of advertisers in the category), it indicates strong cost-efficiency.

- Monitor Budget Efficiency

- Leverage the Budget Report to prevent overspending or underutilisation of allocated funds. Adjust budgets as needed to align with performance goals.

- Example: A high-performing campaign exhausting its budget early can benefit from an increased daily budget to maintain momentum.

- Assess New Customer Acquisition

- For Sponsored Display ads, monitor metrics such as 14-Day New-to-Brand Units to evaluate effectiveness in acquiring new customers.

- Example: If the objective is to attract new buyers, a rise in New-to-Brand Units signifies successful customer base expansion.

- Measure the Impact of Seasonal Adjustments

- Monitor seasonal trends and campaign performance during key sales periods, such as holidays or product launches. Analyse the Performance Over Time Report to identify patterns and optimise strategy.

- Evaluate Long-Term Trends

- Monitor sustained progress towards goals using reports with extended lookback periods, such as the Campaign Report (up to 18 months).

- Example: If the objective is to double sales within a year, analysing monthly performance trends enables strategic adjustments to stay on track.

Consistently monitoring performance goals ensures alignment with objectives, enables timely adjustments, and optimises campaigns for sustained success.

Step 10. Continuously Monitor and Iterate

Amazon’s advertising landscape is constantly evolving, requiring sellers to adapt strategies to maintain competitiveness and maximise results. Ongoing monitoring and optimisation keep campaigns effective and aligned with changing business objectives.

Here’s how to execute this process effectively:

- Review Campaign Performance Regularly

- Set a schedule to review key reports, such as the Search Term Report, Campaign Report, and Advertised Product Report, to identify trends and spot anomalies.

- Example: Conducting weekly reviews allows early detection of underperforming keywords, enabling timely optimisation for improved campaign performance.

- Adjust Bids and Budgets Based on Performance

- Continuously optimise bids for high-performing keywords or ASINs and reduce bids for low-performing targets. Similarly, reallocate budgets to campaigns with the highest returns.

- Example: If a specific keyword sees a rise in conversions, increase its bid to maximise visibility during peak performance.

- Refine Targeting and Keywords

- Use insights from recent reports to add high-performing search terms and exclude irrelevant or non-converting terms. Adjust targeting based on seasonal changes or shifts in customer behaviour.

- Example: After identifying “wireless earbuds with noise cancellation” as a top-performing search term, create a new campaign targeting this term with tailored ad creatives.

- Test New Creative Variations

- Continuously experiment with ad headlines, visuals, and messaging to keep ads fresh and engaging. Track results using metrics like CTR and conversion rate.

- Example: Rotate between lifestyle images and product-only visuals to determine which drives better engagement.

- Monitor Competitor Activity

- Monitor competitor changes, including pricing adjustments, promotions, and ad placements. Utilise the Category Benchmark Report to assess campaign performance relative to competitors.

- Adapt to Market and Seasonal Trends

- Use the Performance Over Time Report to detect demand shifts and seasonal trends, allowing for strategic campaign adjustments.

- Example: Increase bids and budgets for popular keywords leading up to the holiday season or a product launch.

- Implement Learnings from A/B Testing

- Test different ad strategies, targeting options, or bidding methods to see what works best. Apply findings across campaigns to optimise overall performance.

- Example: If an A/B test shows that Top of Search placement yields higher conversions, increase placement-specific bids for similar campaigns.

- Monitor Return on Investment (ROI)

- Consistently analyse metrics such as ROAS, ACoS, and 14-Day Total Sales to assess campaign profitability. Refine strategies to prioritise high-performing elements and maximise ROI.

- Keep an Eye on Invalid Traffic

- Use the Gross and Invalid Traffic Report to monitor invalid clicks and impressions. High rates of invalid traffic may require adjustments in ad placements or targeting.

- Maintain a Long-Term Perspective

- While short-term adjustments are important, also monitor long-term trends using reports like the Campaign Report (18-month lookback). Ensure that iterative changes align with overarching goals.

Implementing a cycle of continuous monitoring and optimisation enables adaptation to changes, enhances performance, and supports sustainable growth in advertising campaigns.

What Are Amazon Advertising Reports?

Amazon Advertising Reports provide data on ad performance, including impressions, clicks, sales, and costs. These reports help advertisers assess the effectiveness of their campaigns and optimise their ad strategies.

Amazon Advertising Reports include:

- Impressions: The number of times an ad is displayed.

- Clicks: The number of times users click on an ad.

- Sales/Orders: The number of purchases generated from ad clicks.

- Costs: The total advertising expenditure.

Analysing these reports enables advertisers to:

- Identify high-performing ads for further investment.

- Adjust or discontinue underperforming ads.

- Track ad spend and determine the most profitable keywords and products.

Amazon Advertising Reports provide insights that support data-driven decision-making, ensuring efficient budget allocation and improved return on ad spend (ROAS).

How Are Amazon Ads Report Generated?

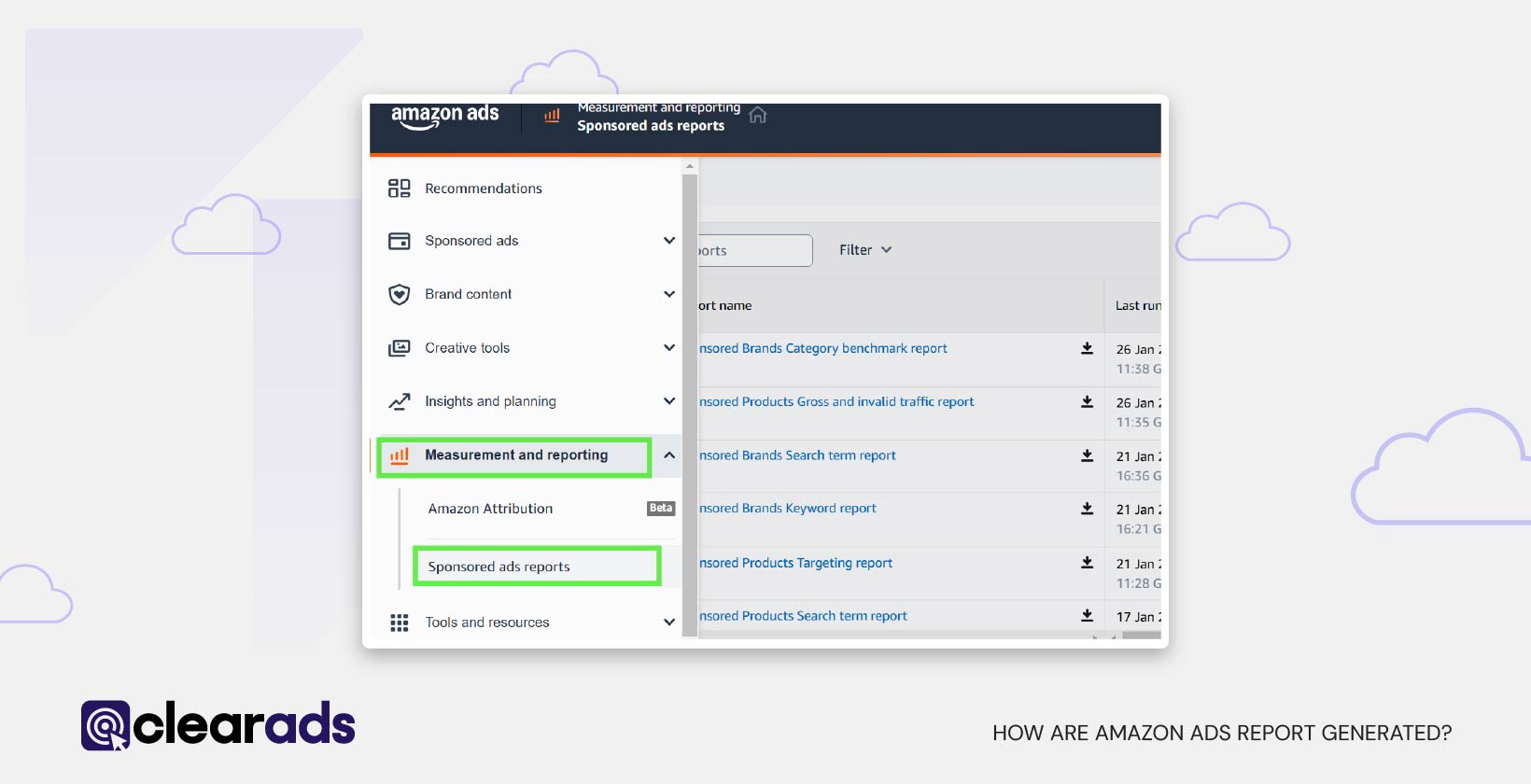

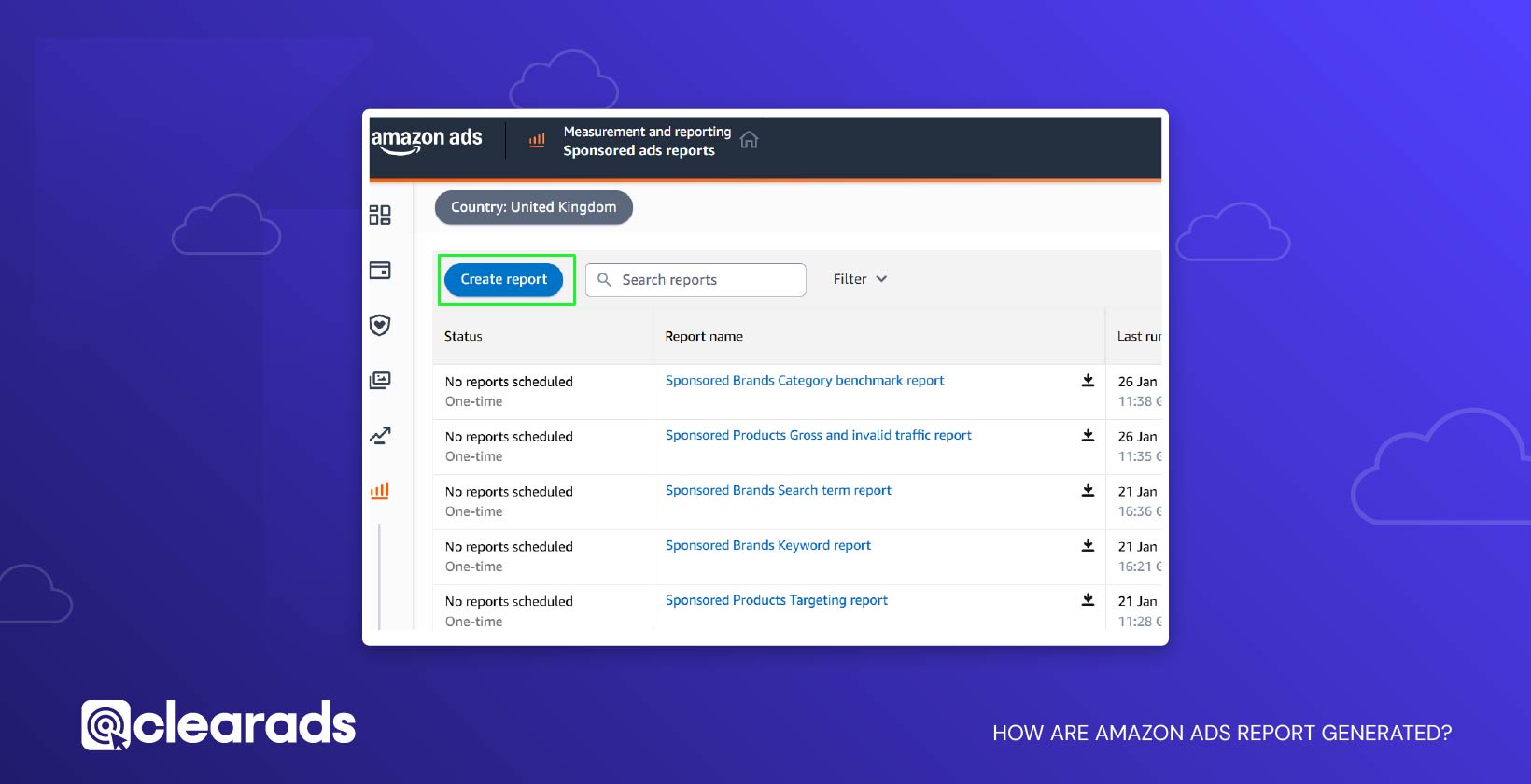

Amazon Ads reports are created through the Amazon Ads Console by following a simple process. Here’s a step-by-step guide to generating these reports:

- Access the Reports Section:

- Log in to the Amazon Ads Console and navigate to the Measurement and Reports tab.

- Select Sponsored Ad Reports and click on Create Report.

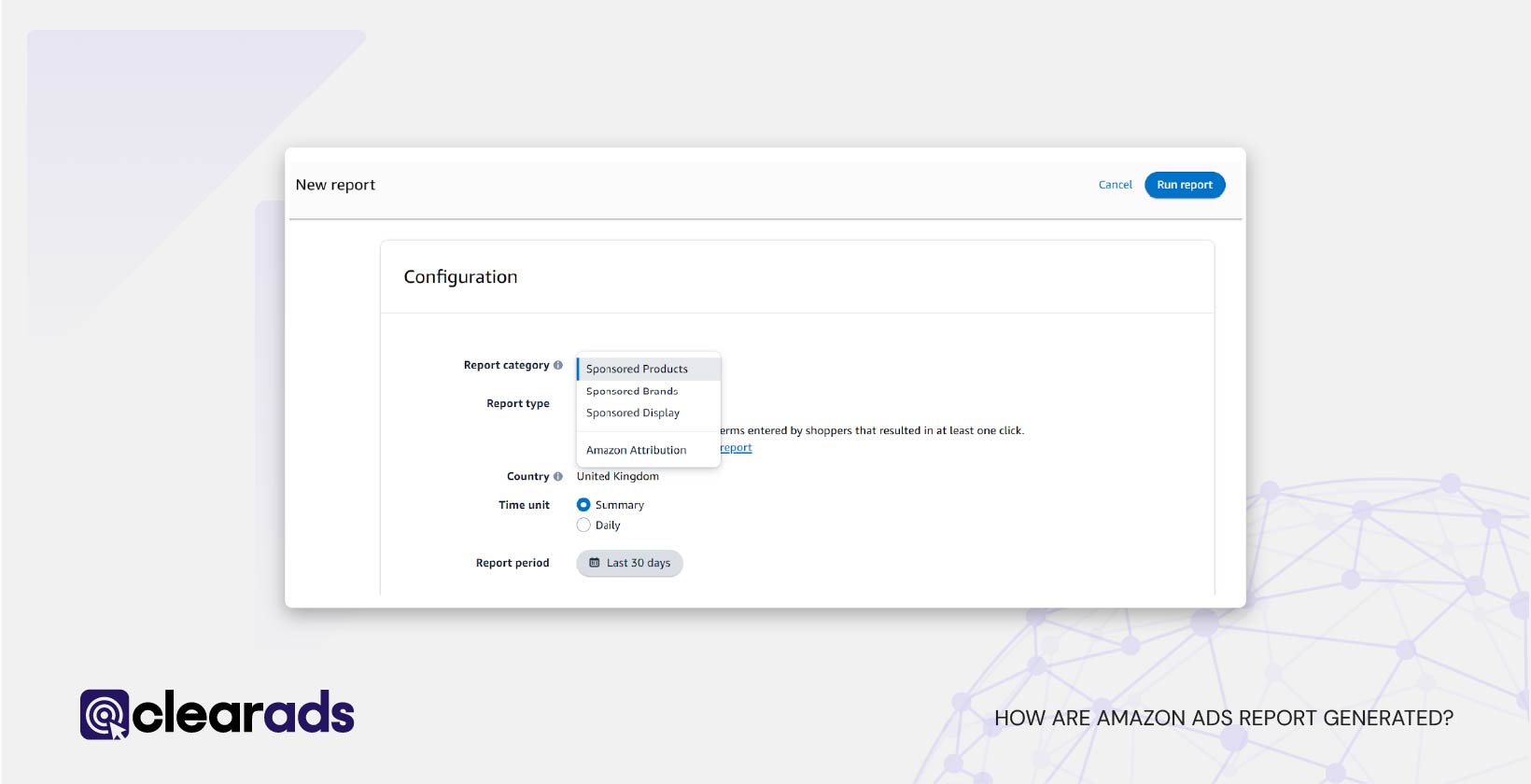

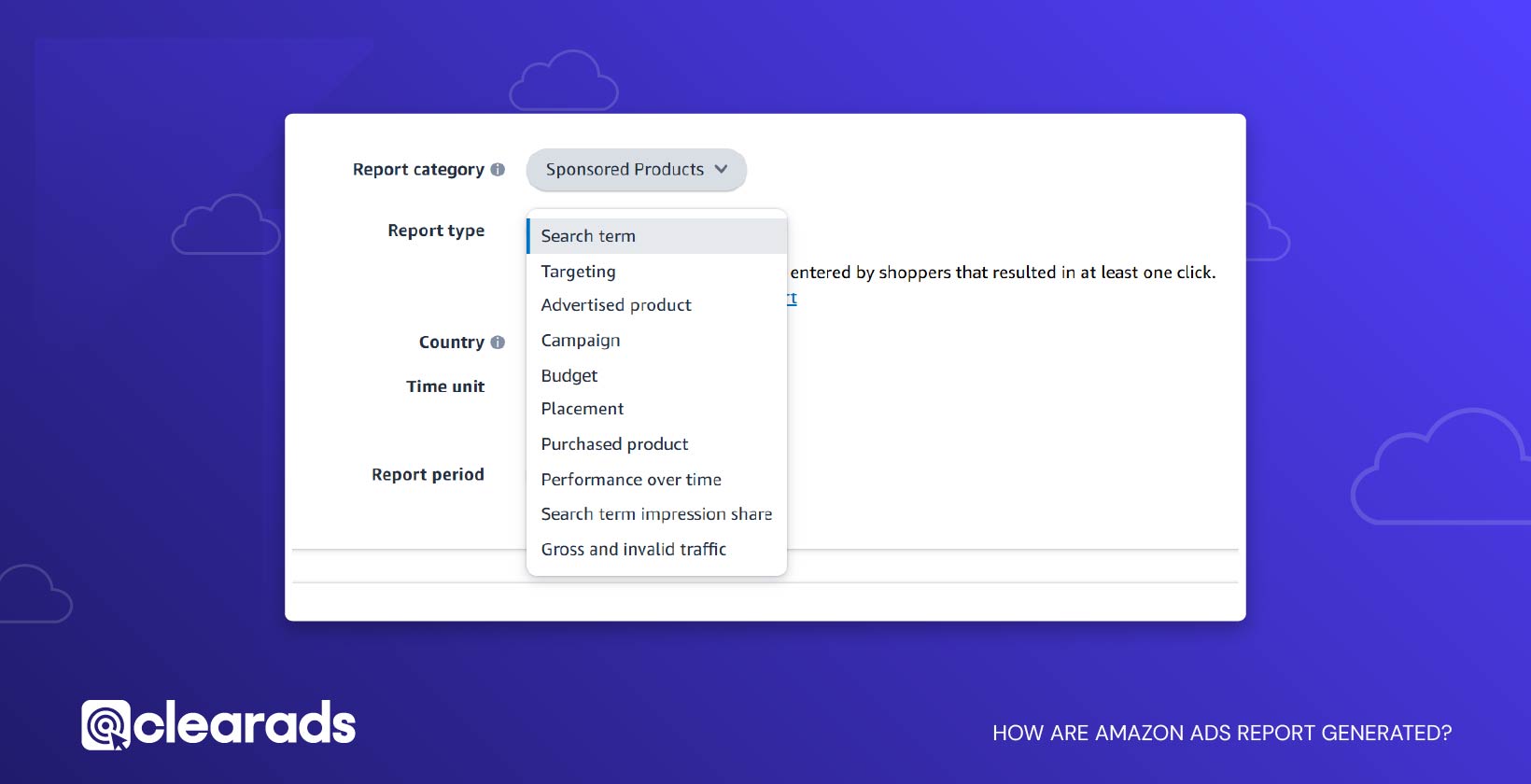

- Choose the Report Category and Type:

- Select a Report Category such as Sponsored Products, Sponsored Brands, or Sponsored Display.

- Choose the desired Report Type, such as Search Term, Budget, Targeting, etc.

- Confirm that the selected country is correct.

- Set Report Parameters:

- Select the Time Unit as Daily or Summary, depending on the granularity required.

- Define the Report Period by choosing specific date ranges or presets like last 7 days or last 30 days.

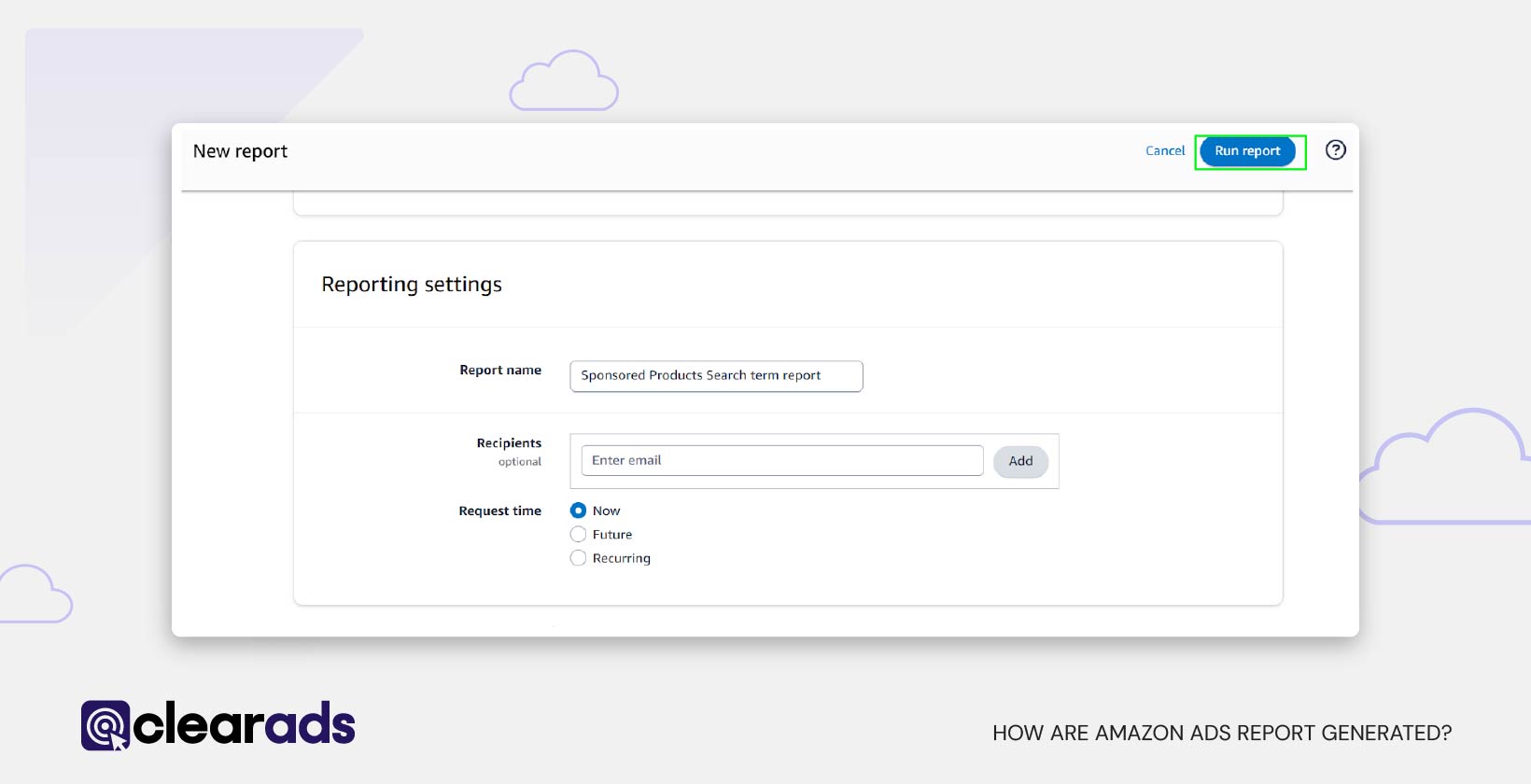

- Enter Reporting Settings:

- Provide a Report Name to identify the report easily.

- Optionally, enter recipient email addresses for the report.

- Choose the Request Time:

- Now: Generate the report immediately.

- Future: Schedule it for a later date.

- Recurring: Automate reports to generate at regular intervals (e.g., daily, weekly).

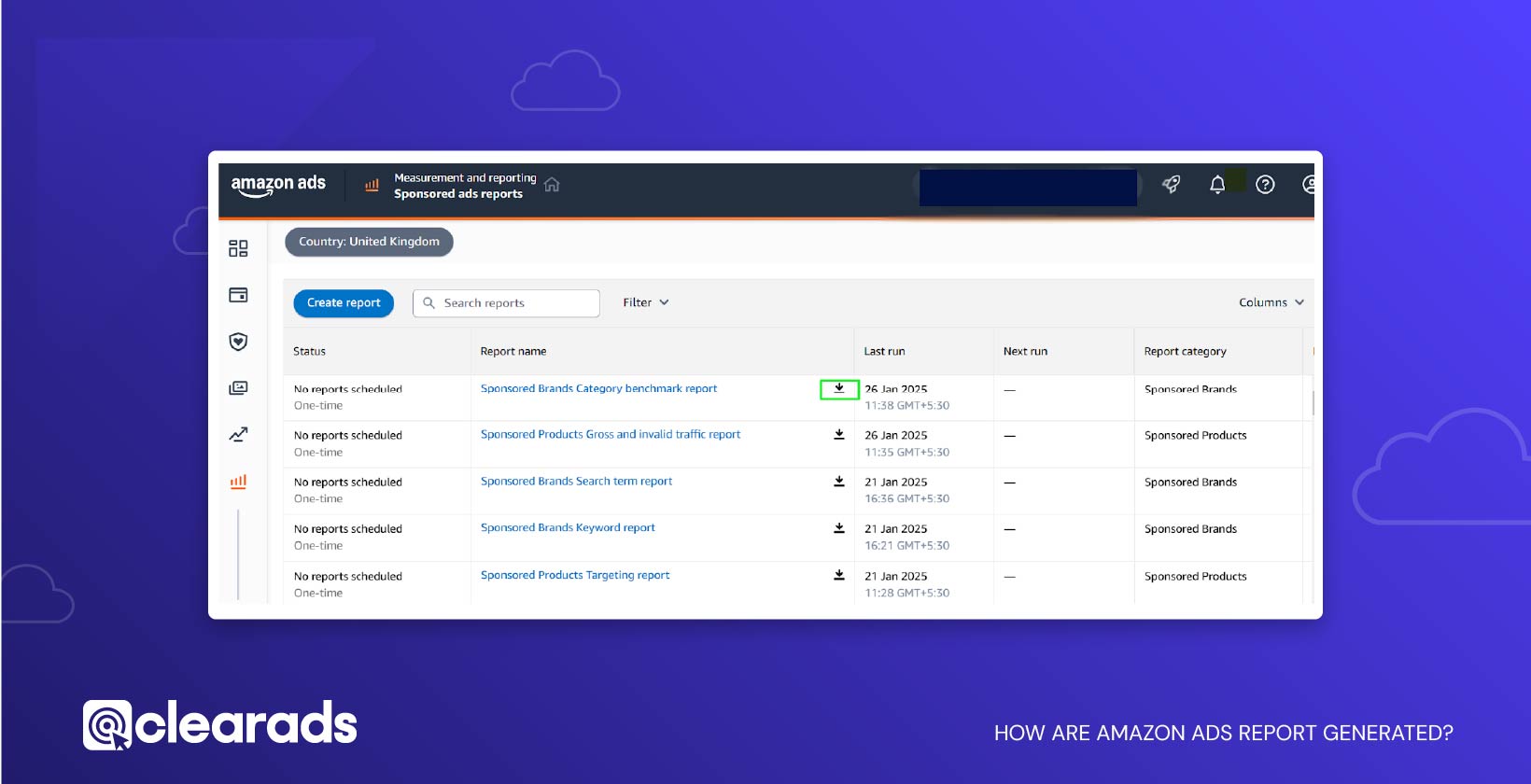

- Run and Download the Report:

- Click on Run Report to generate it.

- Wait a few minutes and return to the Measurement and Reports section to check if the report is available.

- Once ready, click the Download icon (downward arrow) to save the report to your system.

Generating Amazon Ads reports is a straightforward process that equips sellers with comprehensive data to assess their campaign performance. By following the steps to create and download these reports, advertisers gain access to essential insights that serve as the backbone for informed decision-making and strategic optimisation.

Why Are Amazon Advertising Reports Important?

Amazon Advertising Reports are critical tools for sellers aiming to maximise their campaign success through data-driven decision-making. These reports enable sellers to:

- Optimise Ad Spend

Analysing metrics like Cost per Click (CPC) and ACoS (Advertising Cost of Sale) helps sellers identify high-cost, low-return campaigns. For instance, a keyword with a $2.00 CPC and a 60% ACoS may indicate unprofitable spending if the profit margin is lower than the ACoS. Evaluating profitability and adjusting bids or reallocating budgets based on performance data can improve overall campaign efficiency. - Improve Targeting

Advertising reports, such as the Search Term Report, enable sellers to identify high-performing keywords and filter out irrelevant search terms. For instance, if “wireless headphones” drives high clicks and conversions, increasing bids can maximise its impact. Conversely, if terms like “corded headphones” generate clicks without purchases, adding them as negative keywords helps reduce wasted spend. - Measure Performance

Metrics such as Click-Through Rate (CTR) and Conversion Rate provide insights into customer engagement. For instance, a 2% CTR suggests an engaging ad, but a 0.5% conversion rate may indicate issues with the product detail page, pricing, or other factors affecting purchase decisions. Analysing these metrics helps optimise ad creatives and improve product performance. - Enhance Profitability

Analysing ROAS (Return on Advertising Spend) enables sellers to prioritise campaigns with higher returns. For example, if Campaign A has a ROAS of 4x ($4 in sales for every $1 spent) while Campaign B has a ROAS of 2x, scaling Campaign A may improve profitability, provided other factors like margins and growth objectives align. - Discover Growth Opportunities

Reports like the Targeting Report offer insights into untapped categories or products. For example, if an ad targeting a broad category like ‘home decor’ shows strong performance for a subcategory such as ‘table lamps,’ analysing search volume, competition, and conversion rates can help determine whether dedicated campaigns would effectively capture more specific demand.

These detailed insights empower sellers to refine their advertising strategies, reduce inefficiencies, and achieve sustainable growth.

What Does Amazon PPC Reports Contain?

Amazon PPC (Pay-Per-Click) reports contain detailed metrics that cover various aspects of ad performance, enabling sellers to make data-driven decisions. Below are some key components typically included in Amazon PPC reports:

- Campaign-Level Metrics

- Impressions: The total number of times an ad was shown to customers.

- Clicks: The total number of times customers interacted with an ad by clicking on it.

- Spend: The total amount spent on clicks for the campaign.

- Sales: The total revenue generated from ad-attributed sales.

- ACoS (Advertising Cost of Sale): The percentage of ad spend relative to sales.

- ROAS (Return on Advertising Spend): Revenue generated for every $1 spent on ads.

- Keyword and Targeting Performance

- Search Terms: The exact customer queries that triggered ad displays.

- Targeted Keywords: Performance metrics for the keywords selected for ad targeting.

- Top of Search Impression Share: The proportion of total impressions an ad received in top-of-search placements.

- ASIN Targeting: Performance metrics for targeted ASINs, including clicks, sales, and conversions.

- Product-Level Metrics

- Advertised ASINs: Performance data for products being directly advertised, including clicks, sales, and ACoS.

- Purchased Products: Information on products bought by customers after clicking an ad, including both advertised and non-advertised items.

- Placement Performance

- Insights into how ads performed in specific placements, such as Top of Search, Product Detail Pages, or Rest of Search. This helps optimise bid adjustments for high-performing placements.

- Invalid Traffic Metrics

- Invalid Clicks: Clicks identified as invalid to prevent budget waste from fraudulent or unintentional activity.

- Invalid Impressions: Views flagged as invalid, ensuring data accuracy for campaign performance analysis.

- Customer Behaviour Insights

- 14-Day Detail Page Views (DPV): Measures the number of times customers visited a product detail page within 14 days of engaging with an ad.

- 14-Day New-to-Brand Units: The total units purchased by first-time buyers within 14 days of clicking an ad.

- Conversion Rates: The percentage of clicks that resulted in a purchase.

Amazon PPC reports consolidate these metrics, offering advertisers a comprehensive view of their campaign performance. By analysing these data points, sellers can optimise their bids, refine targeting, and improve overall campaign efficiency.

How to Monitor Amazon Ads?

Effective monitoring of Amazon ads requires tracking key performance metrics, analysing trends, and refining strategies based on real-time data. Consistent evaluation ensures optimal ad spend, competitive campaigns, and alignment with business objectives.

Here’s a step-by-step guide on how to monitor Amazon ads:

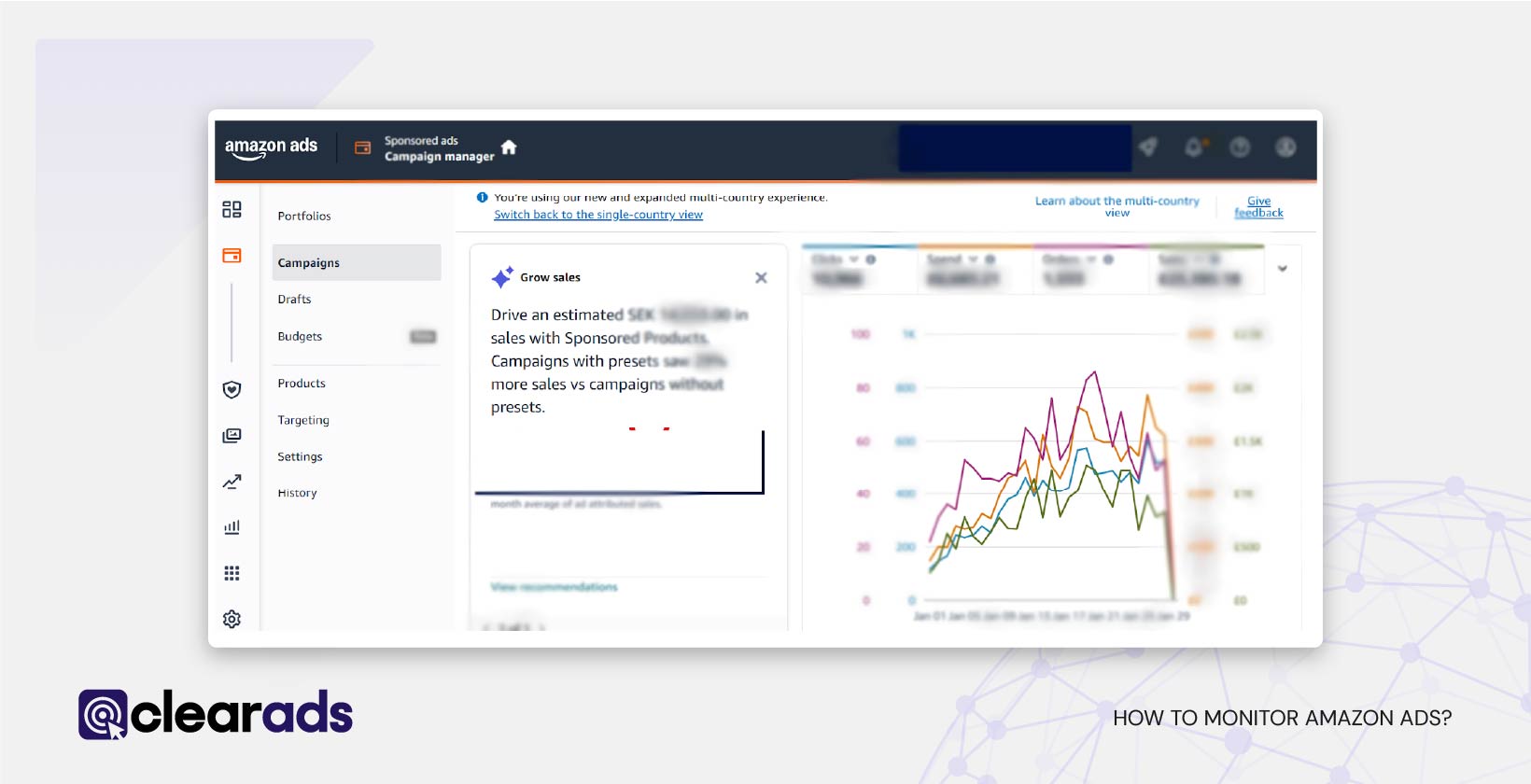

- Access the Ads Dashboard

- Log in to the Amazon Ads Console and navigate to the dashboard. This provides an overview of campaign performance, including spend, impressions, clicks, and sales.

- Set Up Key Performance Indicators (KPIs)

- Determine the most relevant metrics for your goals, such as Spend, Sales, ACoS, and ROAS. Metrics can be selected by clicking the dropdown arrow next to the metric title and choosing from the available options. Setting clear KPIs ensures analysis focuses on key performance aspects.

- Review Campaign Metrics Regularly

- Use the Campaign Report for a high-level view of ad performance. Monitor metrics such as total sales, spend, and impressions to identify trends or anomalies.

- Track Keyword and Target Performance

- Use the Search Term Report and Targeting Report to evaluate the performance of specific keywords and ASINs. Identify high-performing keywords to scale and underperforming ones to optimise or exclude.

- Monitor Placement Performance

- Analyse the Placement Report to evaluate ad performance across different placements, such as Top of Search and Rest of Search. Optimise bids for placements that deliver the best results.

- Evaluate Budget Utilisation

- Check the Budget Report to ensure campaigns are adequately funded and that no budget is being wasted on low-performing campaigns. Adjust budgets as necessary to maximise returns.

- Leverage Real-Time Alerts

- Set up notifications and alerts within the Ads Console to stay informed about critical changes, such as campaigns running out of budget or exceeding spend thresholds.

- Use Automated Tools for Efficiency

- Consider using tools like Amazon’s Advertising API or third-party software to automate monitoring tasks and provide deeper insights into campaign performance.

- Analyse Invalid Traffic

- Consistently analyse the Gross and Invalid Traffic Report to track clicks and impressions marked as invalid, ensuring data accuracy and preventing budget waste from fraudulent activity.

- Conduct Weekly and Monthly Reviews

- Perform detailed weekly reviews to catch immediate opportunities or issues and monthly reviews to evaluate long-term trends. Use historical data from the Performance Over Time Report or Campaign Report to assess progress toward goals.

Consistent monitoring of Amazon ad campaigns helps adapt to market changes, optimise strategies, and maximise advertising ROI.

When Should Changes Be Made to Amazon Ads After Reviewing the Reports?

Changes to Amazon ads should be made strategically and based on insights derived from the reports.. Here are key scenarios and timings to consider when making changes, with specific examples for clarity:

- Low-Converting Keywords or Targets

- When to Act: Immediately after identifying keywords, ASINs, or categories with high spend but low conversions.

- Action: Lower bids, pause underperforming targets, or add irrelevant terms as negative keywords to improve cost efficiency.

- Example: If “affordable desks” receives 25 clicks but results in no sales, reduce its bid or add it as a negative keyword to prevent further spend.

- Budget Constraints

- When to Act: If campaigns are consistently exhausting daily budgets before the day ends, resulting in missed opportunities.

- Action: Increase the daily budget for high-performing campaigns or reallocate funds from underperforming ones.

- Example: A campaign for “ergonomic office chairs” with a $30 daily budget that regularly runs out by noon should have its budget raised to $50 to maximise sales opportunities.

- High ACoS or Low ROAS

- When to Act: Review ACoS and ROAS weekly. Make changes if these metrics show inefficiencies, such as ad spend outweighing returns.

- Action: Optimise bids, refine targeting, or adjust ad creative to improve profitability.

- Example: If an ad has an ACoS of 50% on a product with only a 30% profit margin, reduce its bid or focus on more efficient keywords.

- Underutilised Budget

- When to Act: If the Budget Report shows campaigns consistently using less than their allocated budget.

- Action: Adjust targeting, increase bids for high-performing keywords, or expand audience reach to make full use of the budget.

- Example: A Sponsored Display campaign targeting broad categories with a $50 daily budget but only spending $20 could benefit from more specific ASIN targets or increased bids.

- Shifts in Customer Behaviour or Trends

- When to Act: After identifying seasonal trends or shifts in customer behaviour, such as increased demand during holidays or sales events.

- Action: Adjust bids, budgets, and targeting to capitalise on emerging trends or prepare for peak shopping periods.

- Example: For “holiday gift baskets,” increase bids by 30% starting in late November to capture higher holiday shopping traffic.

- Competitor Activity

- When to Act: Monitor competitor placements and metrics, such as Peer Impressions and Peer ACoS, to detect changes in market competition.

- Action: Modify bids or create new campaigns to stay competitive, especially in high-demand categories.

- Example: If competitors drop prices for “wireless headphones,” consider highlighting promotions or adjusting bids to maintain visibility.

- Declining CTR or Conversion Rates

- When to Act: If CTR or conversion rates decline over a week or more, indicating ad fatigue or misaligned targeting.

- Action: Update ad creative, test new headlines, or refine keyword targeting to re-engage shoppers.

- Example: A Sponsored Brand ad with a CTR drop from 2% to 0.8% might benefit from a new headline or refreshed visuals showcasing unique product features.

- New Keyword or ASIN Opportunities

- When to Act: After reviewing the Search Term Report or Targeting Report and identifying high-performing search terms or competitor ASINs.

- Action: Add these terms as exact match keywords or directly target the ASINs to enhance reach and improve ad relevance.

- Example: If “noise-cancelling earbuds” generates high clicks and conversions, create a dedicated campaign targeting this keyword to maximise sales.

- Invalid Clicks and Traffic

- When to Act: If the Gross and Invalid Traffic Report reveals high invalid click rates or impressions.

- Action: Refine targeting or adjust ad placements to minimise wasted ad spend.

- Example: If a Sponsored Display campaign shows 20% invalid clicks, consider focusing on audience-based targeting rather than contextual placements.

- Post-Testing Adjustments

- When to Act: After completing A/B testing of ad creatives, placements, or bid strategies.

- Action: Implement changes based on the winning variations to optimise ad performance.

- Example: If a test shows that ads with product lifestyle images achieve a higher CTR than product-only images, update all related campaigns with lifestyle visuals.

Regularly monitoring reports and making timely adjustments helps maintain optimal campaign performance while staying aligned with advertising goals. Strategic changes keep ads competitive and cost-efficient in a dynamic marketplace.

Is PPC Better than Organic Performance?

No. Amazon PPC is not categorically “better” than organic performance. They serve different purposes and work best together. While PPC can deliver instant visibility and valuable data (e.g., for new product launches or promotions), strong organic rankings offer more sustainable, lower-cost sales over the long term.

In almost all cases, the most effective approach is a balanced strategy, using PPC to drive immediate traffic and sales while continuously optimizing listings for organic discoverability.

For example, a new product launch may rely heavily on PPC to gain initial traction. Over time, as sales and reviews accumulate, the product’s organic ranking improves, reducing the need for paid campaigns.

PPC (Pay-Per-Click) advertising and organic performance play complementary roles in an Amazon seller’s strategy. While both drive sales and visibility, their effectiveness varies based on business objectives, product category, and competition level.

Here’s a detailed comparison to help determine their value:

Advantages of PPC Advertising

- Immediate Visibility:

PPC ads deliver immediate visibility by positioning products in prominent placements, such as top of search results or product detail pages. This is especially beneficial for new products or highly competitive categories. - Targeted Reach:

PPC enables precise targeting based on keywords, product categories, and audience behaviours, ensuring ads reach shoppers actively searching for relevant products.- Example: A PPC campaign for “wireless earbuds” can target specific customer searches or competitor products for maximum relevance.

- Scalable Results:

Advertisers can adjust bids, budgets, and targeting based on performance data to scale successful campaigns and optimise ROI. - Performance Tracking:

Metrics like ACoS, CTR, and conversion rates enable sellers to analyse ad performance in real-time and make data-driven adjustments. - Seasonal and Promotional Support:

PPC is ideal for capitalising on high-demand periods, such as holidays or sales events, by boosting visibility and sales during key shopping windows.

Advantages of Organic Performance

- Cost-Efficiency:

Organic performance eliminates the need for continuous ad spend. When a product ranks well through optimised content, competitive pricing, and strong reviews, it drives sales without additional advertising investment. - Long-Term Benefits:

Building strong organic rankings can lead to consistent visibility and sales over time, reducing reliance on paid campaigns. - Customer Trust:

Products that rank organically often appear more credible to customers compared to sponsored listings, as they are perceived to be more relevant. - Influenced by PPC Success:

Effective PPC campaigns can drive traffic and sales, which in turn boosts organic rankings by increasing sales velocity and product relevance.

Limitations of PPC Advertising

- Cost:

PPC campaigns require constant investment, and costs can escalate in competitive categories or for high-demand keywords. - Short-Term Results:

PPC-driven visibility and sales stop once advertising ends, making it less sustainable without complementary organic optimisation efforts. - Complexity:

Managing PPC campaigns requires regular monitoring, optimisation, and expertise to ensure profitability.

Limitations of Organic Performance

- Time-Consuming:

Achieving strong organic rankings can take months, particularly in competitive categories where established sellers dominate the search results. - Limited Control:

Organic performance relies on Amazon’s algorithm, which evaluates factors like sales velocity, product relevance, and customer feedback. Unlike PPC, sellers have less direct control over visibility. - Difficulty in Entering Competitive Markets:

New or low-demand products may struggle to achieve organic visibility without the support of PPC campaigns.

In summary, PPC excels at delivering fast results and targeted reach, while organic performance offers long-term stability and cost-efficiency. A well-executed combination of both ensures maximum visibility, profitability, and growth.